Entrepreneurship is key to innovation in any industry. In the growing investment management industry of today, as we see a significant increase in emerging managers, it is rather important to understand how these managers can stand out in an institutional due diligence, where investors are constantly changing and upgrading their manager research and assessment process. A recent survey by CAIA Association also found that about 4,000 small hedge fund managers are fighting over less than $100 billion in assets. What does it take to become institutional, and attract institutional capital?

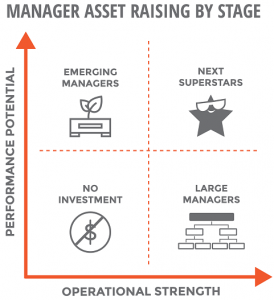

We have created a manager asset raising quadrant to identify various paths. Emerging managers start off in the lower left quadrant, and the ones who put up solid performance numbers may attract allocations from investors who are willing to take business risk and /or have managed account capabilities. Once managers build up their infrastructure, processes, and resources in general, they are viewed as strong in both operational and investment areas. These are the coveted “Unicorns” or “Superstars”, the sweet spot in manager selection in institutional investing.

What’s more, both wealth and institutional investors are beginning to give equal importance to both qualitative and quantitative analyses. Asset managers can work that in their favor and make a good case even without a high level of AUM. According to the CAIA survey, operational competency, research quality, and investment infrastructure are a few major parameters that investors are increasingly looking for today. If an emerging manager can successfully get through the operational due diligence screening process, then they can move a step closer to being considered for the investment allocation.

Below, we provide 5 guidelines that can help create a differentiated profile for potential investors during the manager’s first institutional due diligence:

- Start by researching best practices

- Identify a Due Diligence Checklist for your strategy. Reference publicly available resources such as the ILPA, SBAI, PRI or AIMA DDQ and do a self-assessment. What are your strong points, and where are your gaps?

- If you are running a strategy where a prime brokerage relationship is necessary, leverage resources from your prime brokerage. They have established business consulting units.

- If you are running a venture strategy, check out our friends at Oper8r. They are providing much needed resources for new VC managers.

- Benchmark yourselves. Talk to placement agents, review regulatory filings of firms that you aspire to be to see what they do well.

2. Next, identity your target market

- Articulate your needs. Are you only looking for capital? Or are you looking for capital and resources to develop an institutional DNA?

- Understand the investor landscape and their preferences. Identify allocators that have dedicated emerging managers mandate.

- Which investor type is important for you? Are you looking for capital from pension plans? Or are you looking for FoFs, E&Fs, family office capital or pension plan mandates? Your segmentation will drive your approach of either working with investment consultants, or going direct.

3. Drive strategic engagement

- Identify emerging manager conferences and events. Selectively participate in those based on your investment style. Here’s a list of few conferences that we have compiled:

a. 100WF Emerging Manager Conference

b. Callan Connects

c. New York State Emerging Managers Conference

d. TRS / ERS Emerging Manager Conference

- Communicate your strategy and performance consistently regardless of up or down months. Publish thought pieces and follow up diligently.

4. Get diligence ready

- Review your policy and formation documents for accuracy. Typos, conflicting information can be detrimental in building trust

- Build your personal and firm’s social media presence. Investors will search for you on LinkedIn and in Google

- Prepare your best answers for commonly asked questions. Understand “the why” behind an investor’s question before filling out the responses. Typically, asset managers manage these in multiple Word or Excel files with the challenges of access and version control. A modern diligence process is to make this information easily accessible, preferably cloud based, for all internal stakeholders where everyone had access to a single source of truth..

- Per Gen II’s recent survey, on average, a PE/VC emerging manager meets 100 investors and has on average has 4 meetings with investors who commit capital. Given the complexity and scale of this diligence interaction, it’s important to invest in technology to streamline diligence response and review processes. Making fewer mistakes will deliver a pleasant experience to your investors and save time in closing an investor transaction. What’s more – while this step is crucial in the institutionalization of your process, it will also bring efficiency for the future regulatory oversight process

- If you have the resources, consider engaging with an ODD consultant to run a mock due diligence exam, and get ready for your first institutional diligence

5. Double down on building resilience and growth mindset

- You started the entrepreneurial journey with a growth mindset. Now build resilience as you decide to go to the next level. Be realistic and dedicate bandwidth. Institutional diligence is a process which will take time, so ensure you build efficiency from your end. How quickly can you respond to investor requests? How complete are your responses? How do you minimize time consuming follow ups?

- Invest for the future by building a maturity plan. Investors acknowledge that emerging managers don’t have all the resources to be institutional when starting out, but you can differentiate by showing that you are prepared

- Be ready for follow-ups or feedback. Improve your diligence readiness with feedback from the process

Are you ready to formulate an effective and innovative due diligence framework to make it modern, time-saving, and effective for both you and your investor? We at DiligenceVault are always ready to share resources with our ecosystem, and please reach out at ask@diligencevault.com.

Additional Resources for Emerging Managers

Apart from the tough competition that emerging managers face from incumbents in the industry, there has been an added pressure and hindrance caused by the ongoing pandemic. However, there are many firms that are trying to help emerging managers tackle the challenge of the pandemic as well as build a strong reputation for themselves to stand against the bigger asset management companies. These firms have introduced platforms, programs, and separate funds to support emerging managers in their journey of becoming an established institution.

- Anchin, Block & Anchin (Anchin) launched an emerging manager platform to help start-up and early-growth hedge, private equity, real estate and venture capital funds, with a mix of traditional and non-traditional professional services across audit, tax, advisory and consulting.

- Many LPs and consultancies found that emerging managers and smaller funds tend to perform better than large scale established funds. Believing that investing in a platform focusing on emerging managers can capitalize well, a group of Kauffman Fellows joined forces to launch Recast Capital, a platform to support and invest in emerging managers in venture. Recast Capital has further established an Enablement Program to support the GPs of venture firms that have recently been or have yet to be established.

- ILPA on the other hand has launched an Emerging Manager Toolkit, which is a package of documents designed for private equity managers that want to start fundraising quickly and attract qualified Limited Partner capital from ILPA members. The documents in the Toolkit include those that can be utilized as a starting point in the fund formation process.

- The launch of most of these platforms and programs are a way for firms to become more inclusive and promote diversity among emerging managers, by encouraging and pushing women-led or minority-led funds to the forefront. J.P. Morgan launched one such project recently called ‘Project Spark’ in order to support diverse emerging alternative investment managers.

- Oper8r is a first of it’s kind accelerator program for emerging VCs.

- SBAI SPARK is a new programme from the SBAI for small and emerging asset managers. It provides:

– Advancement of networks through connection and collaboration with peers and allocators,

– Robustness of business operations through the SBAI Alternative Standards, and

– Knowledge of key industry trends and issues through access to SBAI working groups, global events, and guidance memos in the SBAI Toolbox. - Silicon Valley Bank has also dedicated a team to serve Emerging Managers who are managing three or fewer institutional funds, likely under $100MM, with an early stage investing focus.

Our prior blog on emerging managers: https://diligencevault.com/emerging-fund-managers-to-superstars/