The forum was quite well-attended with a structured format featuring two parallel breakout tracks: one focused on investment strategies and market opportunities, and another dedicated to operational, compliance, and tax considerations.

DiligenceVault was a first-time sponsor, providing an excellent opportunity to strengthen its footprint and knowledge of the investment management structure in the Australian market.

Private Credit: Market Dynamics and Regulatory Evolution

ASIC Regulatory Update

ASIC issued a timely regulatory update just days before the forum. The update promotes self-regulation in private credit markets with an emphasis on expected loss frameworks, signaling the regulator’s preference for industry-led standards rather than prescriptive regulation.

Australian vs US Market Structure

The Australian private credit landscape presents significant growth opportunities with stark differences from the US market:

- Australian Market Size: $250 billion AUD with managers, against $3.2 trillion in bank balance sheets (with $2.7 trillion held by the big four banks)

- Market Penetration: Only 8-10% of credit sits with private managers in Australia, versus 80-85% in the US, indicating substantial room for market expansion

- Credit Composition: $2 trillion in public credit with half being bank issuance; corporate debt represents $1 trillion of the market

- MAGA: A theme throughout the conference of “Make Alternatives Great Again” echoed the excitement for the market opportunity in Australia

Strategic Focus Areas

Private credit managers are concentrating on three segments in the Australian market which has a concentration on real estate assets.

- Corporate lending

- Asset-backed securities

- Specialty finance solutions

CPS 230 Implementation in Superannuation

Superannuation funds are actively adapting to CPS 230 operational resilience requirements, with implementation strategies varying across the industry as funds balance compliance costs with operational efficiency.

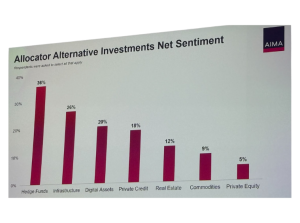

Allocator Sentiment: Opportunities and Concerns

Market Excitement

- Hedge Fund Returns: Current market dispersion creating favorable conditions for hedge fund alpha generation

- Infrastructure: Long term trends in digitalization, AI and decarbonization

- Liquidity Opportunities: Market dislocations providing attractive liquidity premium capture

- Biotech Long/Short: Potential for outsized alpha in specialized healthcare strategies

- AI Integration: Hedge funds leveraging AI as a competitive advantage

- Currency Diversification: Growing interest in USD alpha sources while minimizing USD FX exposure

Key Concerns

Key Concerns

- Convexity Risk: Inability to provide portfolio protection during market stress periods

- Hidden AI Exposure: Concentration risk from widespread AI adoption across portfolios

- Governance Framework: Maintaining rational decision-making and robust delegation structures when market stress tests strategic plans

AI Adoption in Alternative Investment Management

Strategic Approach Segmentation

Firms are taking differentiated approaches to AI implementation through build-versus-buy frameworks, with careful consideration of talent requirements and operational transformation needs.

Workforce Dynamics

Junior staff adoption patterns are driven by dual motivations of job security concerns and genuine curiosity about technological capabilities, creating generational differences in AI integration approaches.

Mental Model Evolution

Firms need to fundamentally rethink data foundations, workflow processes and decision-making frameworks to incorporate AI capabilities effectively.

Data-Driven Decision Making

Effective data utilization helps investment professionals distinguish between different levels of conviction:

- Sort of knowing: Preliminary insights requiring further validation

- Almost knowing: High-confidence views needing final confirmation

- Definitely knowing: Actionable intelligence suitable for investment decisions

Superannuation and Wealth Platform Integration

MySuper Regulatory Impact

The dynamics between superannuation funds and wealth platforms are evolving in response to MySuper regulatory requirements, creating both challenges and opportunities for product distribution and member servicing models.

Strategic Implications

This regulatory evolution is reshaping competitive dynamics and forcing reassessment of member value propositions across the retirement savings ecosystem.

Details that Make the Difference

The Barista coffee station was a nice touch. Also, it was encouraging to see the AIMA / CFA collaboration on scholarship opportunities for continued learning and skill development.

As a sponsor, it was great to be in an area which had attendees stopping by, and our notepads were quite popular. The forum also had a number of other leading technology and service providers which sparked continued partnership and integration areas of opportunity for DV.

Conference held September 24, 2025, as part of Sydney Alternative Investment Week