An Easy Way to Diligence

DiligenceVault is a technology that uses connectivity with your portfolio companies as its foundation to automate multi-step due diligence of private debt, portfolio finance and asset based lending transactions.

Private credit teams often rely on time-consuming processes involving spreadsheets and scattered document storage. DiligenceVault replaces this inefficiency with a centralized digital solution, simplifying the process by enabling teams to:

- Collect and organize diligence and research datasets in real-time

- Facilitate timely and accurate reporting from portfolio companies with ease

- Collaborate seamlessly across teams with a shared, accessible, and centralized knowledge base

By digitizing and connecting the entire underwriting and monitoring process, DiligenceVault frees up capacity for private debt firms to focus on analysis and informed decision-making.

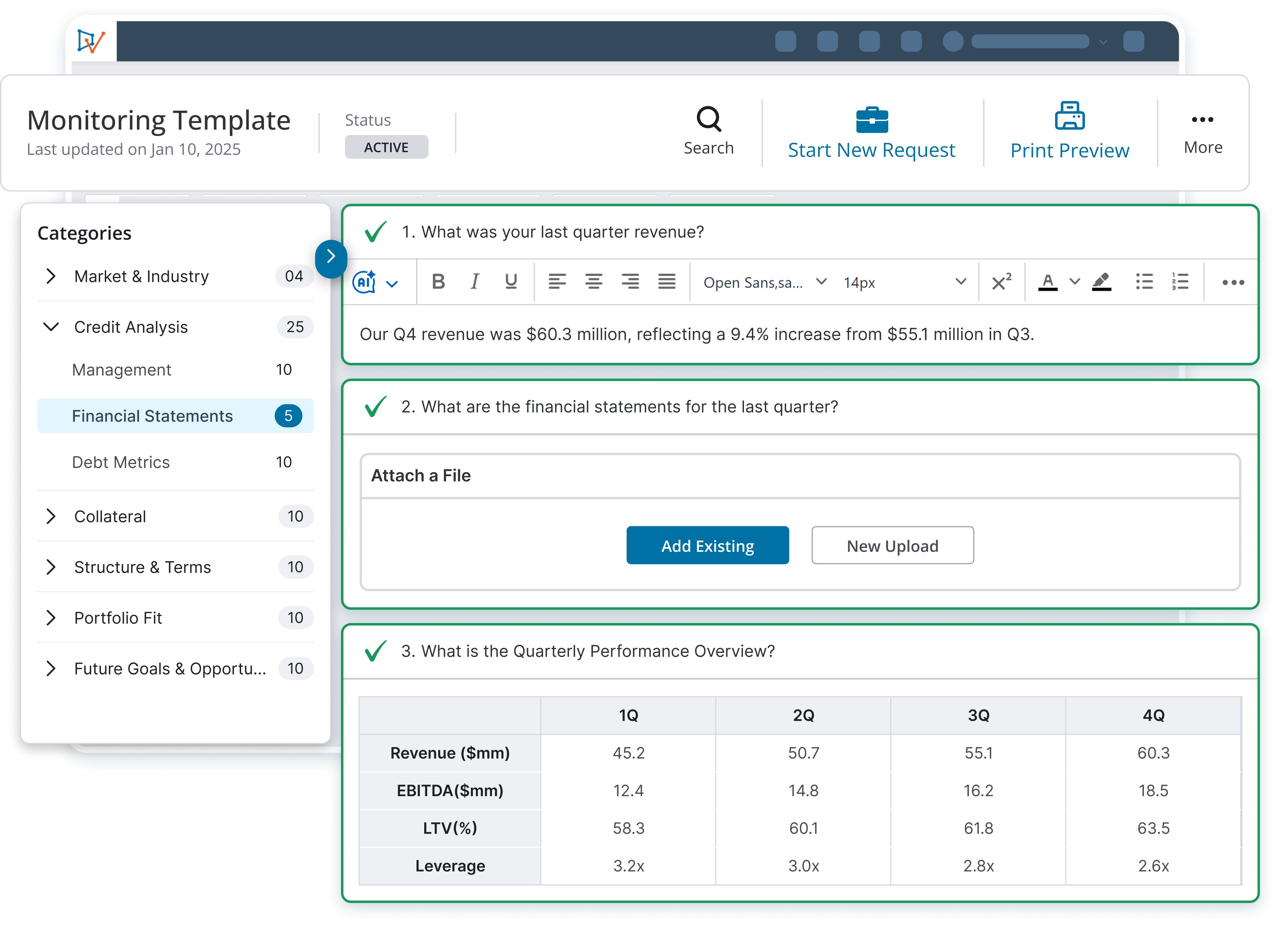

Create tailored private debt investment summaries, simplify team collaboration, and enhance portfolio analysis with DiligenceVault’s integrated tools:

- Integrated Reporting: Easily construct deal memos and reports for investment committees, regulators, and other stakeholders with integrated contextual AI automation

- Single Source of Truth: Seamlessly collaborate with the entire deal team and across operations, product specialists and reporting teams by working off a single golden copy of dataset

- AI and BI Dashboards: Generate insights with AI-driven summaries and business intelligence dashboards

Discover how DiligenceVault enables private debt firms to build scalable, compliant, and differentiated portfolios. Download our specialty private debt fund client case study to learn about their ROI and build your internal business case.

