A successful Operational Due Diligence (“ODD”) program is complex, yet structured for repeatability and consistency and usually is a combination of key components (listed alphabetically). The importance and frequency of each component is defined by each investor based on their fiduciary mandate, staffing and ODD program maturity.

- Background check / investigative verifications

- DDQs and risk assessment

- Document review

- Onsite visits

- Regulatory review

- Service provider review

At DiligenceVault, we have a large cohort of ODD teams as clients and industry friends, and DiligenceVault is the digital backbone for their due diligence workflows, we continue to build connectivity and partnerships with providers who are an integral part of the ODD framework. Today, we focus on background checks / investigative verification products:

A background check is an important risk management tool for investors. Pre-investment and ongoing background checks ensure that the fiduciary allocations are made to individuals and entities who are trustworthy and reliable, limiting the potential liability of the investor.

According to a recent Seward and Kissel survey, 72% of allocators ranked background checks and references as “very important” in conducting their business. We spoke with over 40 clients and industry experts, and our research also points to a high degree of value in conducting background checks.

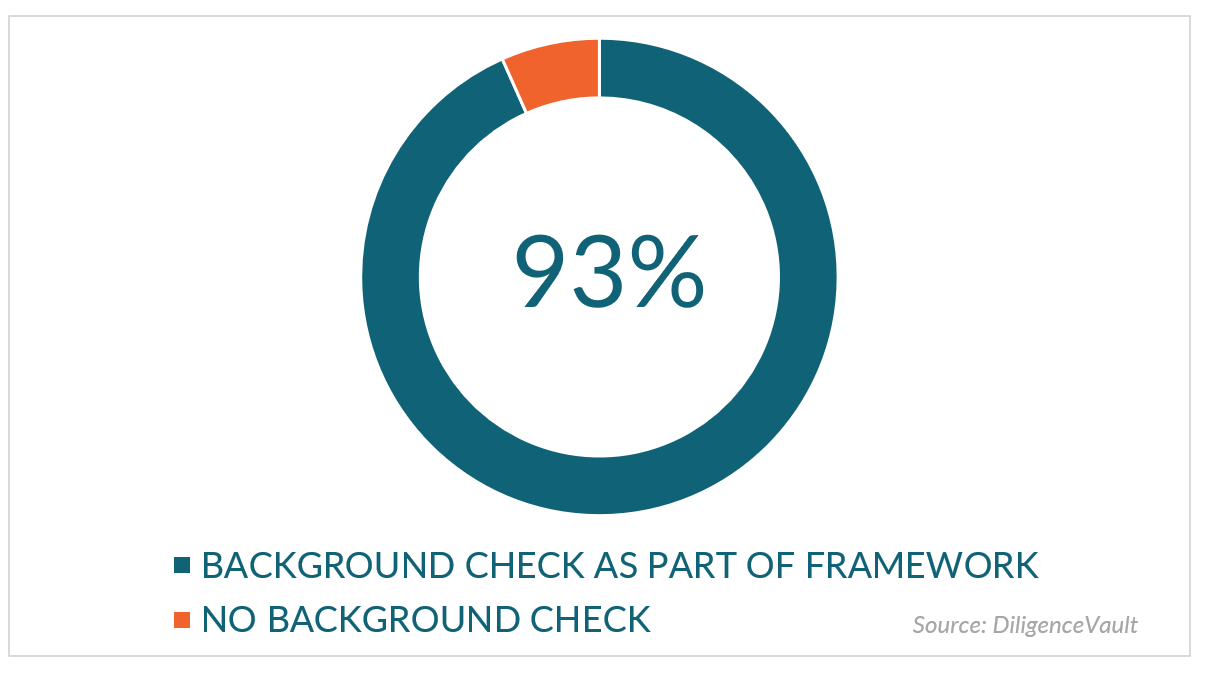

However, what we found is the implementation of a background check framework widely varies across investors.

However, what we found is the implementation of a background check framework widely varies across investors.

