Private markets investing is becoming mainstream, and in response, wealth managers need to find areas for differentiation across product and advice offerings and processes – Oliver Wyman’s report on the ten trends for Wealth Managers highlights how some are enabling access to top-branded private market firms, while others are building internal capabilities around niche, thematic strategies.

To capture the nuances of this expanded product roster and complexity, top wealth management firms are strengthening their manager selection and due diligence teams and framework to reflect the following considerations:

- Greater exposure to private market products also carries the need to manage potential concentration risks through asset class and vintage year exposure, or potentially through fund of funds structures.

- A shift in investment styles to now include more fund investments instead of individual deals.

- A generational shift in wealth investors is increasing the demand for thematic, ESG, impact and sustainable investing strategies. Wealth firms have to build the ability to understand and approve such product offerings for their clients.

- Asset managers are creating structures that meet the needs of wealth investors through the increased availability of interval fund structures, strategies in registered fund structures (40 Act / UCITS), wrapped structures, and tax-efficient fund structures. With the proliferation of options and some asset managers launching them for the first time, the risk factors that need to be understood and assessed are also going up.

- Further, there are multiple ways to gain this exposure – via insurance products, distribution, feeder fund platforms, secondary and co-investment platforms such as Spearhead Administrative Services, iCapital, CAIS, Opto Investments, Dot Investing, YieldStreet, Moonfare, Gridline to name a few.

- As the product set expands, and client demand for digital engagement increases, wealth management firms need to prepare for an expanded reporting and regulatory burden which necessitates documentation and audit trail.

Another theme that heavily influences how wealth management firms build these capabilities is that cost transformation has moved to the top of the agenda, as cost as a percentage of revenue has increased. This necessitates looking at the business model with a focus on efficiency and scalability. Technology plays a key role here, in providing efficiency, but also providing a seamless experience to overcome operational, regulatory, and efficiency challenges that simply cannot be solved by creating bigger teams with more resources.

At DiligenceVault, we work with leading private banks, family offices, registered investment advisors, and wealth management firms across the world. Below are our views on four best practices to help scale a manager selection framework and its impact on future growth:

- Automate repetitive, manual due diligence and monitoring processes in an effort to maximize efficiency and minimize errors

- Accumulate and assimilate more data in the decision making process throughout the firm

- Build an easy to access institutional memory on all approved products to sift through the options and recommend the right product to the client

- Increase transparency and responsiveness in client reporting, which has proven to be a key differentiating factor influencing growth

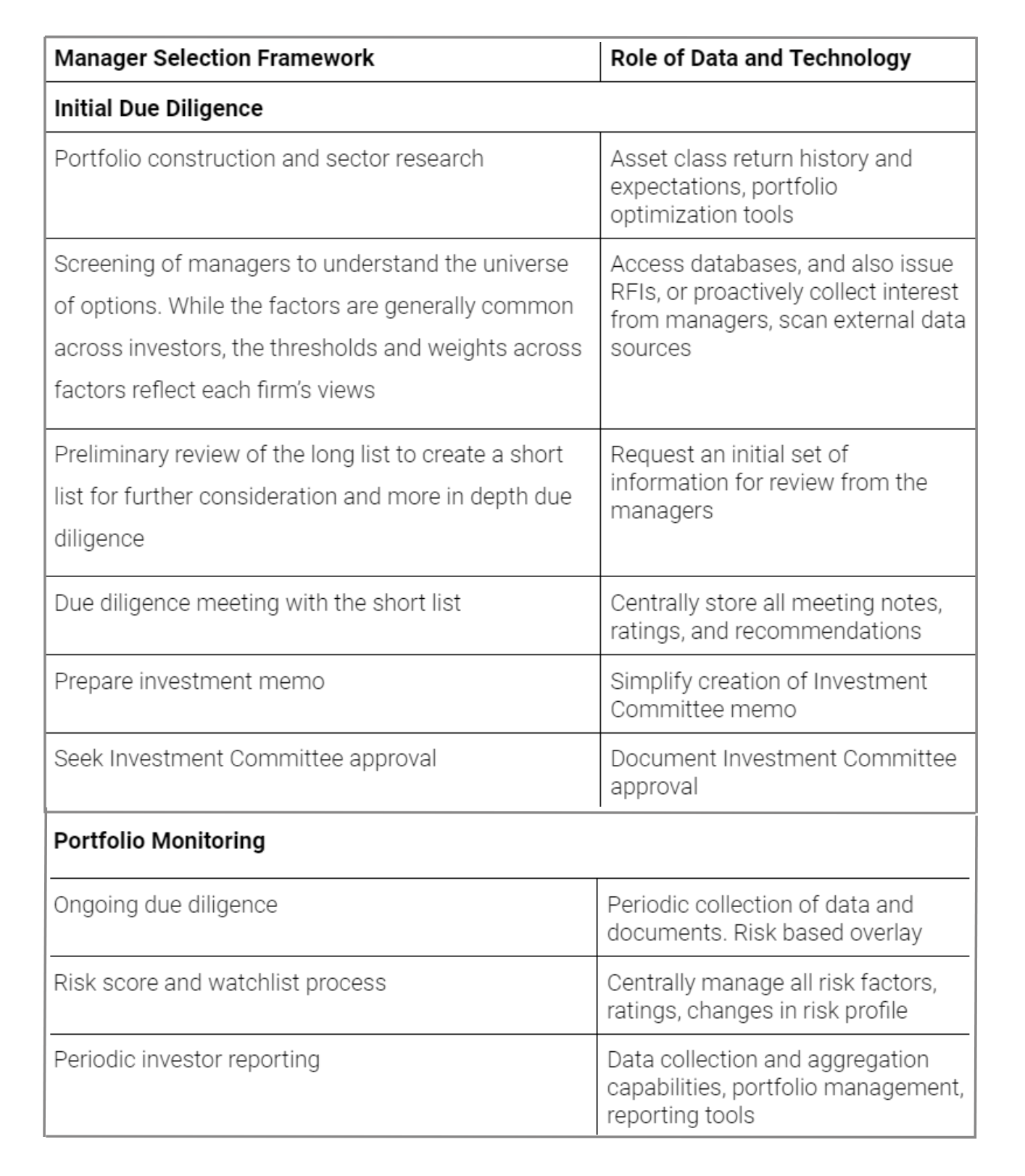

Keeping these four areas in mind, we further breakdown how to align technology use with the core framework for manager selection and due diligence.

DiligenceVault plays a significant role in this framework and have documented these use cases in key solutions for asset allocators and top investment offices data collection use cases whitepaper.

The WealthTech Promise – Unveiling A New Chapter

Firms that anchor their private markets product extension strategy with a meaningful data and technology integration, combined with a focus on creating a long-term, sustainable manager selection framework are best positioned to capture mindshare in this transition to private markets investing. We saw this strategic thinking resonate at the WealthTech 100 event in March 2023 as we met technology leaders in the wealth management space, both at other technology companies but also those business leaders at financial institutions implementing and investing into technology at their firms. DiligenceVault was honored to be included in the WealthTech100 list, and to participate in the Global WealthTech Summit. The demo day was a first hand glimpse into how other technologies are solving problems.

Thinking long term, firms that invest in centralizing their internal data sets will have an advantage in deploying transformational technologies such as generational AI capabilities in improving outcomes for their teams productivity and their clients’ experiences.

Four Related Resources:

Scaling Manager Research – A Case Study with Van Lanschot Kempen

Building a Robust Investment Sourcing Strategy

Private Markets in 2022: Zooming In on Operational Risks & Due Diligence

Hubbis Insights: The Need to Drive Fund Due Diligence Into The Modern World