‘Tis the season of macro and investment outlooks as folks consider what’s in store for 2018. So we decided to take some 15+ views from various banks and investment houses, and to juxtapose two analyses – human review and machine review.

The overall theme is nicely summarized by Howard Marks in his memo – Latest Thinking:

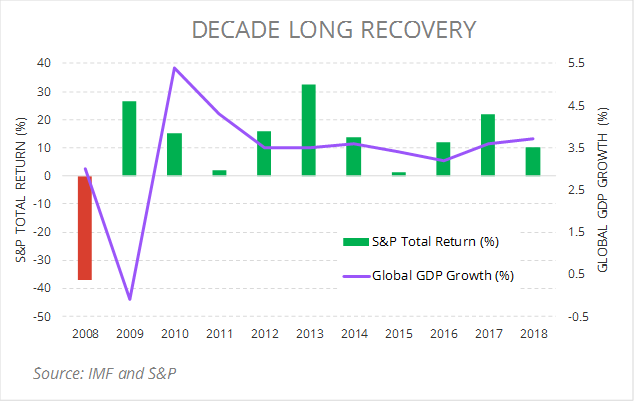

The U.S. economy is chugging along, and the recovery that started in 2009 has become one of the longest in history (103 months old at this point). The rest of the world’s economies are joining in for that rare thing, worldwide growth. Most economies seem to be gaining rather than losing steam, and they don’t appear likely to run out of it anytime soon

A Changing Context

Overall, there’s general consensus that we are nearing the end of the business cycle. Fundamentals remain strong, and valuations are rich.

- Global GDP growth: The forecasts for 2018 ranges from 3.2% to 4%, but most skew towards the high end, signaling a projection of sustained global growth.

- Inflation: While some see inflation undershooting expectations, few see gradual increase, but no significant risk.

- Top three recurring themes in most outlooks: China, geopolitical tensions, and technological innovation

Artificial Intelligence Review

We invest in Natural Language Processing (NLP), which is a form of artificial intelligence around machine understanding of human (natural) languages, and apply it to simplify diligence and research areas. Today, we apply it to a fun exercise – sentiment analysis on these research reports. Sentiment analysis analyzes text and identifies the prevailing emotional opinion within the text, especially to determine a writer’s attitude as positive, negative, or neutral. It has been actively used to decipher sentiments from twitter feeds, reviews and more. And now we apply it to 2018 outlooks, and the results are interesting:

Taking it to the next level, what was fascinating was seeing the titles of these outlooks. While working with short text poses problems in NLP-only application, we added human overlay:

A Difficult Place to Start

Will 2018 be a year of endowment style investing, 60/40 investing or a year of being defensive? Going back to Howard Marks’ memo:

Time to be excited about the fundamentals, but wary of the high valuations and asset prices. Both positions have merit, but as is often the case, the hard part is figuring out which one to weight more heavily.

Quoting BofA Merrill Lynch Global Research – A Year Ahead Forecast So Bullish, It’s Bearish! Good luck to our clients, friends, and industry colleagues for a successful 2018!