Below are five takeaways from our recent discussions:

1. What review cycles do firms follow for a background check framework?

- Prior to an initial investment. This takes two forms – The majority of investors request a background check as part of the ODD or even legal and compliance sign-off which is usually done in late stage due diligence. However, there are some investors who rely on background checks early during the investment screening process before allocating more time and resources to a given investment opportunity.

- Every 2-3 years post-investment during the review of the manager

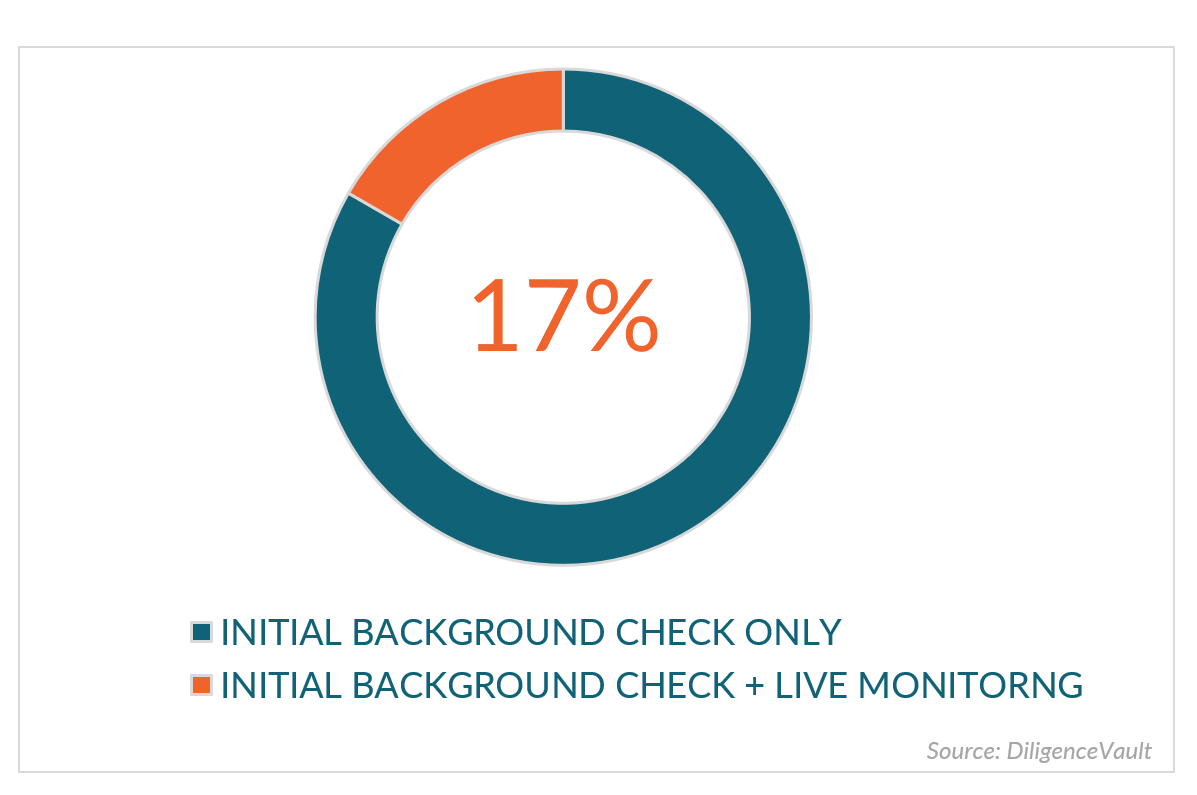

- Continuous legal monitoring and real-time media monitoring for any adverse changes. We note that 17% of our research universe have adopted live monitoring, and more expect to do so.

2. What does a background check encompass?

- Verify the educational credential, work experience, address, and self-attestation of the the key individuals associated with the investment partner

- Review any sanctions, PEP status, and their implications

- Confirm legal standing of the investment partner

- Identify civil and criminal issues including debarment, suspension, investigation, legal action, financial issues or negative publicity associated with individuals or investment partners.

