With the ever increasing focus on independent administrations to support controls around valuations (i.e. AML/KYC and so forth), it’s interesting to visualize the state of the industry:

Based on sheer number of funds, who are the top service providers? We are a bit hesitant in adding up gross assets or regulatory AUM, so we’re showing you an info-graphic based on number of funds:

Takeaway: Admins seem to be more spread out in terms of market players while top Auditors and Prime Brokers dominate

Next up, here is an analysis of popular service providers based on gross assets buckets, so we are comparing apples to apples. While this is at a fund level, some of the smaller fund structures of mega managers would benefit from association. The size of the bubble reflects the number of funds:

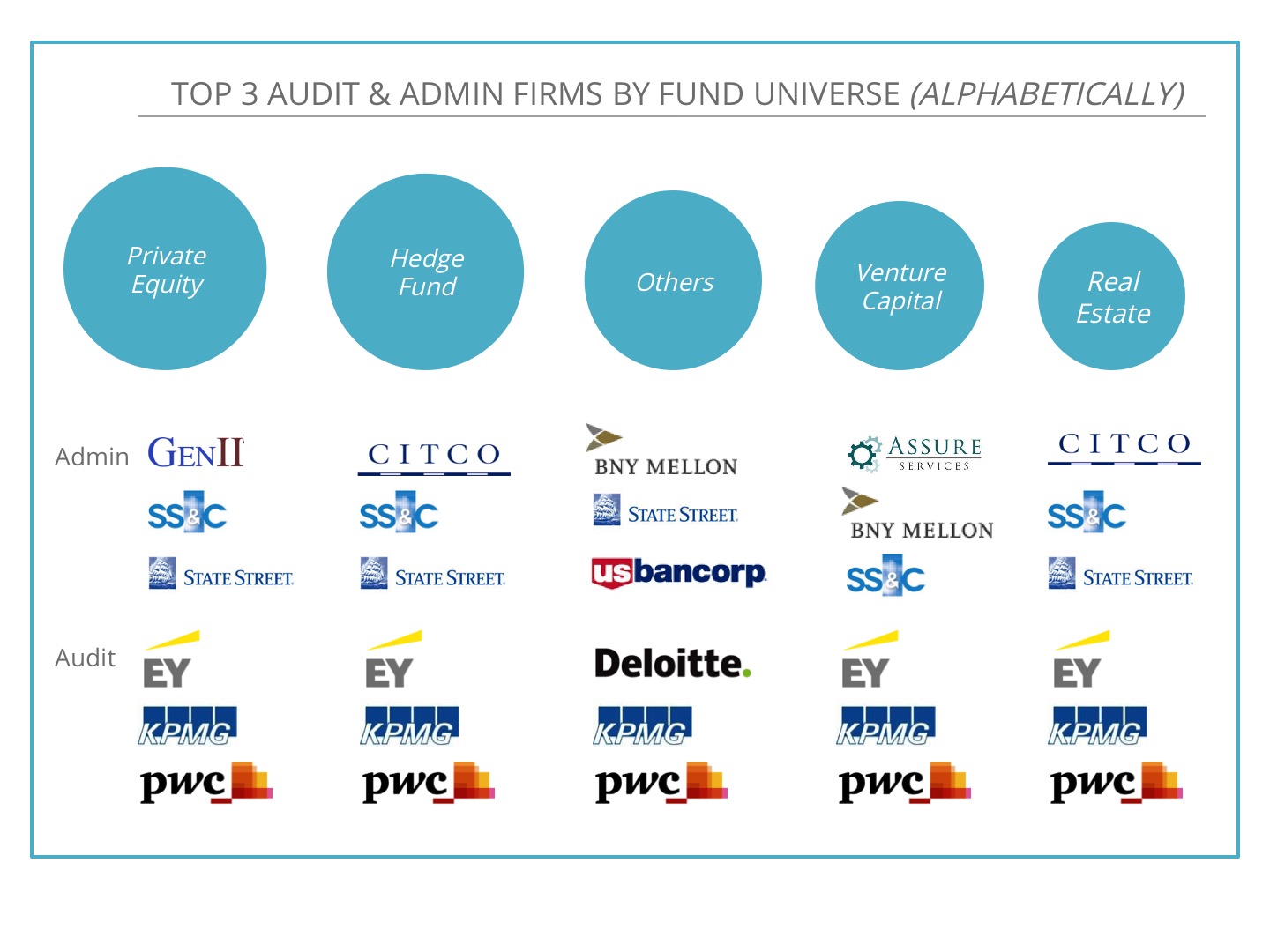

Now, when you slice and dice the service providers by fund types, (as classified by the firms themselves), these are the results (once again, the size of the bubble represents the number of funds in that space):

Finally, we examined – for fun – the most popular pairings of Admins, Auditors, and PBs. The results are as follows:

*Feel free to email me at surya@diligencevault.com if you have any thoughts or feedback!