In their fascinating book The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies, Erik Brynjolfsson and Andrew McAfee synthesize research from multiple fields and analyze the way technology is reshaping our economy, the world of work, and our personal lives. In the same way that the industrial age bent the arc of human history, the current age is also an era of dramatically transformative technologies. What are the forces at work and their implications?

We at DiligenceVault are interested in the book’s research into technology-enabled productivity improvements. While neither investment, operational nor transactional due diligence are specifically mentioned in the book, this blog considers the state of due diligence through the lens of their research.

The Nature of Progress: Gradual, Then Sudden

In the wake of the global financial crisis and the Madoff crimes, the amount and the sophistication of due diligence information has increased significantly, enabled by digital technology and communications. However, the means for information exchange, audit, storage, and meaningful analysis have not kept pace with the sheer volume of information. This means that the due diligence process at present is quite onerous, rife with inefficiencies and full of pain points, including burdensome administrative tasks, mind-numbing repetition, and suboptimal information storage requiring cumbersome searches. In the same way that the Industrial Revolution brought drudgery for factory workers, technology so far has brought much the same for due diligence analysts and asset managers.

As the book notes, investments in technology often take several years to reach full fruition; thus, the due

diligence process as yet appears to be incomplete. How can recombinant technology be applied to reorganize the due diligence workflow so that it is less costly and taxing, and fully leverages the power of the data? More specifically, what is the work that can be done by machines, and what needs to be done by humans?

Man vs. Machine: Working with Data

Citing work over a decade old by Levy and Murnane, the authors note that computers are great at crunching numbers and following rules. So in order to accommodate digitization of due diligence information, some sort of structure needs to be applied to this seemingly unstructured information in order to allow for the application of rules and basic number crunching. Transforming email questionnaires into platform templates to structure the information allows technology to provide a solution.

The book recounts the way that Google searches provided an immense efficiency over library research to find information. In the same way, the storage of due diligence information on a centralized platform can spare users the time and effort of locating historic information on shared drives and in email chains. The general purpose technologies (GPTs) of digital communication, documents and the cloud need complementary engineering to create a centralized research platform that satisfies the demands for information,communication, evaluation, and audit trail in the due diligence process. When the full suite of applicable technologies is applied on one central platform, due diligence technology can move toward its full beneficial multiplier effect on productivity.

Moravec’s Paradox: Hard Problems Are Easy and Vice Versa

The book discusses Moravec’s paradox, which asserts that low-level human sensorimotor skills actually require significant computational resources because they took millions of years to develop and are highly complex. In contrast, machines expend very little computational power for the high-level reasoning that humans developed over just the last several thousand years.

Diligence involves on-site investigation into managers. Since the sensorimotor superiority of Star Wars’ R2-D2 is still far in the future, on-site diligence will require human mobility. Fortunately, there is secure mobile technology that humans can leverage for the task by bringing their mobile devices with them on-site and uploading the information directly. But at present, the information gathered on-site is generally copied and pasted so that it can be stored and analyzed elsewhere. Is there a way to gain further efficiencies in the process? How can we parse the task to come up with a solution?

Cognitive vs. Manual and Routine vs. Nonroutine

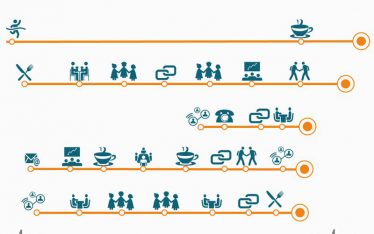

The book cites Acemoglu and Autor’s analysis of work as being either cognitive or manual, and either routine or nonroutine. Routine tasks of both cognitive and manual nature lend themselves to automation with either computational technology or machine engineering/robotics. This implies that any copying and pasting of information into different formats should not be necessary; ideally, such information transfer can be digitally arranged in such a way that humans are spared this mindless and repetitive task. How is that possible? Via a centralized platform that serves as both a repository as well as an information processor. Technology allows for prepopulating the answers to previous or recognized queries, eliminating a tremendous amount of repetitious work. Appropriate leveraging of technology thereby allows the human capital of an analyst’s fund evaluation to be maximized, rather than bogged down by redundant and mind-numbing administrative processes of data collection and storage that are best automated.

Recombinant Technology

The book gives examples of how innovations often result from recombinant technology in which existing capabilities are applied in new ways. In similar fashion for the diligence process, other widespread technologies, including workflow monitoring, time-stamped audit trail, blacklining, and communication between team members can be added to the diligence information gathered on the platform to create more efficient and effective analysis. All of this automation spares humans from drudgery, allowing them to focus on the nonroutine, value-added cognitive and manual tasks involving interpretation of the results and implementing investment decisions. Indeed, in the way that freestyle chess combines both computers and humans to create superior performance, a technology-enabled solution also allows for a more robust

diligence in combining the computational muscle of digital technology with the ideation and creativity of human beings.

Organizational Capital and Marginal Cost

Lastly, the economics of digital advances are a material consideration. The book notes that organizational capital is key. Firms must invest in technology and in reengineering their work processes to allow for a

streamlined and more effective process. Moreover, digital technologies often have a marginal cost approaching zero, meaning insurmountable financial advantage for first movers or market leaders.

Disruptive technology has now arrived in the due diligence space in the form of DiligenceVault. As noted

by Brynjolfsson and McAfee, such innovation is key to increasing technology’s multiplier effect on productivity growth and realizing the full bounty the authors describe as the main benefit of the second machine age. Recombinant technology like that of DiligenceVault also drives reorganization of the workforce over time. Brynjolfsson and Hitt found that the benefit of technology investment takes 5-7 years to be fully realized – so the earlier started, the better!

Cover Image Credit: iDigitalTimes