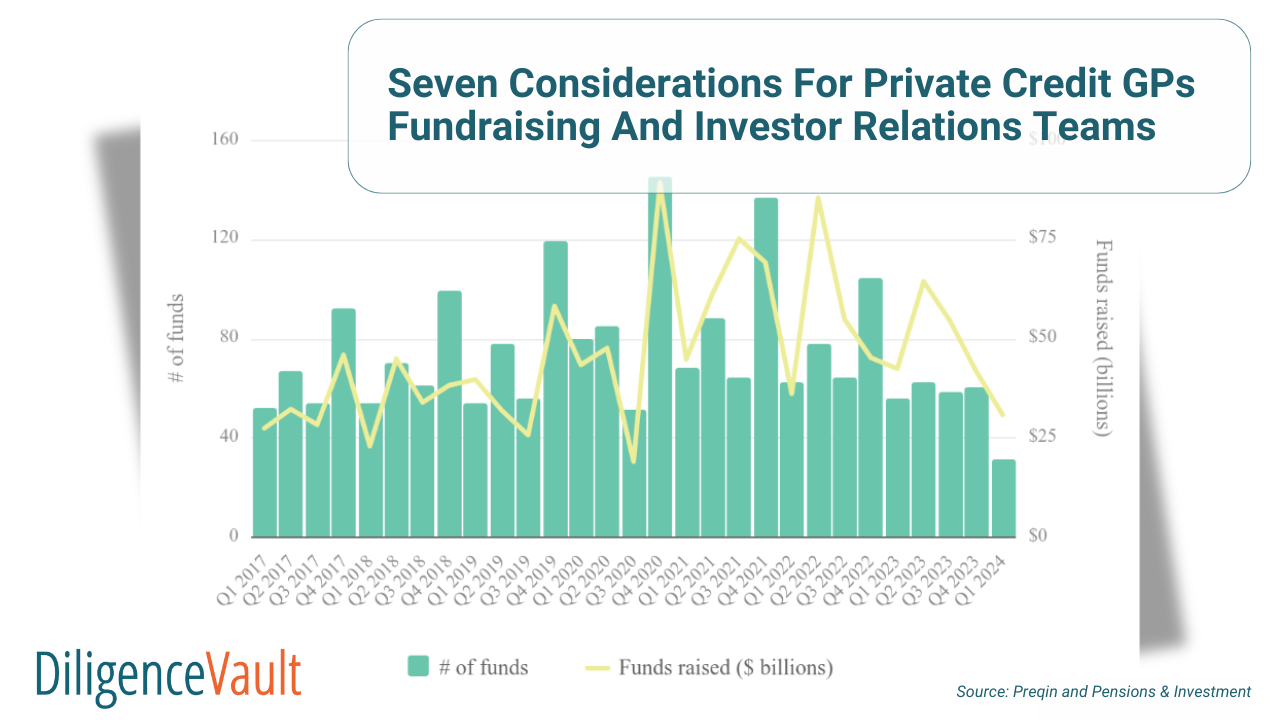

Private credit fundraising has been a trending news topic, with increased focused on the asset class from both institutional allocators and private wealth investors. Recently, Bloomberg reported a slowdown in the fundraising trend in the first quarter of 2024.

- Prioritize Investor Education – While credit investing is not new to investors, allocations to private credit at scale are a new phenomenon for most limited partners (LPs). A key part of relationship building for GPs is investor education.

- Articulate Differentiation – Articulate what makes your private credit strategy different in your fundraising materials – Is it your sourcing network for financing opportunities, is it your credit underwriting expertise, is it your specialist market segment focus, or is it your entire capital structure skills from private equity, private credit to distressed debt capabilities.

- Understand Investor Allocation Preference – Which segment of their portfolio are investors allocating to private credit from? Is private credit allocation a replacement for fixed income, or is it diversification from private equity? Understanding this is crucial when pitching to investors to align on risk-return expectations before initiating due diligence discussions.

- Ensure Fund Structure Alignment – Does your firm have closed-end longer lock up structures, fund-of-one in managed account formats, or open-ended / evergreen structures? Does it meet the investor preference? Depending on the type of investor distribution channel you engage, this distinction and fund structure alignment is crucial for fundraising success.

- Research Peers and Trends – Who are the largest allocators in this asset class, and where are your private equity GP peers getting fundraising success? Stratify your research in at least three dimensions – by geography (Japan, Middle East, or United States), by investor type (insurance investors, pension investors, or private wealth investors), or by allocation size (Top 10 allocators in private credit). Leverage ChatGPT, review GP databases, build Google Alerts and scan Form ADV filings to assist with this research.

- Get Diligence Ready – Due diligence is an integral aspect of private credit fundraising, with added focus on strategy-specific operational aspects. Check out our takeaways from a recent private credit webinar to learn more. Start by preparing your standard DDQ, a crucial resource to share with LPs in the early stages of engagement, and also a great reference when you respond to bespoke DDQs.

- Build Scale in LP Reporting & Transparency – This is an important factor rated by LPs in how GPs are creating differentiation. Build a data engine to inform internal investing, due diligence and covenant monitoring frameworks, and also provide detailed and actionable insights to investors proactively.