Trusted by over 70,000 users in the asset management industry

What's new at DiligenceVault?

Who uses DiligenceVault?

Investment and Manager Research Teams

Manager research teams at asset allocators and asset owners trust DiligenceVault’s technology platform to source, diligence and monitor fund investment across traditional, hedge and private markets asset classes

Operational Due Diligence Teams

Operational Due Diligence (ODD) and Risk and Compliance teams power their DDQs and monitoring checklist via our technology, and create a central risk assessment heatmaps for modern governance and reporting requirements

ESG / DEI / Sustainability Teams

Collecting ESG and DEI data, as well as tracking engagement initiatives are key aspects how sustainability leaders at allocators and asset managers use DiligenceVault’s end to end data collection, diligence and reporting platform

Fiduciary, Conducting, and Controlling Teams

Asset Managers, ManCos and investors systematize their due diligence of delegates and outsourced service providers on DiligenceVault, demonstrating regulatory oversight and meeting reporting requirements

Investor Relations & Fundraising Teams

Asset manager and GPs rely on DiligenceVault’s central content database, industry DDQs including AIMA, ILPA, INREV, PRI, and collaboration functionalities to create an efficient diligence process for new and existing investors.

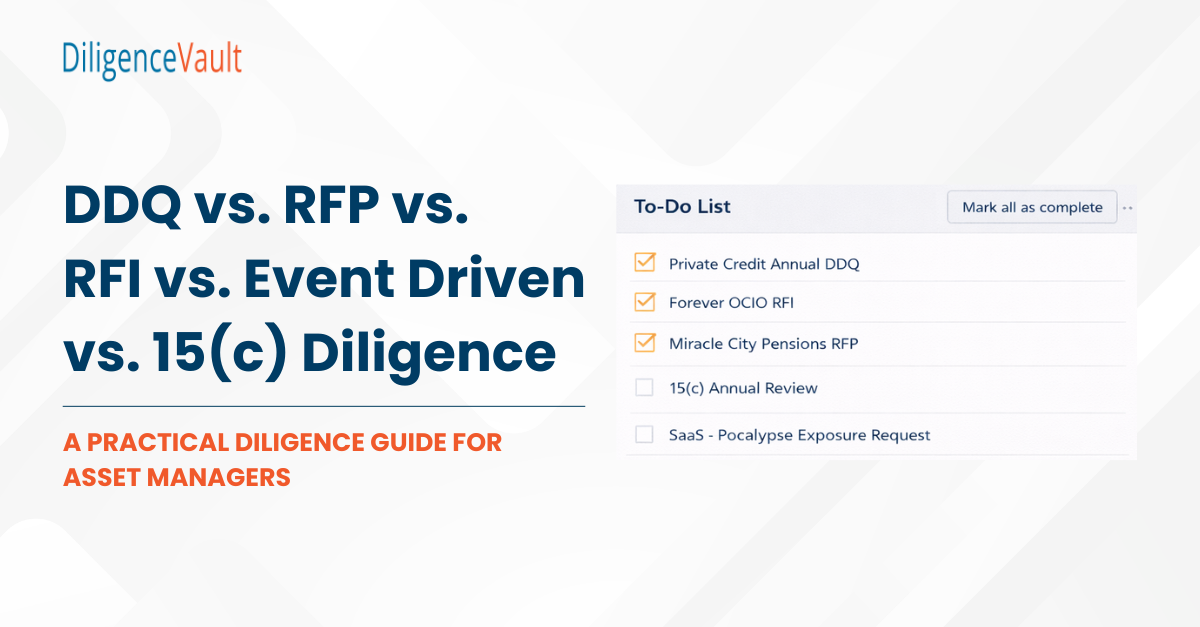

RFP / DDQ and Client Reporting Teams

Central content, AUM, performance, and document library combined with DiligenceVault’s intelligent response management process creates an efficient process for new business RFP and ongoing investor DDQ and reporting requirements for asset managers and GPs.

Experience the world's strongest diligence ecosystem

What our clients are saying?

Quick response and provided instructions to resolve my request. Thank you!

– A $20bn+ Leveraged Credit Asset Manager

Thanks for getting the authentication logs reporting enhanced as we requested. We appreciate the fast action!

– An Insurance Company Client

This is going to be a game-changer in our interaction with the external managers.

– Chief Investment Officer, $1tn+ OCIO

DV is very easy to use even for new hires. GP feedback is also very positive. We love how responsive Team DV is if we have a question or need support.

– A US Plan Sponsor Client

It is so much easier for everybody to capture the information and work on it piecemeal and share questions with people in my organization…and it’s a great product.

– Head of Investor Relations, $4bn Asset Manager

Given the current environment, I’m not sure we would have reached our deadlines without DV. The process went better than it has in the past using offline resources and the ability to use DV to communicate back and forth with our subs in the system saved us valuable time and effort.

– Compliance Director, Subadvisory Platform