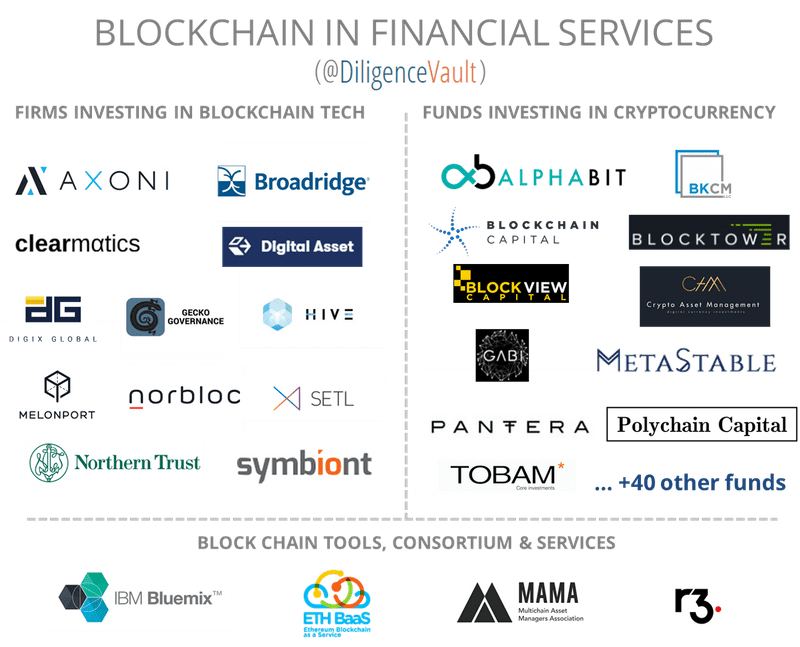

The Questions Du Jour in 2017: Does DiligenceVault employ blockchain technology? Does DiligenceVault offer diligence questionnaire for blockchain investing? The answer to former is Not Yet, and latter is Yes. So thought this focus on diligence for blockchain could be a nice way to close the year, especially as new investment options are knocking on the investors door.

Almost all institutional investors and asset managers have been evaluating or educating themselves on this new technology, and its tremendous potential given its ability to enable a trustless distributed consensus. However, the two different use cases of the tech have received differentiated investments from the institutional community.

#1 Technology Applications

Non-currency applications of the technology have proven to be an attractive investment destination. For example, there has been over $4.5 billion of new investment in blockchain firms this year, with funding coming in from asset managers with institutional LP backing as well as corporate ventures. The most common applications of blockchain in asset management and capital markets world is in smart contracts to enable mutualized settlement and clearing infrastructure, transfer agency, proxy voting, to asset administration to client onboarding use cases. These non-currency applications are expected to transform productivity across the industry and result in massive cost savings.

#2 Digital Currency Applications

Currency applications or cryptocurrency have emerged as new store of value, without requirement of association with a trusted financial institution, but rather by leveraging the technology and the network of users and miner base. We have come a long way from barter system to paper currency to cryptocurrency as a medium to facilitate transactions.

For institutional investors to participate in this area, they would partner with external manager specialists, given the regulatory and operational challenges. Any evaluation of this investment partnership should involve diligence around 4 key areas:

Asset class diligence

- Significant price volatility with marked-to-market (MTM) implications with the skeptic cohort calling for price to zero, vs. believer cohort calling for $50k by Dec 2018

- In spite of positive development in infrastructure in recent weeks (CBOE and CME futures as of Dec 1st, potential for GS investing in market making desk), illiquidity and transaction cost remain a concern.

- Appearance of uncorrelated behavior (45% down move last week in Bitcoin, had no visible spillover in other risk assets)

- Substantial regulatory risks, especially with lack of standardization across jurisdictions

Portfolio manager expertise diligence

- Does the portfolio manager have technical knowledge of underlying technology, mining network, exchange vs. security and network effects?

- Given significant volatility, does the portfolio manager have the right emotional temperament with neither over-exuberance nor overreaction to short-term losses?

Strategy diligence

- What strategy is the portfolio manager pursuing? All cap or only large cap or only small cap, and how does that strategy translate into portfolio concentrations and liquidity characteristics

- What holding period is expected? Is the strategy buy and hold or is active trading around volatility expected? How much alpha is derived from OID (original issue discount) and privileged access driven by market inefficiency, and is it repeatable?

- What are the tax implications of the strategy, and what is the expected return net of taxes?

Business operations diligence

- Is the fund setup to address the asset administration and potential valuation challenges across market cycles?

- Is the audit firm equipped to address the technicalities of this asset class?

- What storage and security is adopted for fund holdings. Is it exchanges or via wallets?

- Is there adequate transparency in operations?

Given the level of uncertainties, expected price volatility, and limited comfort with non-traditional fundamental basis for pricing, institutional allocation to currency applications of blockchain have remained muted. Consequently most funds listed in our map manage tens of millions which is insignificant portion of the overall market size.

Institutional Buy-in: Technology before Currency

For institutional investors,the adopters are already invested in the concept via either their venture capital allocations, or by being a user of blockchain technology product. Investing in cryptocurrency have MTM implications, and the volatility is a tough pill to swallow. It remains to be seen how a specialist cryptocurrency allocation develops in their opportunistic buckets over time.