An Easy Way to Diligence

DiligenceVault is a technology that uses connectivity with over 16,000 asset managers as its foundation to automate due diligence of fund investments for wealth management.

Data-Driven Manager Insights on a Centralized Platform

DiligenceVault transforms the way wealth management firms like RIAs, private banks, and family offices approach due diligence. With connectivity to over 16,000 asset managers, our platform automates data collection and provides comprehensive portfolio insights through risk and opportunity dashboards.

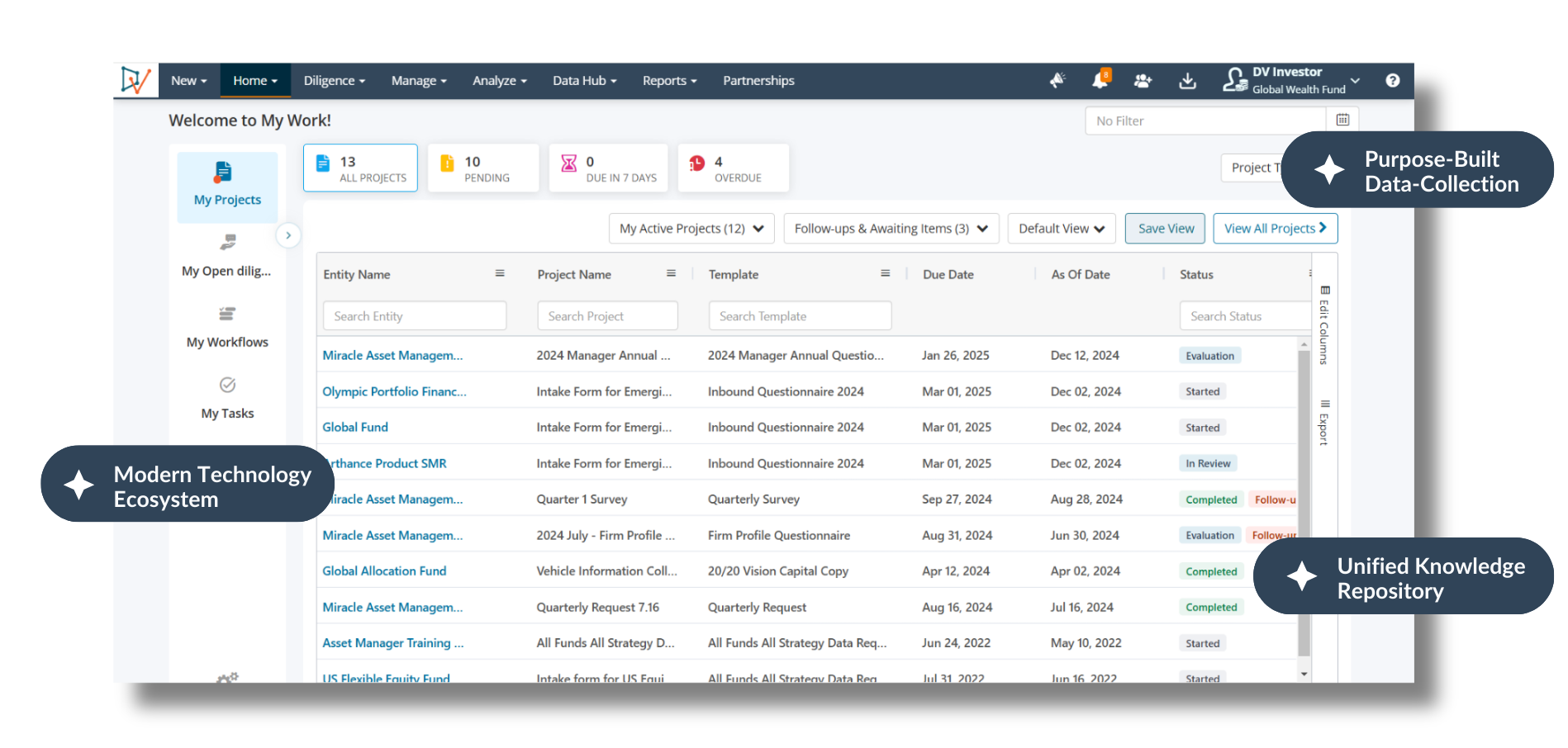

A Modern Technology Ecosystem for Wealth Management

- Replace fragmented systems like shared drives and scattered emails and manually intensive processes with DiligenceVault’s purpose-built data-collection platform.

