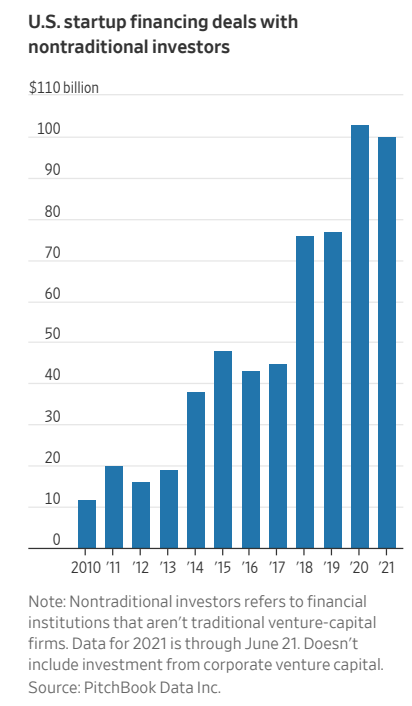

Over the past few years, a wide variety of investors have rushed headlong into the world of venture investing, enticed by the lucrative returns seen in the private markets. These investors, who fall outside the classic venture-capitalist definition and are known as nontraditional VC investors, can include hedge funds, asset managers, pensions, sovereign wealth funds, corporations, and even family offices, and they are increasingly becoming impactful participants in the venture-capital sector, supercharging the growth in this space. In the second quarter of 2021, nontraditional VC firms participated in 41.5% of financing deals in venture-backed companies — transactions that accounted for more than 76% of the invested capital in the space during that quarter, according to PitchBook. As seen in Figure 1, it is crystal clear that nontraditional VCs have steadily ramped up activity in the private sector. This group accounts for half of the top 10 startup investors, as measured in dollars, and includes money management firm Fidelity Investments and hedge fund Tiger Global Management, according to the Wall Street Journal.

Nontraditional investors shaking up ventures

The venture market has been generating impressive returns of late: 2020 exit value in the space topped $300 billion, per PitchBook, and totaled $118 billion in the first quarter of 2021 alone. In comparison with public equities, venture capital has consistently delivered stronger performance: The top two quartiles of venture-capital firms have delivered twice the returns versus public equity across multiple time frames as of 2019, according to Cambridge Associates. Lured by the prospects of stronger performance, hedge fund managers and other nontraditional VC investors are pouring their money into private asset investments at a rapid pace.

Figure 1.

Figure 1.

Beyond performance, the private sector also allows investors to access promising companies earlier on and to avoid competing in the overcrowded IPO process — additional benefits that have helped attract nontraditional VC investors. Startups are furthermore staying private for longer, especially in the technology sector, and startup sale deals are becoming less available in the public markets. By investing earlier, nontraditional VCs can gain entry into a larger pool of high-growth companies. And given their deeper pockets versus traditional VC firms, many hedge fund and asset managers are able to flex their cash strength and pay significantly more for companies. They can also make much quicker deal decisions, thus securing their ability to invest in hot companies before they go public. Finally, nontraditional investors typically have lower return thresholds and are generally less interested in becoming involved in company decisions than are traditional VCs. These are all appealing characteristics for many startup founders, giving nontraditional investors a competitive edge in the bidding process.

It is clear, then, that nontraditional VC investors are making an impact in this space. The combination of deeper pockets and the fervor to tap into private markets have sparked a staggering increase in VC deal activity over the past few years, that has put an upward pressure on valuations toward an all-time high. With valuations becoming richer, VC managers have little room for error when it comes to selecting the best investments. This, in turn, underscores how critical it is that allocators incorporate a more rigorous due-diligence process when evaluating both traditional and nontraditional VC investors.

Maintaining discipline in VC due diligence

As hedge funds, asset managers, and other nontraditional VC managers step into the world of private investing, it is crucial for allocators to conduct thorough research on these managers — on their investment processes, portfolio construction, and any potential liquidity mismatches. Venture investing is very different from public investing on many levels, and it is of paramount importance that allocators truly understand and meticulously vet the backgrounds of managers who may not have had traditional venture-investing experience, yet are now playing the role of VC investor. That said, pouring more hours into due diligence doesn’t always equate to better outcomes. At DiligenceVault, we believe it is the quality of the diligence process that will reap the biggest (risk-adjusted) rewards.

A data-driven platform like DiligenceVault can help allocators leverage technology to thoroughly apply a consistent diligence framework, both quantitative analysis and qualitative research on nontraditional VC managers. In particular, the DV platform automates and digitizes the due diligence process by accurately collecting and organizing large sets of data, making it easier to flag risk areas, outliers, and even unusual valuation processes. Allocators can, in other words, reduce time spent on onerous manual processes and instead focus on more value-add activities, such as understanding how traditional VCs are coping with increased deal competition as well as nontraditional VCs who may just be beginning to invest in the private markets. The bar is certainly high and the margin for error is thin.

At DiligenceVault, our goal is to create a new standard for diligence that is data-driven, automated, and accessible to all. In short, through our innovative technology, we aim to transform the manager due diligence process so that risks associated with venture allocations – or any manager allocation for that matter – can be properly identified, vetted, questioned, and managed.