The asset management industry is undergoing a significant strategy shift. Per a PwC survey, nearly three-quarters (73%) of asset managers are considering a strategic consolidation with another asset manager. In our view, the drivers of this consolidation include embracing efficiency and scale, accelerating growth strategies, supporting product innovation, and strengthening investor engagement.

1. The need for scale advantage as business models are under pressure.

- This is a difficult market return environment, and expectation on future return is also muted given the uncertainty

- Fundraising is much more difficult than before

- Fee pressures continue to mount

As per PwC, global assets under management fell to US $115.1 trillion in 2022 – nearly 10% below the 2021 high (US $127.5 trillion) – representing the greatest decline in a decade. In this environment, cost leadership is a key differentiator to a sustainable business model.

2. Asset managers growth strategy to include geographic growth. For example, EMEA managers looking to enter the US, or US managers looking to build a presence in Asia-Pacific. In PwC’s base-case scenario, growth rates in Asia-Pacific will be roughly 50% higher than in North America by 2027. Asia-Pacific, along with emerging markets in Africa and the Middle East, will set the pace of growth in AUM.

3. Underwriting product innovation and/or adding a new product line – say private wealth focused offering, new private markets offering, or impact offerings. This will need demonstrated product expertise which can sometimes be acquired faster then built.

4. Access to new client segment or distribution opportunity

5. Asset management firm ownership in transition as owners are looking to crystalize their holdings and maybe looking for a liquidity event.

While each of the drivers may be sufficient to drive the M&A decision, usually it’s a combination of few together which make a transaction compelling!

Recent M&A Transactions

- General Atlantic to acquire Actis – January 2024

- BlackRock to acquire Global Infrastructure Partners – January 2024

- Impax to acquire Absalon – January 2024

- TCW to acquire Engine No. 1 – October 2023

- HighVista Strategies to acquire abrdn’s PE business – October 2023

- CVC to acquire DIF Capital Partners – September 2023

- Bridgepoint to acquire Energy Capital Partners – September 2023

- Rithm Capital agreed to acquire Sculptor Capital Management – July 2023

- Ares agreed to acquire Singapore-based Crescent Point – July 2023

- BlackRock agreed to acquire Kreos Capital – June 2023

- Franklin Templeton agreed to acquire Putnam – May 2023

- TPG agreed to acquire Angelo Gordon – May 2023

- Mubadala agreed to take majority stake in Fortress – May 202

These transactions had various strategic motivations including scale, cost leadership, market entry and growth, as well as accelerated product innovation.

Which Investment Bankers / Financial Advisors Were Involved?

We have large investment banks with Citi, Goldmans Sachs, JP Morgan Securities and Morgan Stanley getting involved as well as boutique firms with Andrea Partners, Moelis Company, Piper Sandler, PJT Partners, Raine Group, and Rockefeller Capital Management leading some of the advisory. Andrea Partners is involved in 3 of the 6 transactions highlighted.

- Goldman Sachs, JP Morgan Securities, Morgan Stanley in 2 deals each

- Citi, Moelis Company, Piper Sandler, PJT Partners, Rockefeller Capital Management, and The Raine Group in one deal each

