For decades, the early career journey was defined by “grunt work.” Analysts crunched spreadsheets, interns organized data rooms, junior associates drafted and redrafted memos. In asset management, this meant rekeying data, reconciling reports, formatting decks, maintaining CRM entries, and tracking LP interactions.

Repetitive? Yes. Tedious? Absolutely. But also a rite of passage. These tasks built discipline, provided context, and allowed juniors to learn by doing.

Now AI has changed the equation. Automation can complete many of these tasks faster, cheaper, and with fewer mistakes. That’s a gift for productivity, but it poses a paradox for talent development: if AI takes over the work that once trained interns and analysts, where do tomorrow’s leaders come from?

Beyond just grunt work disappearing, AI also raises expectations. Analysts are being asked to contribute higher-level insights much earlier, which comes with its own pressures.

From Grunt Work to Growth Work

Tasks that once consumed 60–80% of a junior’s day are now handled by AI in seconds:

- Investment offices: document classification, reconciliations, Excel tracking, research note drafting. Instead of manually reconciling trade breaks for hours, analysts can now validate AI-generated reconciliation reports in minutes.

- IR & Capital Formation: CRM updates, meeting note summaries, investor reporting, RFP/DDQ responses, sub-document collection. Instead of spending 8+ hours in creating a DDQ response, IR analysts can now validate AI-generated first drafts in minutes.

The result isn’t less work, it’s a recalibration of what talent contributes and how quickly they progress. These efficiencies don’t just save time, they compress the pace of learning. Juniors who once spent years building up to strategic contributions can now get there faster, provided firms redesign the pathway.

The Productivity Multiplier

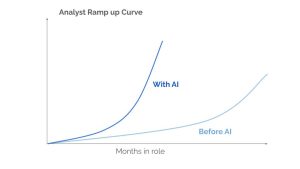

- Before AI: Analysts took 12–18 months to move from grunt work to meaningful insights.

- With AI: That curve compresses to 3–6 months.

The outcome: more funds reviewed, faster LP reporting cycles, fewer errors, and smarter teams overall.

The Generational Redesign

Every generation of finance professionals has had its defining tools:

- 1990s: Excel, Bloomberg, PowerPoint

- 2000s: SaaS platforms for knowledge work, analytics and workflows

- 2020s: AI copilots, AI agents, AI orchestrators and extractors, and domain-specific AI platforms like DiligenceVault

The next generation of talent will be AI-native. Instead of building careers through manual repetition, they will:

- Identify and analyze AI tools across workflows.

- Learn prompting, validating, and refining outputs.

- Drive adoption within teams, because they’re closest to where AI touches workflows.

But new tools alone won’t shape careers. What matters is how firms reimagine the apprenticeship model balancing AI acceleration with human mentorship and judgment.

In the past, analysts picked up skills by proximity: sitting in the same room and absorbing tacit knowledge. With AI reducing task volume, senior leaders must be more deliberate about coaching, guiding, and narrating decision-making.

The New Apprenticeship Model

AI reshapes mentorship and career ladders:

- Analysts and IR juniors become AI-natives, learning faster and driving adoption. They will contribute by being the AI Power Users.

- Mid-level professionals act as integrators, shaping workflows and testing productivity gains, making the AI scalable. They are the AI Power Integrator.

- Senior leaders provide context, oversight, and judgment. AI accelerates the what, but seniors must still teach the why. They are the AI Power Consumers.

This new model will redefine growth. Firms will need new ways to evaluate an analyst’s “readiness”: not by how many spreadsheets they’ve reconciled, but by how quickly they learn AI and how effectively they integrate AI into workflows, apply critical thinking, and contribute insights to investment or client conversations.

For example, an analyst who can design a prompt library for manager research may show more readiness than one who simply produces a polished Excel model

Hiring for the AI Era

Excel is still important. But in interviews, AI-savviness is the new differentiator.

Key questions for evaluating candidates:

- Can they name models and define core AI concepts?

- Did they use AI in their interview assignment? How?

- How did they refine the outputs?

- Can they integrate AI into workflows, not just use it in isolation?

Training Without Grunt Work

If AI has automated repetitive tasks, how should analysts train?

Here’s what to give them instead:

- Critical Thinking: Review AI outputs, challenge assumptions, and debate theses.

- Deeper Research: Compare managers, analyze ESG factors, identify red flags.

- Institutional Memory: Document senior judgment into prompts and frameworks.

- Scenario Analysis: Use AI to model scenarios, then stress-test the assumptions.

- Storytelling: Turn AI-prepared data into compelling narratives for ICs or LPs.

When AI Becomes Generic, How Do Analysts Outshine?

As AI adoption becomes universal, the technology itself will no longer be a differentiator. What will separate high-performing analysts from the rest is how they combine AI with uniquely human strengths.

AI will soon be as common as Excel. The real edge will come from human skills layered on top of AI. AI makes the average analyst faster. It makes the exceptional analyst indispensable.

AI as an Ecosystem

Beyond individual productivity, firms must think at the organizational level. The real unlock comes from building an AI ecosystem that is intentional, scalable, and integrated across workflows. AI isn’t just ChatGPT or Copilot. The next step is creating a library of AI tools across apps — ranked by:

- Integration: Which tools connect seamlessly with workflows?

- Functionality: Which solve real problems vs. gimmicks?

- Centrality: Which are mission-critical vs. peripheral?

Firms must design an intentional AI framework, not just experiment in pockets.

Closing Thought

The asset management industry isn’t facing a talent crisis. It’s facing a talent redesign.

AI won’t replace analysts or IR professionals. It will redefine the starting line, freeing juniors to think critically, research deeply, and steward institutional knowledge. Seniors will mentor with judgment, not manual task lists. Teams will be AI-powered, human-led, and exponentially more capable.

If done right, this isn’t just a productivity gain. It’s a redefinition of how talent learns, grows, and delivers value in asset management.

The ones that get this right will have an advantage in attracting and retaining top talent who want to grow in an AI-rich environment.