As we have seen over the past several days, the need for an efficient and structured due diligence and data collection process is paramount. The due diligence and investment oversight lifecycle spans from the time of initial investment, periodic or risk based ongoing monitoring and when there is an unexpected market event. The recent turmoil in the technology and banking sectors, as seen most prolifically with SVB, Silvergate and Signature Bank, has led to all hands on deck due diligence to determine the impact on fund managers and portfolio companies. A defensible response to a stress event depends on having access to actionable data that you can trust.

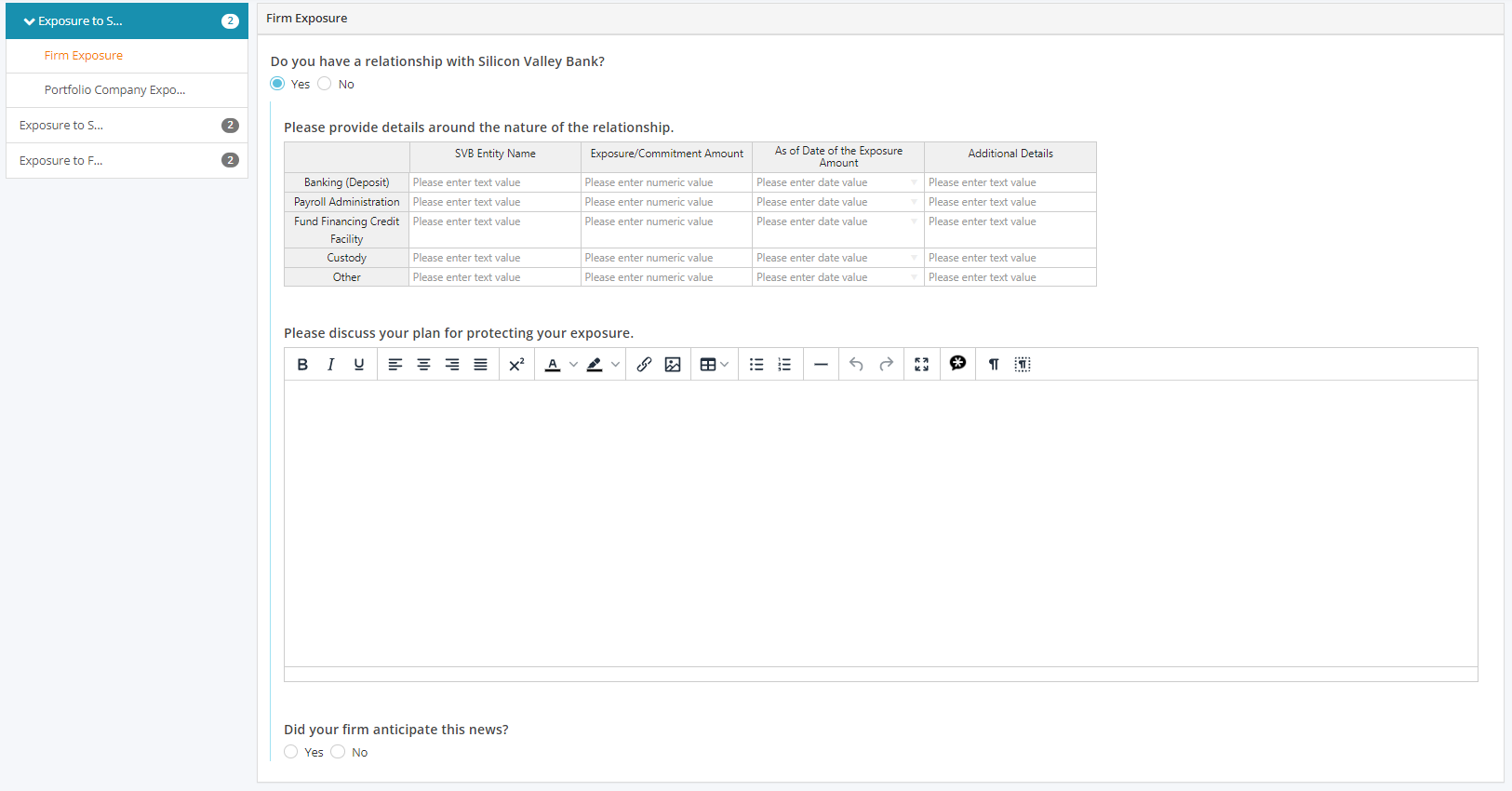

As early as the end of last week, our clients leveraged both Form ADV data and direct manager/portfolio company outreach as the backbone for the due diligence process to assess the impact from the recent market events. We believe that re-allocating time to understand and mitigate risks with your most impacted investments is more efficient, secure and scalable than the time to collect and collate your service provider exposure through a variety of phone calls, emails and hitting Ctrl+F in various PDFs. An ODD advisory client of ours said, “We tailored digital operational due diligence questionnaires (Thank You DiligenceVault!) to proactively reach out to our clients’ managers in real time to gauge their managers’ exposure to Silicon Valley Bank as of present day. This is a more secure, organized, scalable, and timely method versus phone calls, emails.”

