Questions! At DiligenceVault, we ask loads of questions and we answer even more. Feature questions, tech questions, IT and security questions, pricing questions, and plenty of great adoption questions. Further, our platform is created to digitize questions, answer questions, collaborate internally for those questions, rate the questions, and understand all of the answers to the questions. Ahhh, questions. -Excerpt from 2019 year-end blog

This process of questioning questions led me to research further those specific questions / questionnaires which are most important to DiligenceVault clients. The investment management industry is fueled by Requests for Proposals (RFPs), Requests for Information (RFIs), and Due Diligence Questionnaires (DDQs). What are people hoping to accomplish with these processes? Ideally, easier analysis and visualization, data comparability, and faster time-to-data. This blog takes a deep dive into industry-wide resources as well as the current use and overall future of these questions and questionnaires.

Do the Due:

There are a growing number of teams performing diligence, collecting data, and ensuring compliance and transparency with their partners. At DiligenceVault, we work with the Manager Research and Selection, Operational Due Diligence, Compliance, and Tax/Audit teams of firms who need to collect all forms of data at the firm, fund and strategy levels. Consultants use DiligenceVault to collect the information they need. DV also works with Managers who send out questionnaires for service provider and vendor diligence.

Historically, the data has been collected manually through phone calls, on-site meetings, and emailing questionnaires to be completed. Today, firms have increased their collection efforts using databases, relying on the self-service model, and consultants. One of the most important factors in effective data collection is collecting structured data so that it can be easily accessed and analyzed.

In response to the many forms of questionnaires, we have Consultants, Asset Managers, Service Providers, and Vendors who are answering these questions as well. Research suggests that this isn’t slowing down anytime soon, either. Cerulli Associates writes specifically about the Asset Managers in this case:

The volume and complexity of requests received have increased over time due mostly to an increase in due diligence efforts by investment consultants and other institutions, as well as a shift in asset allocation decisions,” says Laura Levesque, senior analyst at Cerulli. Volumes from 2017 to 2018 for all request types have increased approximately 2% for RFIs. RFPs and DDQs have seen a more significant increase in volume, jumping approximately 13% and 20%, respectively.

