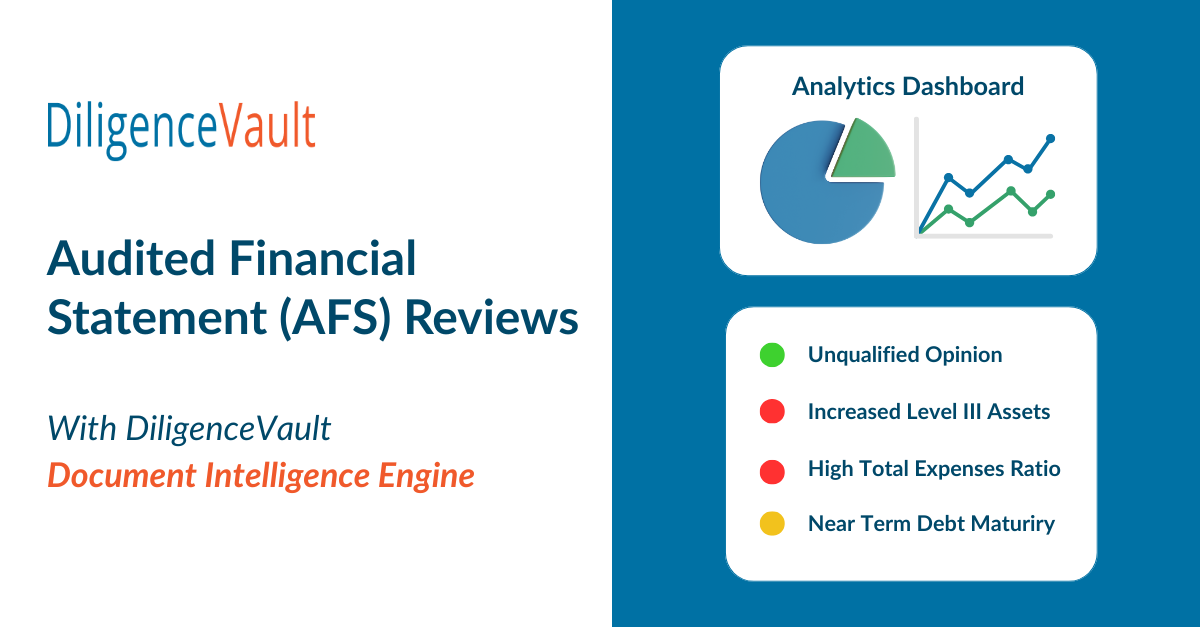

When allocators and consultants dive into manager and fund Audited Financial Statements (AFS), the process is anything but simple. AFS reviews are essential to understanding a manager’s and funds financial position, key risks, portfolio characteristics, but they remain one of the most manually intensive and nuanced steps in the due diligence process.

The scale of work is significant. On average, institutional allocators review 200 to 300 financial statements each year. These reviews span not only fund-level AFS, but also management company financials, filings from publicly listed firms, unaudited quarterly updates, and even portfolio company financials for private markets strategies.

What’s Involved in an AFS Review?

The typical review unfolds in three main steps:

- Extracting Key Metadata, including the name of the auditor, audit period, type and basis of audit, and any qualifications or limitations in scope.

- Analyzing the AFS, with key review areas include:

-

-

- Realized and unrealized gains and losses

- Liquidity and financing structures

- Expense ratios

- ASC 860 Level I-III asset breakdown

- Schedule of Investments

-

-

- Reviewing the Notes which often contain critical insights such as:

-

-

- Risk disclosures

- Conflicts of interest and related-party transactions

- Subsequent events

- Nature of financing

-

-

For hedge funds, the complexity increases further due to master-feeder structures and multi-entity reporting formats.

What makes this process even more challenging is the lack of standardization. Terminology varies widely. Managers classify and disclose information in different ways. Most allocators who review audit financials, extract and store this information manually in spreadsheets. Additionally, several stakeholders are involved in this review across functions such as finance, ODD, and investment for ongoing trend analysis and monitoring.

What’s About to Change in AFS Review?

Clients have been requesting features to manage this process for quite some time. At DiligenceVault, we asked a simple question: How can we make AFS reviews more scalable, consistent, and collaborative, without losing depth or context – especially when applying Generative AI?

