Each day we work with professionals who interface directly with their firms’ clients. We see that these professionals are increasingly willing to leverage technology for an uptick in efficiency and experience. Whether the discussion takes the form of a discovery call, a product demo, or an implementation meeting, these client-facing individuals often see the value for their teams, their firm, and most importantly their clients before anyone else.

The top themes and priorities of these professionals revolve around:

1. Accessibility and visualization – creating an optimal client experience

2. The future of their firm as the industry adapts to changes

3. A focus on quality vs. volume as their clients rationalize investment options

4. Partnerships with the right technology platforms to support future growth

5. Leverage artificial intelligence

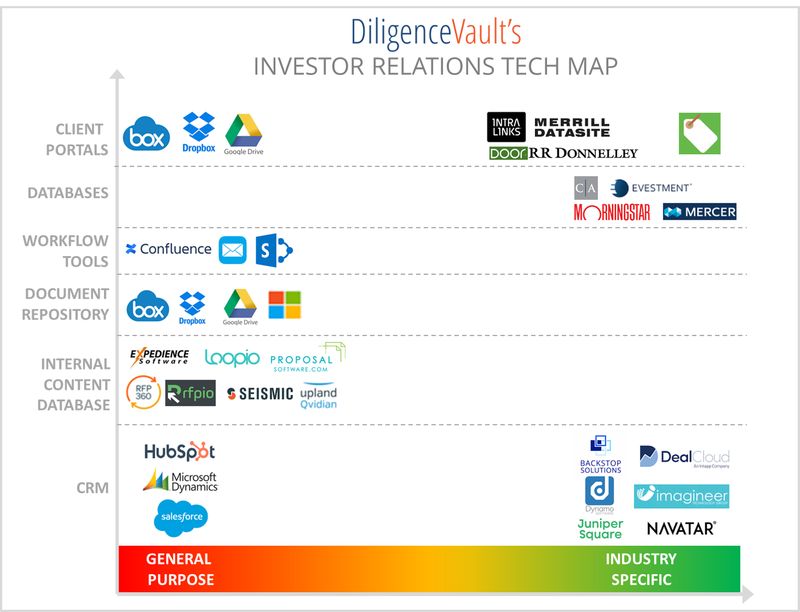

As modern technology starts to play a larger and more integral role in investor client engagement, we know there will be key differentiators between the past, current and future providers. As the asset management industry is changing, so are the industry’s available digital solutions. The technology used by these teams range from generic solutions, but in some segments, particularly CRM and VDRs, larger firms have defaulted to industry specific digital solutions.

Too Near, Yet Too Far

The starting point for most firms considering new technology is budget. It can be difficult to estimate the various costs involved, and budget is always a concern for non-immediate alpha generating functions. Additionally, any change that poses a risk of disrupting client service is bound to be subject to heightened scrutiny from multiple constituencies within the firm. Further, the enterprise overall may have an agreement with a technology provider whose application is not specific for the industry, and whose adoption then leaves gaps in needed functionality. Many digital solutions can’t communicate with each other across platforms, which necessitates manual processes, creating opportunity for errors and omissions. Lastly, many technology solutions are static and do not evolve, which limits their ability to truly transform with the enterprise.

All of these challenges typically result in firms adopting point solutions that are affordable, and then implementing manual workarounds to make these solutions work. Such workarounds can take the form of double-entry of information into multiple systems, manual reconciliations or even customizing the system to meet industry needs. In these cases, the human costs significantly eclipse the technology cost, resulting in a highly expensive and inefficient process.

IR Tech Roadmap

What should the future roadmap look like for IR teams? It is important to consider plans for the next 6-12 months as well as for the next decade when constructing this roadmap. The three core questions an IR leader should consider are actually the same for both short term and long term, however the importance of each could change depending on the time horizon:

1. How can we grow our business?

2. What are the possibilities to run our operations more efficiently?

3. How can we deliver the next level of customer experience?

-Deloitte 2019 IM Outlook Report

Asset manager firms find themselves in new business environment as the industry is undergoing transition with fee pressures, increasing regulation and investors rationalizing their investment options. As the asset management industry shifts, a robust and agile digital solution will be a top priority when looking at the roadmap. In the short run, working on a technology plan that brings operational efficiency is key, as an operationally sound organization is well positioned to deliver higher growth, preserve margins, retain market share and retain talent by making employees’ lives easier.

The first step is to ensure your firm has a cohesive technology stack. As it stands now, the asset management industry is full of old tech, new tech, and the weird “in between tech” which no one knows what to do with. Organizing this messy technology infrastructure landscape and ensuring that all applications, platforms, and databases work together is a first priority. This will lay the groundwork for future improvements.

Long term technology plans will build on operationally efficient improvements while developing better and better customer experience initiatives and empowering IR teams by offering insights which can be easily gleaned. This next step would involve design thinking, data integrations and AI applications. Many firms are already taking advantage of data science and modern tech, but in the alpha generation aspects, while investor relations does not get it’s share.

The promise of AI has generated lots of buzz, and users expect magical outcomes. The problem with this lies in the assumption that an initial technology upgrade will mean “AI magic”. Rather, advancing technology is a multi-step process that should be recognized as such. Over the next decade, firms will need to put their technology infrastructure in place and start utilizing agile platforms which promote centralization, structuring of data and processes, and collaboration. This will lay the perfect foundation for advanced algorithmic transformation. This roadmap for IR technologies ultimately will help IR leaders understand their changing clients’ need and deliver a delightful client experience.

As one of prospective user said, “Enjoy Tech, and don’t just endure it.”