Selecting and managing Ireland or Luxembourg based Management Company (ManCo) relationship is a crucial decision for asset managers as part of their distribution strategy especially in the EU (European Union), EEA (European Economic Area), and Switzerland.

In this blog, we will go over the selection process, jurisdiction considerations between Ireland and Luxembourg, as well as a monitoring framework that asset managers should consider.

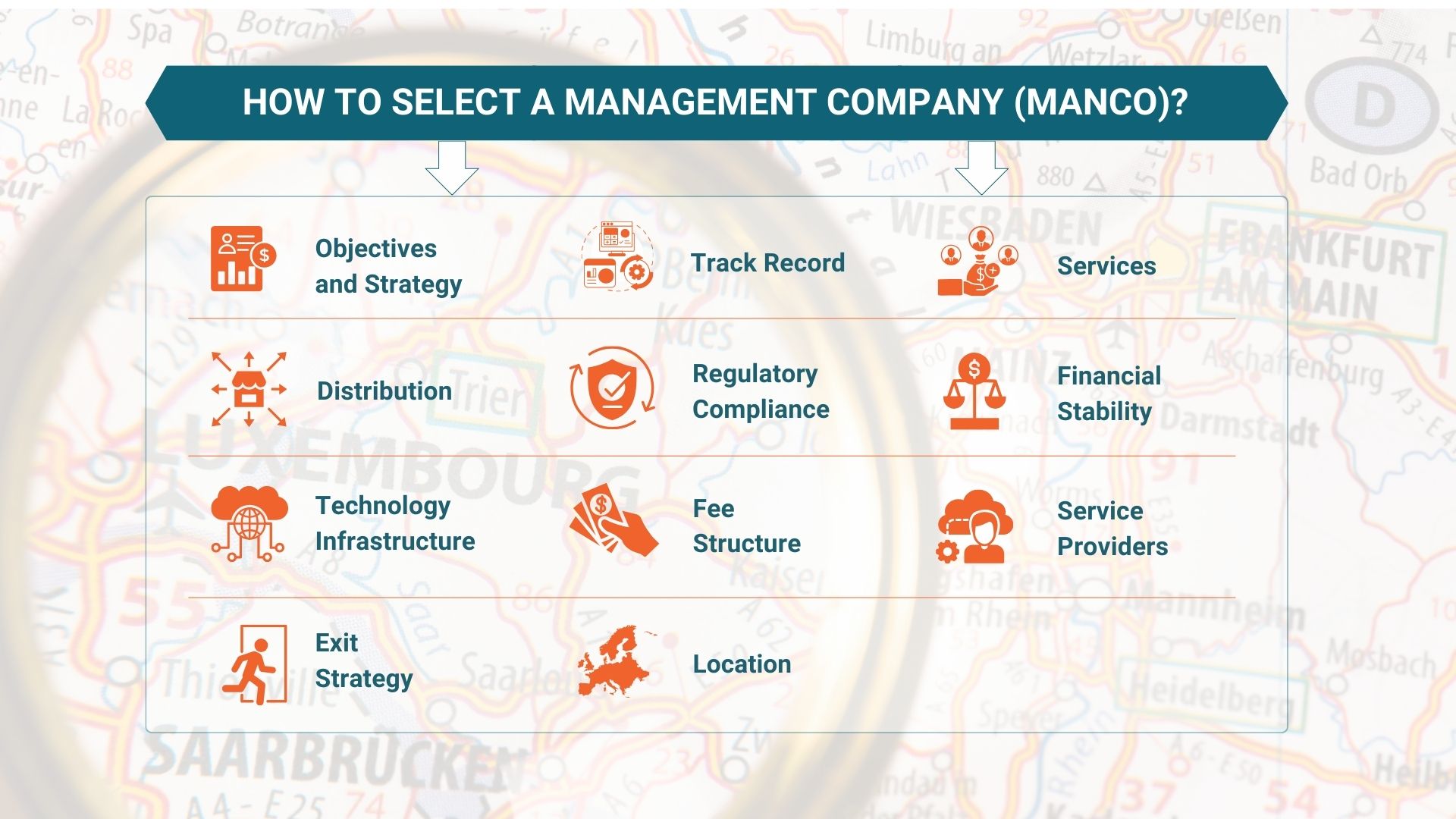

How to select a Management Company (ManCo)?

To help asset managers create a due diligence framework for selecting a ManCo, we are sharing 11 key considerations:

- Your Objective: Before selecting a ManCo, clearly define your objectives, investment strategies, and distribution plans. Consider factors such as the type of funds you want to launch (UCITS, AIFs, etc.), target markets, and investor profiles.

- Track Record: Evaluate the reputation and track record of potential ManCos. Look for those with experience in managing funds similar to yours, asset managers in your peer group, and a history of delivering solid performance.

- Services: Assess the range of services offered by the ManCo. This includes fund management, risk management, compliance, and regulatory reporting capabilities.

- Distribution: Consider the ManCo’s distribution capabilities and choose one with an established network and expertise in distribution in the EU / EEA and Switzerland.