The result is the DV AFS Analysis Module, powered by our Document Intelligence Engine.

Here’s How It Works:

- Pre-Engineered AFS Blueprint: We provide a consistent framework based on deep industry input, eliminating the need to start from scratch for every client, while maintaining the flexibility to customize the analysis.

- AI-Powered Extraction With Confidence Scoring: Our engine extracts key data points and tags them with confidence levels, helping reviewers focus on what needs verification.

- Built-In Risk Flagging: Automatically identifies irregularities and highlights potential issues, such as audit qualification, delays, or unexpected variances.

- Collaborative Reviews: Multiple stakeholders, including legal, finance, ODD, compliance, and investment teams, can work together in one shared workspace.

- Manager Interaction: Clarification requests and open items can be tracked and resolved directly with the fund manager, avoiding scattered communication.

- Downstream Integration: Extracted data flows directly into portfolio monitoring dashboards, peer benchmarking tools, and investment memo templates.

Why We Built It This Way – Our Design Principles

Initial research showed that users wanted to chat with AFS documents and ask the kinds of questions they typically review. This was heavily influenced by their internal use of tools like ChatGPT, CoPilot, or demos from LLM wrapper vendors. Essentially, the request was for faster horses.

We began our R&D with that experience, and in most cases, the AI outputs were strong and directionally helpful.

But Several Friction Points Emerged Quickly:

- Users expect instant responses when interacting with documents. For complex AFS files, that’s difficult. Running deep backend processing for accuracy takes time and doesn’t align with real-time expectations.

- Many users weren’t sure how to craft effective prompts. It’s not always obvious what to ask AI, especially with complex financial reporting.

- Even if users could build a strong prompt set, would they really want to repeat the same 20 questions across 200 AFSs? That’s not scalable or efficient.

- Then there’s the question of how to use the AI output. Should they export to Excel? Feed it into DiligenceVault? How does it fit into their portfolio monitoring, time series analysis, or ODD/IDD memos?

- And when a red flag is spotted, how do teams collaborate, escalate, or resolve issues within a shared workflow?

These gaps made it clear that prompting alone wouldn’t meet the operational needs of our users. So, we built a truly scalable solution around five core design principles:

- Standardization Through a Common AFS Blueprint: We developed a consistent structure for AFS review, based on collective internal expertise. Shout out to our finance team and general counsel, who previously worked at an OCIO and helped co-design the first version.

- Client-Led Enhancements: We expanded the blueprint through more than 25 in-depth interviews with allocators and consultant clients. Some even contributed their internal Excel or DV templates, helping us refine the blueprint and review priorities.

- Faster Time-to-Value: Rather than relying on open-ended prompting, the automated baseline simplified client time-to-value. This eliminates repetitive document interactions and gets teams to insight faster.

- Built-In Prioritization: Our models surface material risks and key data points, so reviewers focus their time where it matters most.

- Connected Workflow: The platform supports a seamless flow from extraction to review to analysis and memo generation. No more copy-pasting between documents, spreadsheets, and tools.

What we ended up building is far more robust and complex behind the scenes, but dramatically simpler for users. To borrow from Henry Ford, we didn’t just give users a faster horse. We are giving them the car.

Ready to Rethink AFS Reviews?

Discover how your team can reduce manual work, uncover insights faster, and collaborate more effectively while maintaining the highest standards of review quality, and review 100+ AFS in a matter of hours.

Sign Up for a Demo of Our “Car” Today

If you don’t have the internal bandwidth but would like to initiate an AFS review process, we can introduce you to ODD specialists who are also clients and can provide an advisory overlay powered by our technology.

What is a Document Intelligence Engine?

The Document Intelligence Engine is a purpose-built module within DiligenceValt’s AI offering – DV assist. The engine supports asset managers and allocators in navigating the complex landscape of fund documents as part of their due diligence workflows.

Allocators can use the engine to extract structured data from a wide range of fund documents, including AFS, PPMs, investment policies, prospectuses, assurance reports, pitch decks, and fund commentaries.

Asset managers, in turn, can harness these documents and DDQs in AIMA / ILPA formats to efficiently pre-populate investor DDQs and RFPs, streamlining workflows and reducing manual effort.

📢 Read the Document Intelligence Engine launch Press Release

🤖 Learn More About How AI Powers DiligenceVault