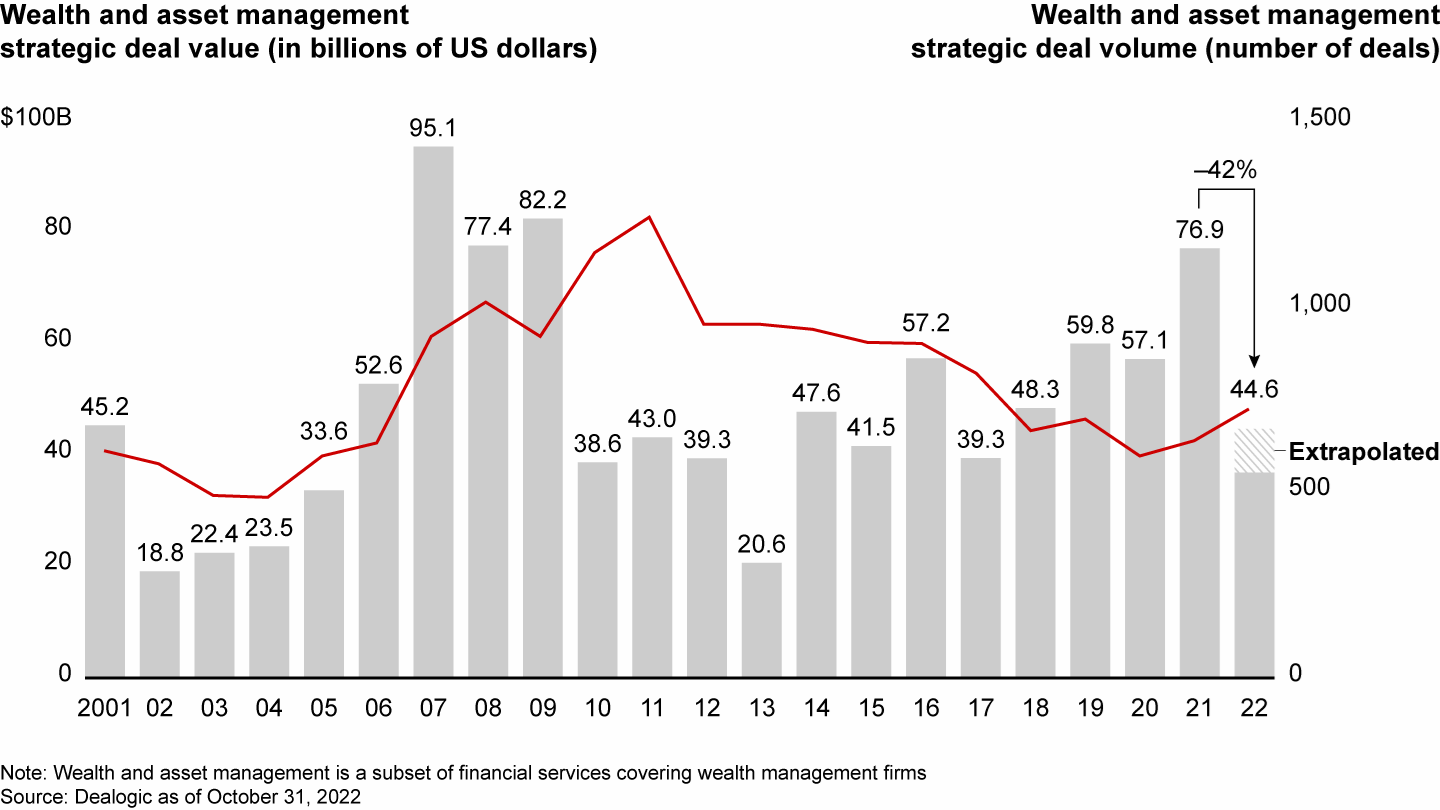

The Deal Activity Is Expected To Rise. The Deal Value Is Expected to Decline

Based on 2023 Bain & Co. viewpoint, the largest market players are expected to use M&A as a strategy to outpace growth. However, the deal size is also expected to be smaller given the uncertain macroeconomic environment. The gap between winners and losers is expected to widen. This anticipated high volume, low value transaction pattern as well as widening gap adds complexity for investors as they have to build a scalable due diligence response.

Source: Bain & Company

Due Diligence Considerations For Investors

Given this consolidation and M&A trend is expected to continue, are investors prepared to review emerging risks and opportunities across asset managers in the portfolio? At DiligenceVault, our technology can support augmenting your due diligence framework to assess new risk factors with confidence:

- What is the impact on business risk for firms that are involved in transactions?

- How important is the success of the transaction? Is it likely to have an incremental impact, or a disruptive impact on the surviving firm?

- What due diligence did the firms in a transaction do on each other? What are the conflicts?

- Who advised the transactions and how were they chosen?

- Are there any regulatory roadblocks with the proposed transaction?

- What investor transparency was provided proactively by the firms announcing transactions?

- Is the M&A implementation timeline reasonable?

- Does the firm have the right integration resources to ensure the combined entity achieves its stated goal?

- Is there alignment in cultures between the two firms that are part of the M&A transaction?

- How do the firms plan to retain key talent?

In today’s environment, investors are dealing with key asset allocation and portfolio management challenges around inflation, interest rate increases, geopolitical risks and market volatility. Now they also have to be aware of additional risk factors in their portfolio and extend their due diligence frameworks.

Moreover, any transaction is a trigger for closer as well as more frequent oversight and monitoring. This creates a data and tracking burden for the team. Technology can help streamline the process, both from a content and workflow perspective.

Are you ready to manage the new risk dimensions and complexity, and scale your diligence framework? Learn more about how DiligenceVault’s digital diligence and workflow offering can be leveraged by requesting a demo here.

Found this short article useful? Share it with a friend. Didn’t like it much? Send it to an enemy :).