- Assess risks via regulatory filings

- Monitor adverse media

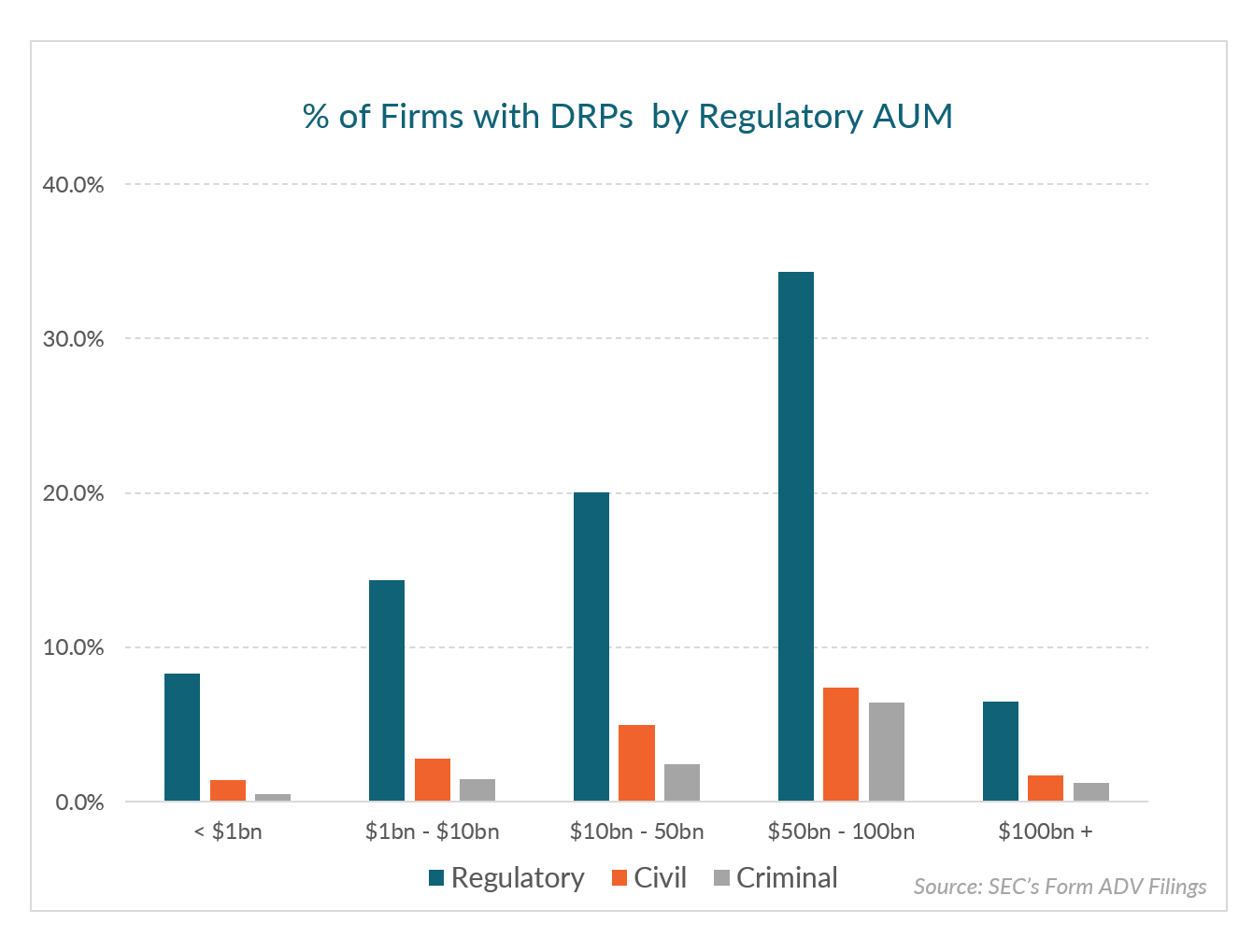

A general expectation is that big firms may not have “unknown” issues uncovered based on investigative background checks, given their sophisticated governance and controls framework. On the other hand, as the complexity at large firms increases, the risks issues also increase. Our analysis of SEC’s Form ADV filings suggests that firms having regulatory AUM ranges of $10bn – 100bn have the highest risk in terms of civil, criminal and regulatory issues.

