Explore how DiligenceVault's technology creates an efficient due diligence process and fundraising experience for asset managers and GPs

CONTENT MANAGEMENT

Create a comprehensive and secure cloud-based storage of your pre-approved content to quickly and easily respond to investors’ RFPs and DDQs. Access your content stored in DiligenceVault from our Chrome browser extension and Microsoft Office add-ins. Gain a competitive advantage with our modern content management tools such as intelligent content search, suggested response engine, and Q&A content uploader.

RFP AUTOMATION

Respond efficiently and confidently to RFPs, RFIs, Operational Due Diligence Questionnaires, ESG and DEI Questionnaires, and ad-hoc investor requests.

Track all investor requests on a centralized dashboard to ensure transparency and collaboration across the firm. Complete investor requests faster by using our auto-fill and response recommendation engine.

THIRD-PARTY & CONSULTANT DATABASE MANAGEMENT

Say goodbye to data disparity and welcome consistency across investment database population, regulatory filings, and reporting requirements. Prepare product and firm profiles for investment databases such as Mercer/eVestment, Callan, Morningstar, Wilshire, and many more.

INDUSTRY & STANDARD DDQ DISTRIBUTION

Maintain your Standard DDQ on DiligenceVault. Take advantage of industry DDQs such as the ILPA, PRI, AIMA, INREV, and SBAI, all digitized and pre-loaded on the platform. Reduce tailor-made response burden, raise capital faster, and address increasing needs for ESG/DEI requests by sharing your standard DDQs with investors directly via DiligenceVault.

ESG DATA COLLECTION AND REPORTING

Take advantage of a comprehensive framework to capture and monitor key ESG KPIs that are most relevant to you, your investors, and regulators. Choose from a number of pre-defined industry-standard reporting templates available on the platform (ESG Data Convergence Project, eFront ESG Framework, LSTA, InvestEurope, UN PRI) or create your own questionnaire with our flexible, no-code capabilities.

WHITEPAPER: How to Select the Right Technology to Support Your Investor Relations Teams

See how our whitepaper on selecting IR technology can help you as you formulate your strategy easier and better. The whitepaper covers:

- Benchmarking your technology and process automation needs

- Understanding current technology offerings in the market

- Identifying the right technology partners

- Getting internal buy-in and approvals

- Creating an adoption plan for success

BLOG: What is an Investor Relations Technology?

Successful capital raising or fundraising is a key component of revenue driver for asset managers. For a high-functioning IR team, data analytics and technology are key to streamlining sales processes, identifying potential investors, understanding their preferences, and tailoring pitches and diligence effectively.

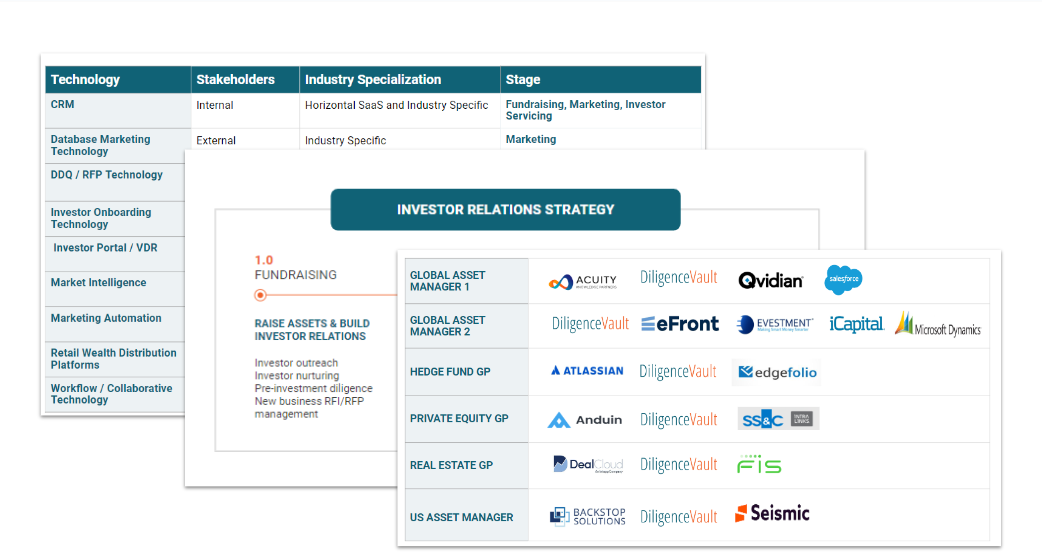

The investor relations technology stack for asset managers has modernized quite a bit over the last five years. Based on our research with our clients and users, we note that asset managers have chosen to use a combination of industry agnostic technologies along with purpose built vertical technologies to orchestrate their competitive advantage in support of their investor relations strategy.

Read More