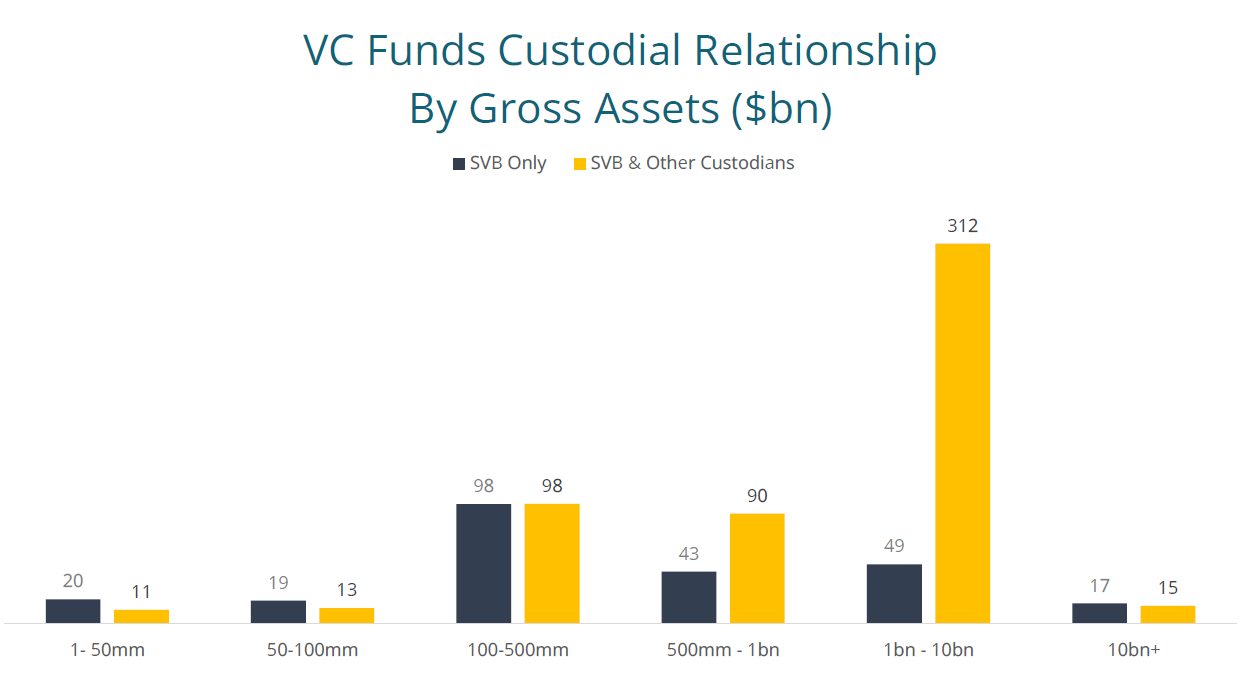

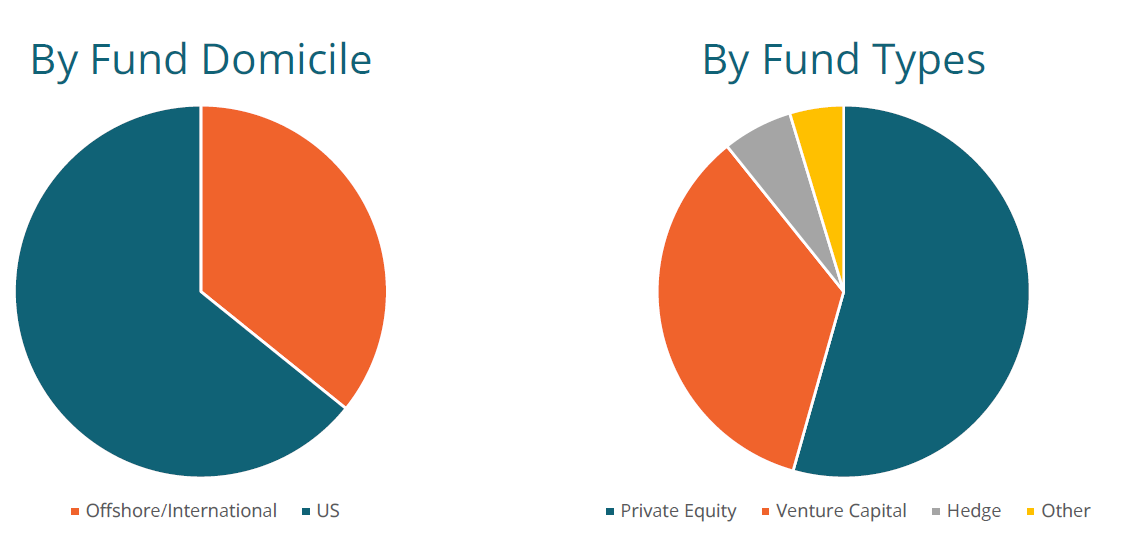

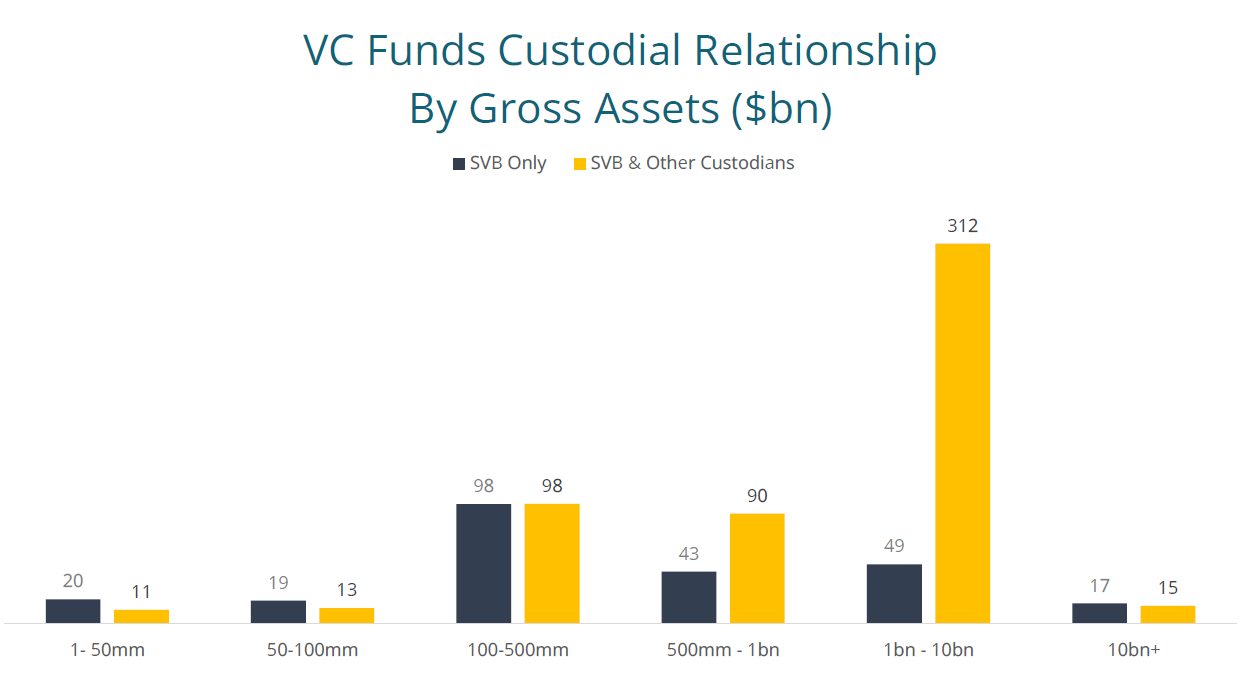

Through DV’s Form ADV monitoring, investors are able to monitor, search and track service provider exposure and trends across firms and funds. We spent some time analyzing these rich data sets, specifically SVB, and have included a few exhibits below as reference.

Silicon Valley Bank: Custodian Business Overview

As a supplement to Form ADV data, we witnessed many investors sending out brief due diligence questionnaires to their investment partners to get a better grasp on their service provider exposure. DV created its own questionnaire and made it available on our platform as a resource to our clients to allow for efficient monitoring processes. Some of the key processes and steps allocators and funds with exposure we’ve talked to are taking include:

- Search and analyze ADV filings data

- Use DV questionnaire to get exposures from funds and portfolio company investments

- Review flags and aggregate exposure

- Create a summary for internal portfolio and risk management team

- Evaluate de-risking options, and downstream stakeholder communication

The ad-hoc and market event driven due diligence has been on the rise over the last three years. Beginning in March 2020, some key market events that investors have leveraged DV for, and that we have created initial questionnaires for, span investment, operational, cyber/IT and geopolitical issues including:

- Pandemic / Business continuity

- Real estate valuations

- SolarWinds breach

- Log4j vulnerability

- Return to Office (RTO) survey

- Value / growth sector rotation

- Ukraine / Russia conflict exposure

- Credit Suisse exposure

- Silicon Valley Bank and tech-focused banks exposure

During a stress event, it’s important to create a high impact and objective information request instead of a detailed request. Having a system questionnaire provides a starting baseline to investors, but also makes it easy for the responders to minimize redundancy and enables them to focus on the resolution of the issues at hand.

The way we see it, technology should allow investors to have a well oiled communication and outreach process with their investment partners – one that they know, trust and gain efficiencies from reuse answers across requests. Having a technology solution that combines publicly available information with workflows for custom data collection and analysis optimizes a multi-pronged due diligence approach, where response rates and response times matter. As due diligence is not a one size fits all process, and certain areas of risk and research are more scrutinized by different organizations, flexibility is key.

These ad-hoc due diligence processes are not solely done in times of turmoil and stress. We hear from numerous clients that following a quarterly board meeting, or a new area of focus within ESG/DEI emerges, a new risk from a collaborative internal discussion, or a department needs some key quantitative or qualitative information from investment partners that they quickly create short questionnaires and surveys to efficiently gather and analyze this data. You can read more about the different types of data our clients are collecting here: The Role of Data Collection in an Investment Office

We’d love to hear from you on how you are approaching your due diligence program and how technology can play a role in it. Join our upcoming webinar to know more.