3. Seven factors drive the evaluation of a background check provider

3. Seven factors drive the evaluation of a background check provider

- Depth of coverage and verifications: The industry experts place a high degree of value on boots on the ground processes. Given that some court records are not digital, and for the ones which are digital, oftentimes there’s a delay in getting records digitized.

- Quality of coverage and output is equally important: Identification of false positives, and having the ability to summarize findings, are critical, especially for complex investment managers and individuals. Delivering a clean historical output for large and complex managers is important for the clients. For example, media coverage of Larry Fink or Blackstone would return many records and would be overwhelming for the users to summarize and focus on areas of importance.

- Data privacy regulations: Given the dependency of background check verifications and monitoring on PII (names, email, address, birthdates, etc), the handling of data privacy aspects is important.

- Speed of results: As the transaction speed is ever increasing, the speed of report turnaround is critical for investors, especially as more investors are looking to implement background checks earlier during the due diligence process.

- International coverage: Most investors make global allocations and hence coverage of international subjects and entities is important. This is an area to build competitive advantage in for most background checks providers given challenges with differences in regulatory reporting, language, regional complexities, and limited availability of records.

- Client service and support as well as report output are also often deciding factors

- Most investors maintain multiple relationships as they can call on the provider based on expertise, price and speed of delivery in case of backlogs

What’s exciting is that there is important innovation happening in this space as new business models and technologies are employed. Our research surfaced the following providers who help with all or components of background checks. There are clear trends of preferred providers based on the type of the investor – whether you’re an asset consultant, an endowment, a foundation, a bank, or an FoF platform.

4. Return on Investment

4. Return on Investment

- Based on our research, adverse results from background checks have on average blocked < 2% of investments in a decade. While the risk is perceived as remote, the severity could be huge in terms of negative news or bad behavior making it a necessity to be prudent and protect the downside. A good background check framework is considered an important investment as the allocation check size can be in the millions.

- Overall, background checks are more expensive for private equity fund executives vs. hedge fund executives.

- Background checks are also more expensive for international subjects, where the records and verification information availability in public domain is also limited.

5. The next innovation in the background check ecosystem

- Client experience: Investors are increasingly expecting a better user experience, where they want the ease of use in automating the background check request process, efficient report delivery, access to analytical dashboards, et al.

- Automated risk scoring: While there is room for greater automation and the introduction of risk scoring models, often this decision requires a lot more judgment. For example, how should a DUI record be scored? Different investors have varying degrees of thresholds for such risk factors, so an absolute score is often not a good indicator of generalized risk.

- Coverage: A focus on greater coverage is important for investors to cover for edge cases. As an example, most providers assess the most recent 1-2 places of residence, which leaves gaps if the subject has lived in many locations, or travels extensively.

- AI & ML applications: For news and continuous monitoring – the efficacy of technology to address language restrictions is a competitive advantage. Another important aspect of continuous monitoring is to avoid false positives by deploying sophisticated entomology and language models.

- Integrated experience: While background checks are important aspects of due diligence, they are one of the sources of diligence, and investor’s wish lists include an integrated experience on a centralized platform.

Thank you to our clients and industry friends for sharing your insights and experiences as we build background check integrations in our platform. This research has been instrumental as we have begun a phased approach to partner and integrate with background check providers leading innovation in this space.

To evaluate how DV and our technology partner ecosystem can help digitalize your investment, ODD, ESG due diligence frameworks, please contact us to learn more.

Check out DV’s resources on DDQs and regulatory reviews here: