Software as a Service (SaaS) is both a revenue model as well as a computing model. Also known as cloud computing, this method of delivering an application was arguably first introduced by Larry Ellison, Zach Nelson, Evan Goldberg, and Marc Benioff (think: Oracle, Siebel, Salesforce) when the notion of running a version of Siebel on the internet was first considered a possibility (CRMSwitch.com). From this, many innovations have occurred, all of them seemingly picking up an acronym along the way. So, what is in an acronym? Why all the fuss about SaaS applications in various verticals? Most importantly, how has InvestTech been impacted and what is coming next?

[Cue the acronyms]

Before Cloud (BC)

When we look at the beginnings of cloud-based computer software, we can essentially thank the Rolodex. Digital Rolodex systems came about and were quite popular in tracking contacts. But when that aforementioned group led by Ellison began to apply the internet to these programs, everything started to get “SaaSsy”.

After Digital (AD)

This roadmap for a digital Rolodex became a catalyst for many things we know today as SaaS. Though, prior to Benioff and the bunch, we need not forget about a pre-SaaS solution, ACT! (Automated Contact Tracking) considered, “…the first ever CRM, and was developed by Pat Sullivan and Mike Muhney in Texas.” It was a simple idea; people needed a software solution to manage their contacts. But when Benioff developed Salesforce, the jury was still out on what further functions a system like this would serve as well as what it would be called. Regarding the name of a system like this, we had a variety of choices to choose from.

Let’s recap:

- CMS – Contact Management System

- ACT – Automated Contact Tracking

- CRM – Customer Relationship Management

- SFA – Sales Force Automation

- ECM – Enterprise Customer Management

- CIS – Customer Information System

Whew, that’s a lot!

By the end of 1995, CRM (Customer Relationship Management) won out. Some attribute this to the technology research company Gartner; while Tom Siebel, Larry Ellison and Marc Benioff all have their own version of the history (CRMSwitch.com). Regardless, around this time the software started to provide more than just contact information. From a digital Rolodex we saw the importance of Enterprise Resource Planning (ERP) being interconnected with a CRM. This function allowed for the CRM to move away from single customer solutions to entire enterprise solutions. Oracle, SAP, and others all started competing for the top CRM as well. Who wins? Well, Siebel was the earliest widely-adopted CRM solution at the time, but Larry Ellison also invested in Benioff’s rendition which would become Salesforce. Salesforce, also known as (AKA) the first successful SaaS company, became the fastest growing software provider in the world by digitizing the Rolodex and putting it in the cloud. They dominated the CRM SaaS market with their ironic and iconic advertisement: “The End of Software”.

Horizontal SaaS Phenomenon

The SaaS revenue model has become preferred as well, with a monthly or annual payment in exchange for the software service. This model is easy to report and forecast while also containing relatively small upfront fees. Today, there are SaaS companies for nearly every functional line of business.

SaaS meets Finance Vertical

When we look at fintech, we see a multitude of areas where innovation has occurred. We can look at the evolution of fintech from Arner, Barberis and Buckley, 2016:

- Fintech 1.0 – From around 1866 to 1967, the financial services industry remained largely analog, despite being heavily interlinked with technology

- Fintech 2.0 – From 1967 to 2008, finance was increasingly digitalized due to the development of digital technology for communications and transactions

- Fintech 3.0 – Since 2008, new start-ups and established technology companies have begun to deliver financial products and services directly to businesses and the public, as well as to banks

Now that we’re in Fintech 3.0, let’s look at its impact on InvestTech. First, the investment and asset management industry has fully come to terms with the adoption of cloud computing (thanks be to the cloud!). But it has taken a few years. Just 40 percent of respondents said that they had a clear and coherent digital strategy, according to a 2017 survey conducted by MIT Sloan Management Review and Deloitte. In fact, nearly two-thirds of respondents reported that not enough time, energy, and resources were being spent to implement digital business initiatives. When we look at the respective InvestTech maps for both Investors and Managers DiligenceVault has published for the industry, we see there are many functions with different SaaS applications available for each. It’s obvious the industry has had its fair share of innovation.

Limited Partners (LPs) & General Partners (GPs), Connected

Looking specifically at a few technologies both Investors and Managers use frequently, and often times in tandem, we find those CRM applications, as well as Research Management Systems (RMS), Virtual Data Rooms (VDR), and Request for Proposal (RFP) tools. Then, of course, there are the shared drives, emails, workflow and note-taking apps, as well. This begs the question, what’s next in this area? What will be innovated?

One team thought there was more to be done. In 2014, DiligenceVault sought to combine these technologies to create a digital, automated and transparent process for both sides: the manager research and due diligence professionals could use one aspect with multiple functions; and the sales, business development and RFP teams, the other. The information exchange between the two sides gets digitized and centralized.

One more acronym (DDP)

Thus, a new SaaS application was developed and brought to market utilizing a multitude of the most important functions across the respective portions of that InvestTech map, while at the same time connecting the two worlds. In fact, DiligenceVault is the first two-sided Digital Diligence Platform (DDP) in the industry.

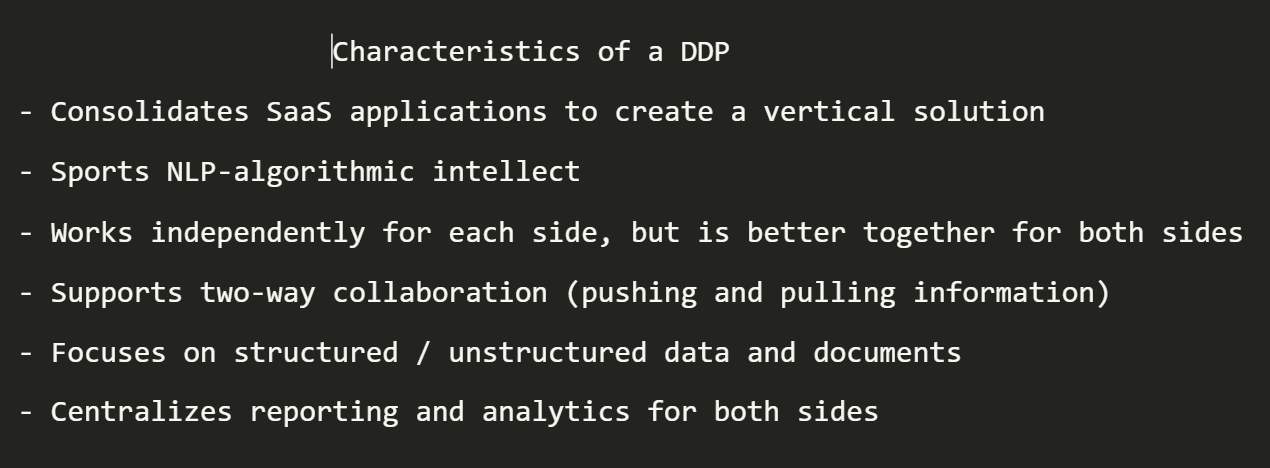

Characteristics of a DDP:

– Consolidates SaaS applications to create a vertical solution

– Sports NLP-algorithmic intellect

– Works independently for each side, but is better together for both sides

– Supports two-way collaboration (pushing and pulling information)

– Focuses on structured / unstructured data and documents

– Centralizes reporting and analytics for both sides

DDP is an acronym we coined because despite the various applications in the industry, there is nothing which really brings diligence, research, and relationship management together under one roof while also connecting the managers to this process via a data/document portal and a proposal platform. This, my friends, is a DDP! It should be noted, DMS (Diligence Management System) was a top contender for this title. But DDP, with its emphasis on “Digital”, captures the transformational change in the diligence space – going digital. So, to all the digital or diligence enthusiasts out there, DDP is a new technology in the industry and certainly an acronym worthy of review.

Disclaimer: No letters were harmed in the writing of this blog.

References:

Brandell, 2017

Buckley, Ross & Arner, Douglas & Barberis, Janos

CRM Switch

Deloitte 2019