- Centralize your manager selection and monitoring lifecycle, creating a unified knowledge repository for all investment strategies, including traditional, hedge, and private markets.

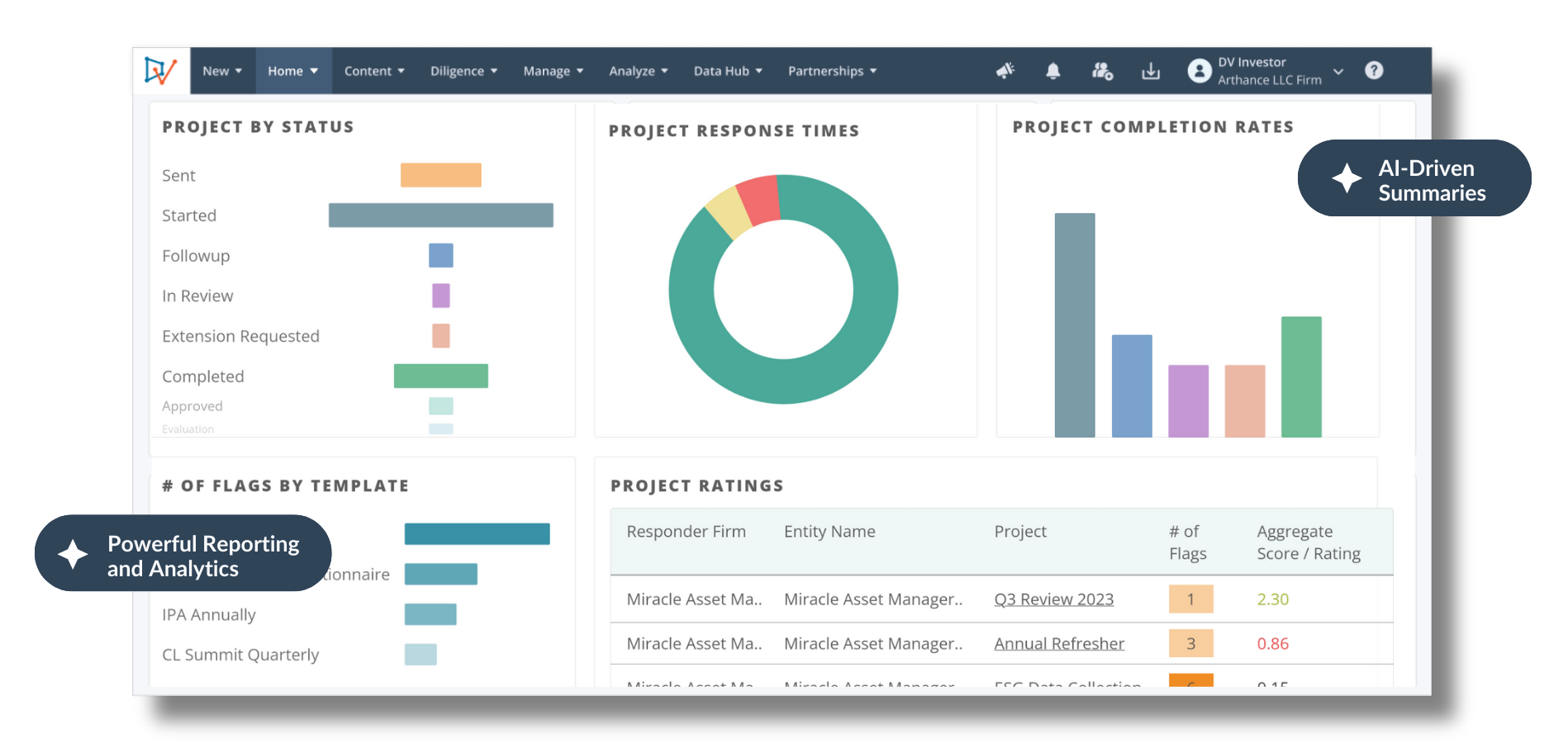

AI-Powered Reporting and Due Diligence Analytics

- Generate automated manager and investment summaries for stakeholders, including investment committees and clients.

- Use built-in BI dashboards and AI-driven summaries to enhance your analysis and decision-making process.

Private Markets Due Diligence for Wealth Management

BLOG INSIGHTS

- Learn more about how top wealth management firms are strengthening their manager selection and due diligence teams and framework to reflect six key considerations.

- Read our views on four best practices to help scale a manager selection framework to include private markets allocations and its impact on future growth.

What Our Clients are Saying?

![]()

Love how DV has transformed a cumbersome diligence process and streamlined data and document collection via a centralized framework for our team and our asset managers. Most of our asset managers were already familiar with DV, and DV being a known entity is a huge plus.

– $30bn Model Portfolio Platform

See DiligenceVault in ActionSuccess Stories: Trusted by Leading Wealth Management Firms Globally

Learn how a top-tier U.S. bank streamlined fund sourcing and monitoring for ETFs, SMAs, CITs, mutual funds, and alternative strategies while balancing product depth and compliance.

Read MoreThe Investment Research and Governance team at Netwealth selected DiligenceVault’s due diligence technology as part of their continued commitment to enhance the information collection capabilities, communication and operational efficiency.

Read MoreSTANLIB, leading South African wealth manager, digitizes asset manager due diligence and monitoring with DiligenceVault

Read MoreThis leading European wealth management firm scaled its manager selection and monitoring processes while ensuring compliance with regulatory requirements using DiligenceVault.

Read MoreKey Features of the DiligenceVault Platform