- Regulatory Compliance: Understand the regulatory framework in Luxembourg (Lux CSSF Circular 18/698) or Ireland (Irish CP86), as well as the specific requirements for your type of investment funds and asset manager. Ensure that the chosen ManCo has a strong track record of regulatory compliance, including capital adequacy, risk management, and governance standards.

- Financial Stability: Check the financial stability and resources of ManCo, as a financially robust ManCo is better equipped to support your fund’s operations and growth.

- Technology: Assess ManCo’s technology infrastructure, including data management, reporting capabilities, and cybersecurity measures. A modern and secure infrastructure is essential for efficient fund management.

- Fee Structure: Understand the fee structure of the ManCo. Ensure that the fees align with your budget and expected fund performance and that there are no hidden or additional charges.

- Service Providers: Consider diversifying service providers (e.g., fund administrator, custodian) to minimize concentration risk with the ManCo.

- Exit Strategy: Have a clear exit strategy in place in case you need to change the ManCo in the future. Ensure that the transition process is well-defined and smooth.

- Location: The location of the ManCo is an important consideration, which we will address in the next section.

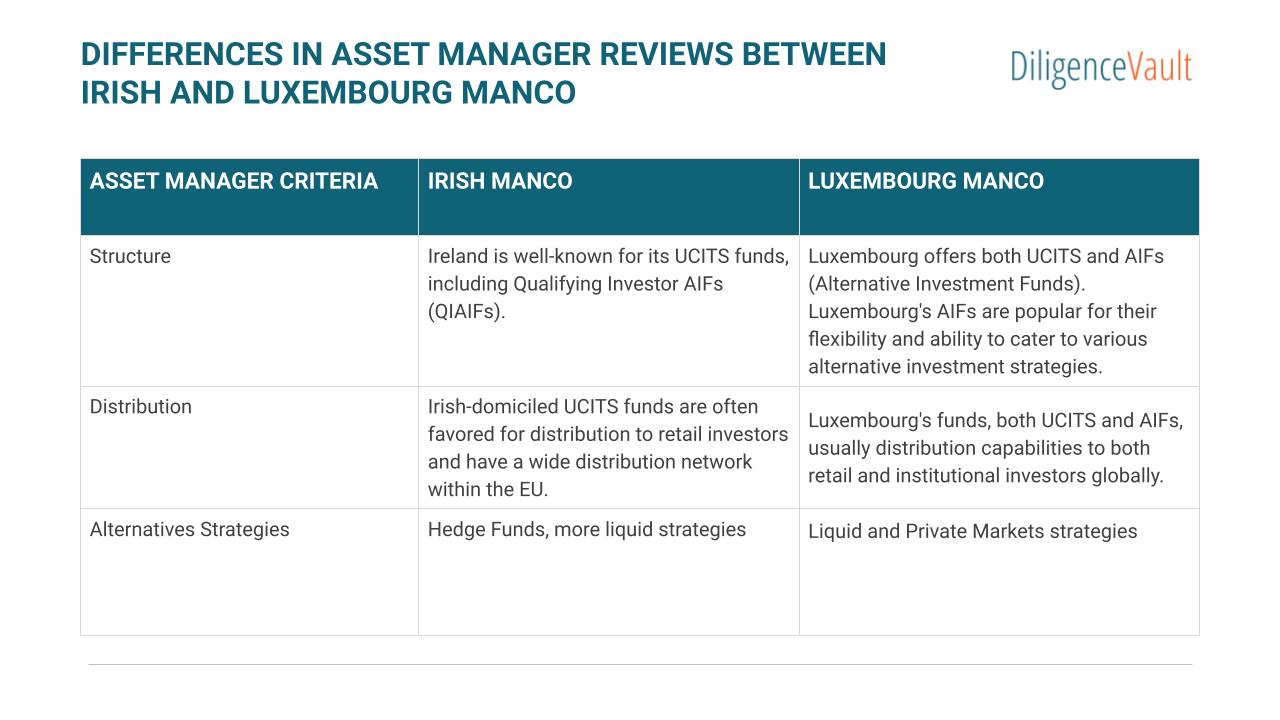

What differences should asset managers review between Irish and Luxembourg ManCo?

While Luxembourg and Ireland are both popular ManCo choices for asset managers, the location can impact factors such as regulatory oversight, tax implications, and operational convenience.

Why should asset managers create a ManCo oversight framework?

Why should asset managers create a ManCo oversight framework?

Once the relationship is established, asset managers must build an oversight framework around ManCo. A robust oversight and diligence framework ensures the quality of the service, ongoing compliance and alignment with your objectives.

Additionally, regulators around the world have also strengthened oversight of asset manager’s 3rd party and 4th party risk oversight. ManCos are important service providers for asset managers and should be part of a robust 3rd party due diligence program.

Ultimately, selecting and managing the right ManCo relationship is a critical decision for asset managers and requires careful consideration and due diligence. While this is a viewpoint from DiligenceVault, always engage with legal counsel who has the expertise to help you navigate the complexities of ManCo selection and setup.

Are you looking for more resources on this topic? Check out how DiligenceVault helps with ManCo oversight, depository oversight and seamless regulatory oversight.