DiligenceVault’s recently sponsored the PEI Investor Relations, Marketing and Communications forum in London with nearly 75+ GPs in attendance. Aaron, Aleks and Guillaume from our team attended this 2-day conference (sans our cool DV notebooks and reusable water bottles which was held up in UK customs).

As always, we include highlights and takeaways from a panel discussion we led on ‘Tech tools and where to use them’, and top of mind topics for investor relations, client solutions and capital formation professionals.

1. Larger funds are growing even larger in the current market: Larger GPs are experiencing significant growth. In the current market conditions. These funds are attracting more capital from LPs, due to historical strong performance, investor confidence, better distribution, or a combination of factors.

2. Secondary markets are seeing increasing interest with discounts exceeding 10%: The fact that assets are being acquired at discounts exceeding 10% indicates that LPs are willing to sell these assets at a significant markdown from their carrying valuation. The drivers include LP’s overall allocation to private markets, liquidity needs, changing market conditions, combined with a view on forward valuation of the transacted assets. In addition to LP_led transactions, GP-led transactions are also on the rise. New secondaries funds are also launching with successful raises in 2023 include Adams Street Partners, Ardian, Apollo, Goldman Sachs, Hamilton Lane with aggregate asset raised exceeding $50bn.

3. Fundraising is still posing challenges for GPs, but the current environment is comparatively better than it was a year ago: GPs continue to see extended fundraising cycles, and a tougher environment to attract new LP clients. However, when compared to the conditions a year ago, the fundraising environment has seen improvements.

4. Top of mind topics included interest rates, inflation, and the potential for a recession: There is investor anxiety around these topics which is impacting allocation activities. Along the same lines, GPs are concerned about the impact of these macroeconomic factors on their fund performance as well as operating model, and as a result, there is greater focus on efficient business models.

5. Private credit continues to see increased interest similar to Secondary markets, but for a different reason: Private credit including direct lending, mezzanine, distressed debt for the corporate segment as well as for real assets, venture and real estate has seen increased interest. The factors include macroeconomic environment, the place in capital structure, the shifting dynamics for the borrowers, and the bespoke nature of structuring which helps better manage risks.

6. Private market valuations are being scrutinized more closely: This is a trend which was expected to mature over time as there are less exits, more continuation vehicles, and greater secondary transactions, so LPs are looking for greater support for valuation of the assets on their books. In addition, there are upcoming regulatory guidelines around valuations which is getting GPs to focus on the topic.

7. ESG/DEI is a prominent topic, with data standardization and usage distinctions causing confusion: There was a huge focus of ESG/DEI and the challenges around distinguishing the blurred line of using it as a risk management framework or a marketing tool. Contrastingly, there is no ambiguity about the challenge of capturing and standardizing the data with confusion across the board about what data is the right data and how it is audited.

ESG & DEI goes deeper than just meets the eye on gender, race, ethnicity – one panelist asked the audience to raise their hands if they went to a state school; one of the very few times I’ve been in the tiny minority!

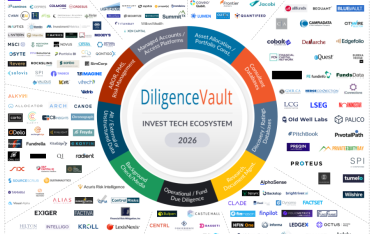

8. Technology for operational scalability: As return and fundraising environments both are under pressure, GPs are looking to either to build more efficient business processes, differentiate themselves in the eyes of their LPs, or both. The panel discussed the best practices of building a tech stack to support the investor relations and capital formation teams including CRMs, investor engagement technologies, Datarooms, RFP/DDQ automation technologies, compliance approval workflows and portfolio company data collection. Gen AI is on everyone’s mind as its potential to transform the industry, and people’s job, is yet to be seen.

“This event was a great opportunity to meet with current clients and future ones. Attending the sessions and hearing GPs talk freely about the challenges they face without the pressure of the LPs being present unlike other events was refreshing. When the fundraising environment becomes challenging, technology becomes a differentiator. A solution like DiligenceVault that sits between GPs and LPs, is ideally positioned to help attract and retain clients by automating the questionnaires completion process and document sharing.” Guillaume Rouault, DiligenceVault EMEA Director.

If you’re interested in learning more about DiligenceVault’s Investor Relations technology solution, please reach out to us here. We look forward to seeing you at the next conference!