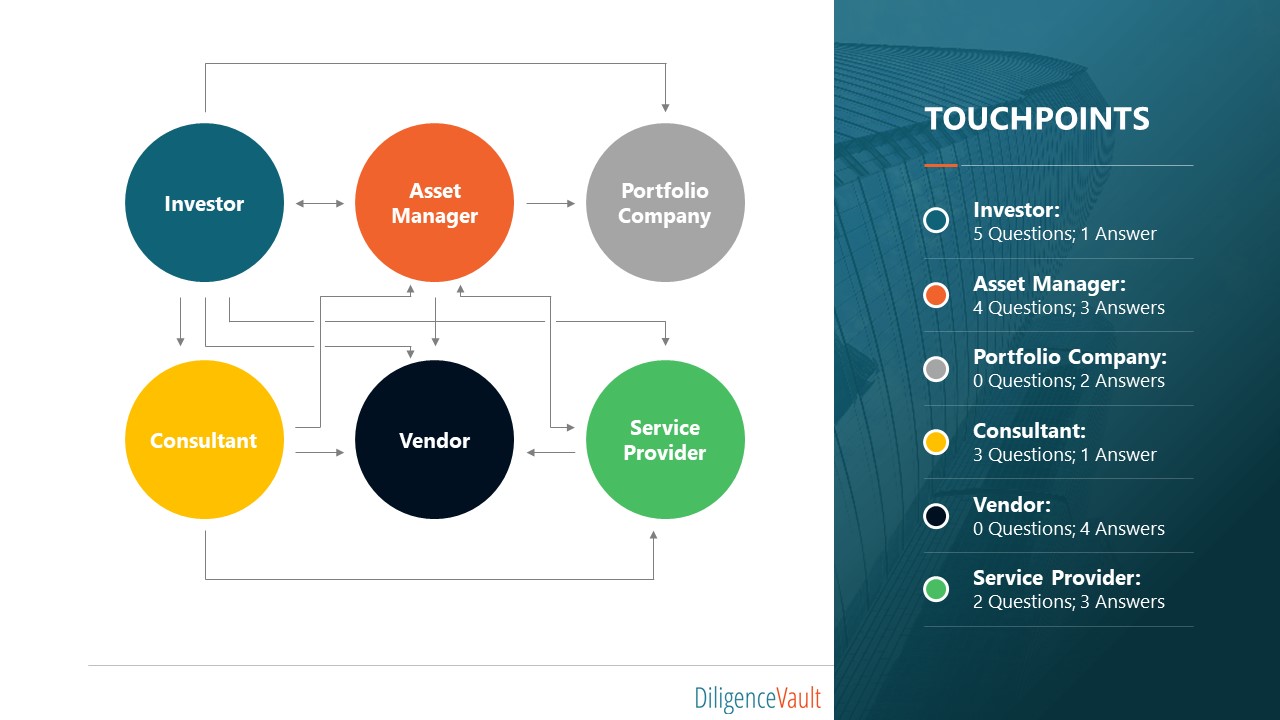

Looking at the DiligenceVault Data Collection / Data Response figure (below), it’s obvious why a two-sided platform for both sending and receiving questionnaires is crucial. As you can see, most of the players on this map are extended beyond DV’s threshold (two touch-points) for needing a two-sided DDP. The average firm has to both perform diligence on one of their partners as well as respond to some form of diligence from another. Client consultation from DV shows that with so much back-and-forth, the best experience for both sides of the Collect / Respond relationship is to provide technology-enabled assistance ensuring a streamlined and automated process.

Org(s) Chart:

To understand more about these questionnaires, a good start is to look at the organizing bodies of the industry who help promote best practices and have been successful at developing the questionnaires that help standardize the data collection process. They have created DDQs for their members and are great resources for those taking the plunge into a better DD process. These organizations also hold events that are great places to share best practices and compare notes. Please click the link for inquiry into their respective DDQs:

• Alternative Investment Management Association (AIMA)

• Institutional Limited Partners Association (ILPA)

• Principles for Responsible Investing (PRI)

• Investors in Non-Listed Real Estate Vehicles (INREV)

• Standards Board for Alternative Investments (SBAI)

AIMA:

AIMA has created dozens of standard DDQs for hedge funds and private credit. Topics include governance, service providers, ESG, and operational aspects. AIMA provides a long form and an abridged version. Contact this website to apply online.

ILPA:

ILPA engages, empowers and connects limited partners (LPs) to maximize their performance on an individual, institutional and collective basis. Their questionnaires and best practices are built with private equity and venture capital allocators in mind. Want to join? Click here.

PRI:

The PRI is the world’s leading proponent of responsible investment. It works to understand the investment implications of environmental, social and governance (ESG) factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions. Become a signatory here.

INREV:

INREV is Europe’s leading platform for sharing knowledge on the non-listed (unlisted) real estate industry. INREV aims to improve transparency, professionalism and best practices across the sector, making the asset class more accessible and attractive to investors. Inquire about membership here.

SBAI:

SBAI (previously known as the Hedge Fund Standards Board (HFSB)) is a neutral standard-setting body for the alternative investment industry and custodian of the Alternative Investment Standards (the Standards). It provides a powerful mechanism for creating a framework of transparency, integrity and good governance to simplify the investment process for managers and investors. Become a signatory here.

These organizations are establishing best practices, driving the industry towards standardization, and removing the bespoke burden on the industry as a whole.

What’s Due for the Future:

The future of how the industry performs their diligence is up for grabs as applications such as artificial intelligence and machine learning start to work through the efforts of digitizing, extracting data from documents, and applying algo-specific workflows to automate entire functions. Looking back, we see Post-Madoff and the Crisis, the industry has really ramped up their diligence of all things Investment and Operations. In 2020 and beyond, we’ll see this diligence get a tech-makeover.

At DiligenceVault we have talked to hundreds of our users about their question and answer processes and we’ve gained great insights. While industry questionnaires are a great starting point, the industry is constantly evolving and there is more yet to come through innovation and industry collaboration. Each firm has its own process, perspective and area of expertise. This drives the need for each firm toask the specific questions and collect the data integral to their process in order to achieve the investment results that they and their clients desire.

To this end, there are conferences promoting and accelerating innovation. Through organizations like Foundation Research Associates (FRA), Informa Connect with the Global Alternative Investment Management Operations (GAIM Ops Cayman), and Managed Funds Association (MFA), among others, best practices are discussed and firms are brought together globally for education and networking.

DiligenceVault has partnered with the various organizing bodies mentioned earlier (AIMA, ILPA, and PRI) to provide digitization and ease-of-use when firms want to work with information in a digital environment. With the culture of data collection only increasing, the question is not “if”, but rather “how” will your firm digitize due diligence? However your firm chooses to move into the digital age, you should seek a solution that has the flexibility to support your own unique process and value add, in addition to enabling you to comply with evolving industry standards and best practices.

Join in the conversation with us and the organizations mentioned above. Engage in the process, and you will find a way to strike your own unique path forward to investing and business success. No question!!