India remains an attractive investment destination for the right reasons: its growing share of global GDP; the significant amount of investment necessary to support such growth; and its large population and young demographic that remain a rich source of consumer demand. The country continues to strive for globalization, efficiency, and socio-economic reforms with positive outcomes around ease of doing business index, bankruptcy reforms, cross-border joint ventures, and public-private partnerships. Counter-weighing these strengths, however, are risks from high dependency on oil, the high current account deficit of around 2.5% of GDP largely on the back of high government debt and high corporate debt levels.

An investment in India at this stage signals a bet on the government’s ability to deliver on significant market-focused reforms and support policies, a substantial farming infrastructure package, and potentially bank recapitalization, so all eyes are on the second term of the National Democratic Alliance (NDA). A high growth bet is also on the Indian entrepreneurial ecosystem which is taking advantage of the same catalysts that make India an attractive investment destination for foreign investors.

Accessing India Story

The India story is unique as it offers alternatives for multiple asset allocation sleeves: value, growth, distressed, impact, private equity, real estate, infrastructure and venture investments, some of which exhibit low correlation to global markets. Foreign institutional investor flows into Indian equities are $11 billion year-to-date, surpassing the total annual tally in each of the four previous years. We see investors accessing the India story via three channels:

Going direct: Many sovereign wealth funds and global funds have offices in India to scout opportunities, especially in private markets. A new generation of business owners and professional managers is more open to alternative forms of investments and partnership models with private equity funds.

Diversified allocation via India sleeve in EM funds: These investments via the public equity market has been the default option historically.

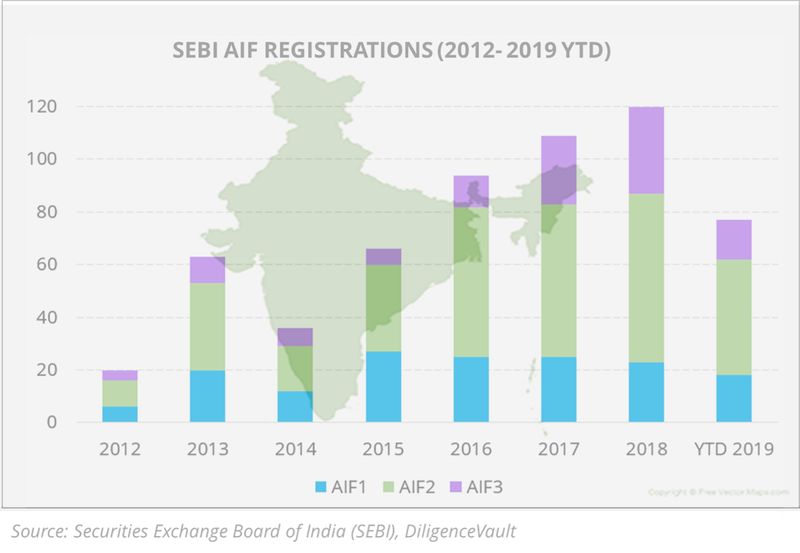

High conviction allocation via single-country, India-focused funds: In addition to the availability of Mutual Funds and ETFs, in 2012, the Securities and Exchange Board of India (SEBI) introduced the Alternative Investment Funds (AIF) framework to ease capital flows into alternative assets. Since then the number of AIFs have grown to nearly 600 across the three categories.

Diligencing India

The elusive list: Successful investing in India beyond the attractive macro story begins with the ability to rapidly access asset manager and fund data, and normalized analysis across multiple fund offerings in order to create the long list. While this process sounds obvious, the limited transparency around such data is a key inhibitor in doing meaningful analysis and comparisons. Should you be successful at the first step, the next level of diligence to arrive at the short list requires access to boots on the ground, an understanding of the culture, regulatory landscape and visits to the country mixed with the possibility of exotic and culturally immersive vacations 😊.

Structure: Historically, an area of diligence that usually gives external investors pause is the regulatory and tax regime where SEBI has made efforts to add transparency and ease access. Availability of established offshore jurisdictions – Singapore and Mauritius, and attractive onshore investments given the same tax treatment have reduced the burden of execution structures.

Investment Diligence: The focus on pedigree and skills, investment resources, and robust investment process, have been more mainstream in the Mutual Fund universe as compared to the newer structures such as AIFs. Elevated valuation is another area of diligence. The current Sensex P/E ratio is nearing 30, vs S&P’s is low twenties vs Shanghai Stock Exchange at low to mid-teens. Private markets also enjoy similar valuations.

Operational Due Diligence (ODD): Once convinced on the investment front, the next focus is on corporate governance and conflicts in a country where these philosophies are yet to become mainstream but are a necessary precondition to foreign institutional investments. Moreover, when investing locally in India, the ODD process must take into consideration both local India regulatory requirements and tax treatment and potential regulatory requirements in the home market, depending on the fund legal structure appropriate for the investor.

Technological edge: The friction and lost opportunities in the early stages of screening and diligence needs critical evaluation. Imagine how both the asset managers and investors can move up to the opportunity line with easier access to data and faster diligence timelines. Technology is part of the answer here. However, the technological revolution that has been permeating the asset management industry globally has seen limited influence in India because of the widely available, skilled and economical human resources. This is quite ironic, as India has enjoyed being the outsourcing destination for the world’s technological revolution.

Necessary Innovation

The end to end diligence process for Indian opportunities becomes quite expensive and lengthy, both at the onset as well as on an ongoing basis; however, it is still justified by the current return potential. These points of frictions present the potential for disruption by technology to make available normalized fund data, while also helping to help bridge the time and distance gap and shorten the decision timeline, to meet the demand which is clearly there. Simultaneously, this presents an opportunity for the Indian asset management ecosystem to come together and solve the data challenge if they want to grow and sustain their share of institutional asset allocations, and unleash the investment potential that India offers. The billion dollar question – Will They?

Many thanks to friendly spirits with no names, whispers in the wind, Donald Lucardi, and Abhijit Shankar Singh for your review and thoughts. Thanks also to our very own Bhautik Senjaliya for providing rapid access to data for this analysis!