ESG Resource Center

Access a collection of insights and resources for ESG data collection, ESG ratings and data sources, reporting standards, as well as ESG integration frameworks.

INSIGHTS

Our current thinking on the state of ESG, DEI and Impact Investing

INDUSTRY PERSPECTIVES

Views from industry practitioners on important topics such as greenwashing, greenhushing, SFDR reporting, Scope 3 reporting and more

Why Scope 3 emissions don’t stack up?

Data quality and potential double-counting of emissions are common challenges in measuring Scope 3 emissions associated with investments. Per Fulcrum Asset Management, investors should focus less on the problems with the data, and more on the problems the data is for, which is to identify the sectors and industries where Scope 3 emissions are an essential measure of carbon risk. Read more

Navigating uncertainty in ESG asset management

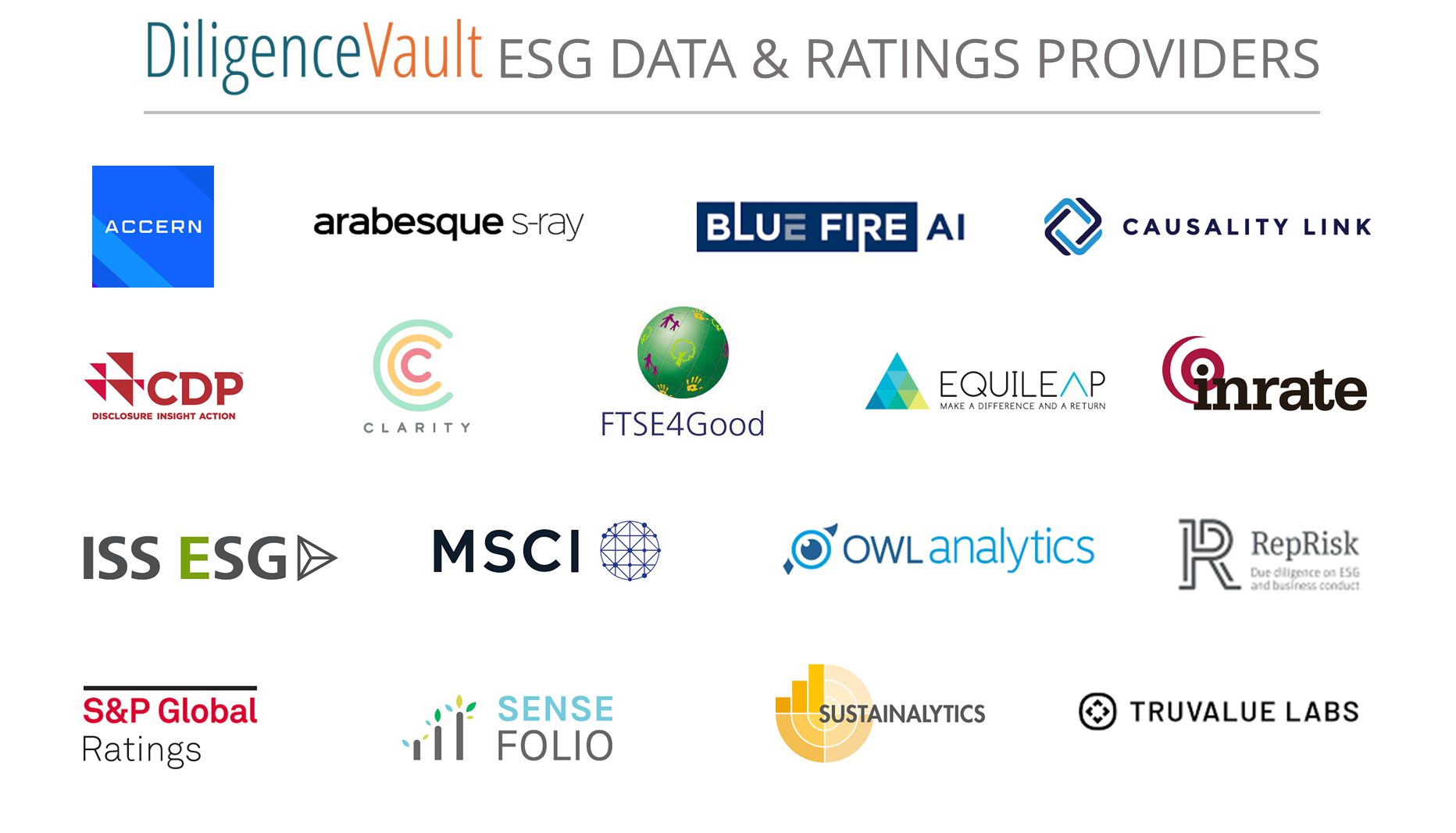

To meet ESG compliance, investment managers are increasingly challenged with the sourcing of reliable third-party ESG data. While investment managers are accustomed to using service provider data (such as MSCI and Bloomberg) to inform investment decisions, ESG presents a unique challenge in not only evaluating the sheer number of data providers, but their quality. Deloitte outlines considerations for investment managers… Read more

INDUSTRY STANDARDS AND REPORTING TEMPLATES

As the investment industry works to standardize ESG metrics and KPIs, DiligenceVault is pleased to host a number of industry-standard templates on its platform