We find ourselves in a complicated valuation environment at present, with unparalleled volatility shorts in the market, VIX at an all-time low, extended outperformance by passive indices, massive unrealized valuations in portfolios, and limited exits in private markets. This month we also marked the 30th anniversary of Black Monday, the largest single-day equity drawdown in the history of the US equity markets. With this as backdrop, most investment professionals who lived through the 1987 crash could feel nostalgic. And those who didn’t are probably discounting that draconian event as a spooky impossibility.

Nevertheless, given where valuations and fundamentals are, one can’t help but wonder about the future, and strategically re-assess current risk positioning and long-term risk thinking. It’s actually a very good situation to be in, to be able to think about risk when you are in a position of strength. As markets, techniques and thinking evolve, what will be the face of risk in 2027? It will be driven by how we act today and develop the following core competencies, as opposed to maintaining a singular focus on the technical aspects of valuations, models and hedging.

A tussle between conformity and individuality

Despite significant evolution in investment management as a profession, the fallibility of human nature to avoid crowd think is the biggest weakness in any risk framework. This risk is manifested as FOMO rallies, large drawdowns, and subsequent interruption in liquidity. This hilarious Candid Camera snippet provided by Prudential is a nice reminder about the prevalence of group think:

This video shows a couple of unsuspecting subjects in an elevator eventually conforming to the strange and inexplicable posturing of the rest of the crowd. The ability of a firm to address this susceptibility will be key to its ability to create competitive advantage.

Asking the right question

In Charlotte Beyer’s book “Wealth Management Unwrapped” she reminds us of the importance of asking the right question, and even greater importance of how this question is being asked. That is the difference between a rote, check-the-box approach vs. gaining real insights. For example, if we look at the outcome of the famous bet between Warren Buffet and Ted Seides, one could conclude that hedge funds underperform S&P 500 always. However, if one would ask instead for a risk-adjusted outcome, or an outcome under a different market condition, the answer could be so very different.

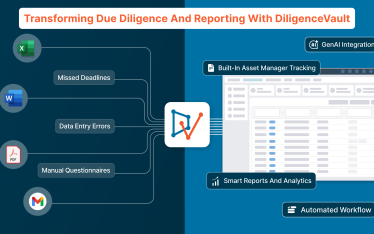

Decision and collaboration models

How many missed opportunities have happened because of a failure in communication? One of the critical innovations that has happened in the last 5 years has been in the area of transparency, communication and collaboration. Development in this area enables decentralization in decision making. We know that the more you experiment, the more successful you can be. Greater decentralization in decision making breaks down a single high stakes decision into many sub-decisions, helping build bottom-up centers of influence. In a DiligenceVault blog on checklists, our colleague Heidi refers to Atul Gawande’s research into Submittal schedules which illustrates this point. A futuristic example is the possibility of building a NY to DC hyperloop with a travel time of just 29 minutes. It’s a moonshot, and a high-risk complex project. Whether it will be successful or not, the progress from idea to execution is made possible by better collaboration, along with technology as a central theme.

Knowing the end game

Contrary to what many may think, risk management is not all about technical ratios or exposures.

Fundamentally Risk Management is about “How do we protect the asset base?” It shouldn’t be about not being wrong, but rather about minimizing the chances of being wrong. And if you are wrong, how do you minimize exposure to losses?

In the process, are you building a better engine or a brand new vehicle? Is it former, and completely new risk thinking and models (outcome-based investing, or AI-driven investing, or agent-based models, or new datasets in search of alpha) or the latter, which is improved execution of MPT or calculation of VaR? Both could be equally successful, but it needs to be clear what is being solved for.

Leveraging technology

With all the hype around tech, and now data, we know that they can be very blunt instruments if applied to the wrong problem, or if applied incorrectly. One example of this is applying Value at Risk models to Private Equity portfolios where the essential ingredient of a tradeable time series of daily statistics is missing. This is akin to applying deep tech predictive algorithms to problems where data creation is the priority. As an investment firm, how do you approach developments in tech? Are you treating technology a discrete expense line item, or is it viewed as a capital investment with important strategic impact that also provides an offset to administration and other costs?

Building solver teams

Solvers teams hold joint accountability for success of failures, rather than building functional silos (inspired by this thoughtful article by Ajay Srivastava). As the complexity in investments, structures and decisions increase, are you creating multi-perspective teams or solver teams?

2027

The uniform focus on teams, decisions and technology is significant as the investing world continues to increase complexity, and interconnectedness. Although there are many different decision points and prospective paths to the future, we will only see one manifestation. Choices made in all of the above areas will result in compound decisions with longer term impact. They will prepare investors to own their future by being well informed, being able to make risk and investment decisions faster, and accept these decisions as a team. How would you prepare for 2027?