Access NowBook a DemoPrivate Debt Diligence Platform Capabilities

A secure and purpose-built platform – source, approve, and monitor your investments across diverse debt strategies.

Source Opportunities

Digitize your credit sourcing funnel while creating a personalized database for new opportunities. Make it easy for portfolio companies to connect with you.

Diligence & Approve

Streamline data and document collection with a digital diligence framework. Document your risk assessments and views on a centralized platform for better decision-making.

Monitor & Analyze

Track credit KPIs and identify risks proactively. Use integrated tools to enhance monitoring and build differentiated, resilient portfolios.

Related Resources

Due Diligence In Private Credit Investing – A GP And LP Perspective

Explore key considerations and best practices for due diligence in private credit investing. Read the blog for insights to make informed investment decisions

Read Takeaways

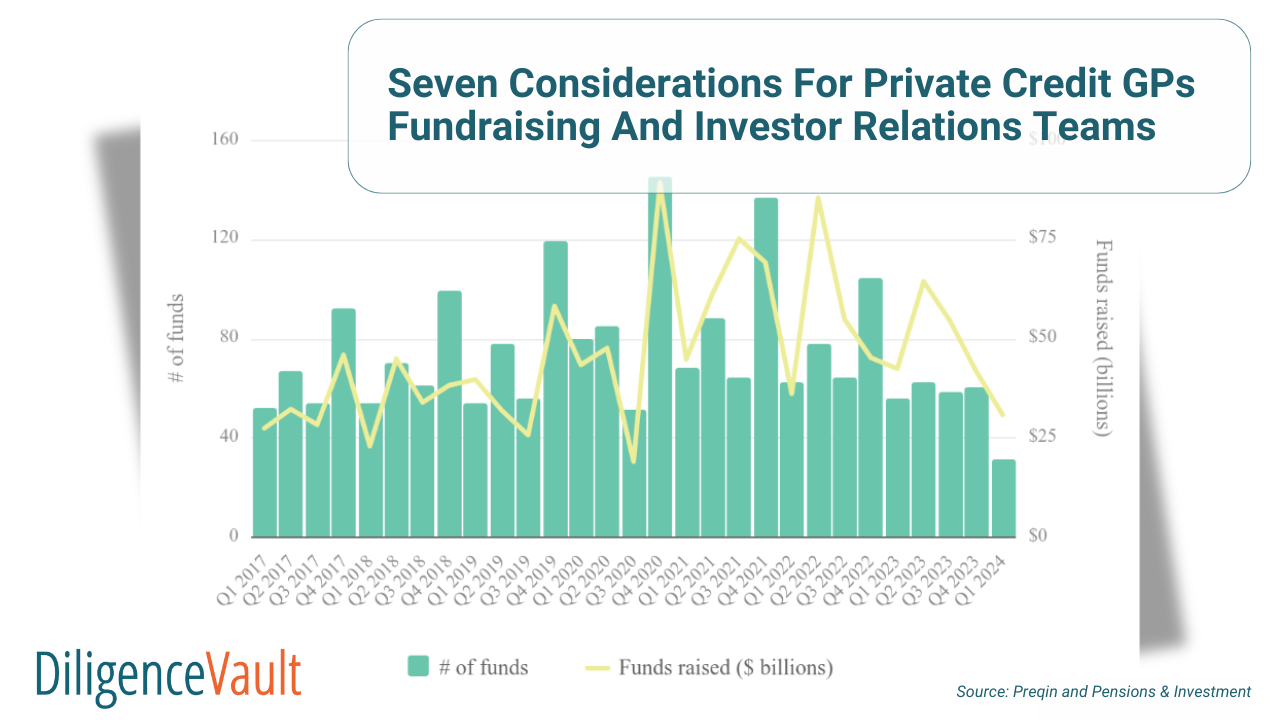

Seven Considerations For Private Credit GPs Fundraising And Investor Relations Teams

Learn how private credit GPs can enhance fundraising with actionable insights and technology. Read the blog for strategies to boost investor engagement and efficiency!

Read moreFrequently Asked Questions

DiligenceVault serves a diverse range of clients within the asset management industry, including:

- Allocators

- Asset managers

- General Partners (GPs)

These clients utilize the platform to manage direct investments, co-investments, and fund investments, ensuring comprehensive support across their portfolios.

The platform is designed to accommodate a variety of private credit strategies, offering tailored solutions for:

- Asset-based lending

- Direct lending

- Portfolio finance

- Real estate finance

- Specialty finance

By digitizing processes and frameworks, DiligenceVault provides a centralized knowledge management solution for seamless operation across these strategies.

DiligenceVault helps automate the workflow of sourcing new investments based on your tailored KPIs and sourcing criteria and creates a connecting pipeline on the platform.

DiligenceVault has been using AI since 2019 and has also launched a Generative AI module in 2024 called DV Assist. This module helps in reviewing manager diligence materials and creating draft of fund summaries.