Perhaps you are a large investment firm looking to create a culture of excellence that will perpetually attract top talent and dominate your market. Alternatively, you may be an accomplished group at a small boutique looking to punch above your weight and innovate your way to market leadership. Either way, you need to harness the skills of your people in a systematic way so that they perform well on a recurring basis to ensure investment and business success.

Columbia Business School Professor Joel Brockner’s 2016 book “The Process Matters” provides a practical guide for creating collaborative processes in the workplace that ensure quality output. Largely focusing on the human element, the book offers concrete steps for creating a work environment that contributes to job satisfaction and employee retention, while ensuring business success.

Past Performance Is Likely to be an Indicator of Future Success

The famous investment industry caveat notes, “Past performance is no guarantee of future results.” The disclaimer was well known long before the massive amount of technology-led disruption currently impacting the industry. Over the past decade, we have seen some large investment advisers achieve significant market dominance. These firms have managed information well and implemented high-quality processes that allow them to work more efficiently, effectively, and faster. They have leveraged their people and processes to achieve consistency in performance at scale, thereby creating significant competitive advantage.

Brockner defines a high-quality process as one that both engages and equips people to accomplish their objective. From our perspective, equipping allocators and asset managers with the technology they need to secure strong investment performance for their clients and constituents on a repeatable basis has seen great adoption. For any kind of workplace – large firms with people who are far-flung or remote, as well as smaller ones needing to leverage the resources they have, success is defined by productivity and growth, and finding new ways of doing things beyond the quarter century old technology of documents and emails.

Plus Ça Change

Experienced investment professionals are adapting to a pace of change that was unthinkable earlier in their careers, while young professionals can only surf the waves of change that seem to come almost monthly in an industry where there seems to be no fixed career path. Brockner notes in his book that change creates uncertainty, and it also requires people to do more work, since they still have ongoing responsibilities while they are learning something new. However, a high-quality process is likely to result in people embracing rather than resisting change.

From Process to Workflow – Digital Implementation

Broadly, a workflow is the sequence of processes through which a piece of work passes from initiation to completion. A good process establishes micro steps and creates a workflow to manage sequence and execution of these steps. Increasingly the industry has adopted workflow technologies. However, without a well-designed workflow process, any technology solutions around it would not achieve optimal results.

Investment / Deal Workflow

For an asset allocator, a common workflow involves selecting and implementing an investment in a fund. The people involved include analysts and portfolio managers, risk, legal and compliance staff, operations, finance and accounting. Workflow technology can help ensure that none of the steps are missed, that the appropriate people perform the designated tasks, and that there is backup in case a team member is absent or traveling. The above process is repeatable, but also configurable for different situations involving investments in various sectors or types of instruments. Workflow expedites processes by allowing work to be completed in parallel when possible, and also in the appropriate sequence. A workflow ensures that all relevant steps are taken and that there is oversight and accountability. It also helps highlight any bottlenecks or choke points.

Request Management Workflow

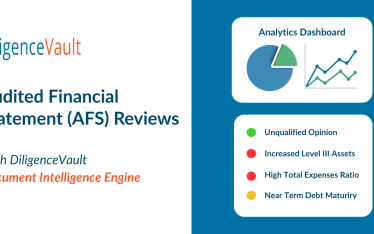

Another key workflow for the investment management industry revolves around information requests, which need to be screened and routed to the appropriate people for processing. Marketing/IR/RFP teams manage and respond to information requests constantly. As the team responds to a high volume of information requests, they seek to provide accurate, consistent, well-crafted and compliance-approved content in a timely fashion to their investors. At DiligenceVault we have a high conviction that micro technological automations augmenting request management workflow, combined with natural language processing algorithms that identify previously provided information and rules that tag information relative to product, will ease administrative pain points, minimize errors, improve content and cut costs. Workflow with recombinant technologies applied to this use case results in a productive balance between rigor to the process ensuring a quality product, as well as timeliness and strong oversight.

Workflow Driving Productivity

How do you implement the wonderful tool of workflow technology so that you can achieve the full benefit? Where do you even begin? We see the best implementations with those clients who start by doing an assessment. A thoughtful review of how things are done at present, solutions that are available, and a visualization of desired goals will set the stage for success.

Once you have constructed and implemented your workflow, work with it for a bit and then do an analysis of the results, perhaps using process audit tools mentioned below. How much time has it saved? Where are there bottlenecks and inefficiencies that can be further improved? Where is there opportunity to grow your business? Once you have your workflow in place, you will see that it is a great tool for driving results, as well as for business process oversight and measuring your success.

Process Audit

There are well-established tools available to help you evaluate your process. It is important that technology is leveraged to let the outcome drive the processes, rather than the process driving the purpose. Technology can help to customize a rigid process, based on the requirements of the situation. A process audit can be done with various models including

Carnegie Mellon’s Capability Maturity Model Integration (CMMI) framework or the

Process and Enterprise Maturity Model (PEMM) created by Michael Hammer at MIT. Both models were created in the early- to mid-aughts. A helpful worksheet provided by Hammer in HBR lists the five salient process elements as Design of the process, the Performers, the Owner, Infrastructure, and Metrics, along with the relevant considerations for assessment of each. Process Audit Worksheet

Power to the People

Organizations are comprised of people, individuals who each have unique strengths and weaknesses. A process helps to institutionalize best practices and avoid errors. All processes exist to support and empower people, who are the most important assets at all our client firms. However, given the very generic nature of workflow technology, partnership with a firm that understands your industry will serve you well in achieving optimal results with your process.

Investment in workflow technology is expected to grow rapidly over the next few years. MarketsandMarkets Research estimates that the market for workflow management technology comprised $3.5bn in 2016 and should grow to about $10bn in 2021 for a CAGR of 23% per annum. What does your plan include? If you want to join the discussion, please get in touch.