How We Are Managing “Explanation Risk”

(and coined yet another buzzword while using the most over-used chart in the investment industry. High fives ALL around!)

In every investment professional’s life, the 4-quadrant (“quad”) analysis is omnipresent in daily professional and personal living. When did you come to terms with your quad chart addiction? Was it during your business school case studies (think SWOT Analysis)? Economics class (think Utility functions)? The 500th investment presentation (think Risk/Return, Style analysis)? Or was it that time you mapped out the productivity of your Saturday afternoon vs. length of time you spend at brunch?

However, instead of checking into quad chart rehab or reconsidering how we spend our Saturday afternoons, we at DiligenceVault have chosen to embrace our addiction. Yes, against our better judgment, we have defaulted to explaining what it is we do here using a quad analysis, the only language we know how to effectively communicate with fellow investment professionals.

In the early stages of beta testing, we found ourselves struggling with “explanation risk” (also coining a much needed NEW buzzword).

Explanation Risk

noun

The risk that no one actually gets what your company does. Possible causes include:

- poor explanatory skills

- lack of direct competitors

- apples and oranges comparisons with existing solutions

Our audience couldn’t relate to what we were building. Common questions were – how are we different than various screening databases? Are we just another virtual data room? Or are we competing with incumbent CRM systems? How can you explain your vision when you do not have anything comparable to point to? After much confusion and failed attempts in telling our story, it was time to go back to the drawing board.

Time to tackle this explanation risk head on.

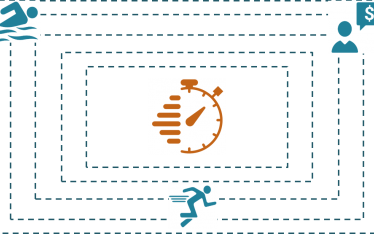

During our nth brainstorming session, we came up with quad analysis to convey a concept (clearly, or so we like to think) to a group of investment professionals.

Fundamentally; DiligenceVault is built as a centralized due diligence platform based on two concepts:

- Data Efficiency: Moving the industry from document-driven manager selection and monitoring to data-driven decisions, using structured data (buzzword alert!) to improve analytical capabilities.

- Process Efficiency: Automating manual processes to streamline workflow and collaboration.

Here is the quad we finally came up with (guess who falls in the coveted top right? DiligenceVault, of course!)

Since our industry describes so many concepts in boxes, we went through an exercise to describe what we are trying to do in a lanuguage that everyone should relate to (while at the same time feeding our addiction to quad analysis). Our goal was to distinguish our platform from existing technology while describing our value proposition. After all, it’s not about what you believe you offer, it’s about what the industry believes you offer.

Stay tuned for more updates! (and most likely more quad charts and new marketing buzzwords).

This article was co-authored with Monel Amin.