Source Opportunities

Digitize and simplify your manager sourcing funnel. Build a personalized database of investment opportunities and make it easy for asset managers to pitch their strategies to you.

Diligence & Approve

Create a scalable, digital due diligence framework for pre-investment data and document collection. Capture your views and risk assessments seamlessly in one place.

Monitor & Analyze

Enable ongoing asset manager monitoring with integrated tools for proactive risk identification. Build differentiated portfolios with greater efficiency.

We are Proud to Be an Award-Winning Technology

Best Asset Management Due

Diligence Platform 2024 – USA

Best New Solution

European Awards 2023

Fintech Global

WealthTech100

Best Investor Relations &

Due Diligence Platform

Frequently Asked Questions

DiligenceVault’s client base includes private banks, bank wealth platforms, warehouses, RIAs, wealth platforms, advisors, multifamily offices, TAMPs, wrap platforms, boutique OCIOs across the United States, Europe, Australia and South Africa.

Yes, over 60% of asset managers on the platform manage hedge funds and private market strategies.

DiligenceVault is a centralized knowledge management platform with a strong connectivity to traditional and long only asset managers including mutual funds, UCITS, CITs, ETFs, SMAs and related investment vehicles.

While DiligenceVault is not an investment database, it helps automate the workflow of sourcing new investments and creates a connecting pipeline on the platform.

DiligenceVault has been using AI since 2019 and has also launched a Generative AI module in 2024 called DV Assist. This module helps in reviewing manager diligence materials and creating draft of fund summaries.

As regulations increase for wealth management industry, auditable record keeping, ability to demonstrate fiduciary duty, product suitability, and service provider oversight are key areas of focus for our clients. Our clients leverage DiligenceVault’s capabilities to comply with applicable regulations SEC, FSA, Mifid, ASIC and more.