Overview and importance of Form ADV

‘Tis the season for investment advisors who do business in the US to file Form ADV, a key disclosure document required by the SEC. Not only is filing Form ADV required to register with the SEC, but advisors must also update their filing each year at a minimum 90 days after their fiscal year ends or when triggered by a significant event. There are some exceptions which are Exempt Reporting Advisers (“ERAs”) that are not required to register as an adviser but must still pay fees and report public information via the IARD/FINRA system. The Form ADV filings are a rich source of data to help gain valuable insights including, but not limited to, company ownership, the services the firm provides, what fees clients pay, and if there are any disciplinary actions against the firm, its affiliates or its employees. The filings serve as an important avenue for continuous monitoring, peer analysis, and identifying outliers.

Pros and cons of ADV data

Use cases of Form ADV

This rich data set caters to many teams within the asset and investment management industry. Top 3 Use Cases:

1. A common scenario used by managers would be to review their peers’ ADV profile, giving them an insights into their competition.

2. For the investors, the Form ADV module assists in reviewing the manager’s profile, creating a market map, evaluating manager’s adherence to best practices, and monitoring significant changes.

3. Form ADV can also be used as a tracking tool for mergers and acquisitions strategy.

The table below also shows additional use cases for the service providers as well as other stakeholders:

Accessing Form ADV filings

A free copy can be accessed through the Investment Adviser Public Disclosure website at adviserinfo.sec.gov. Alternatively, you can also check state regulator websites where the advisor operates.

Fun fact: Did you know that on average, there are 129 firms updating their Form ADV filing everyday? Yes, everyday! How would you be able to track these changes?

This data is publicly available for review and analysis, but the sheer volume of data and the way it is structured makes it extremely painful to review, analyze and reuse. It has been a source of confusion and anxiety for years.

Now imagine how powerful the insights would be if all of the data was analyzed together. Wouldn’t it be great if there was technology to aggregate the data and analyze it at the same time? Your time-consuming menial tasks can now be automated and streamlined! 🙂

How DV helps accelerate informed decision-making

DiligenceVault not only helps in streamlining the due diligence process for the Investors and Fund managers, but we also simplify the decision-making process for the Investors/Allocators via our Form ADV module.

“It’s a useful contribution to anyone doing investment due diligence at scale. It’s a logical tool to use.” – Jeff Barnes (Senior Associate – Operational Due Diligence (ODD) at University of Virginia Investment Management Co. (UVIMCO))

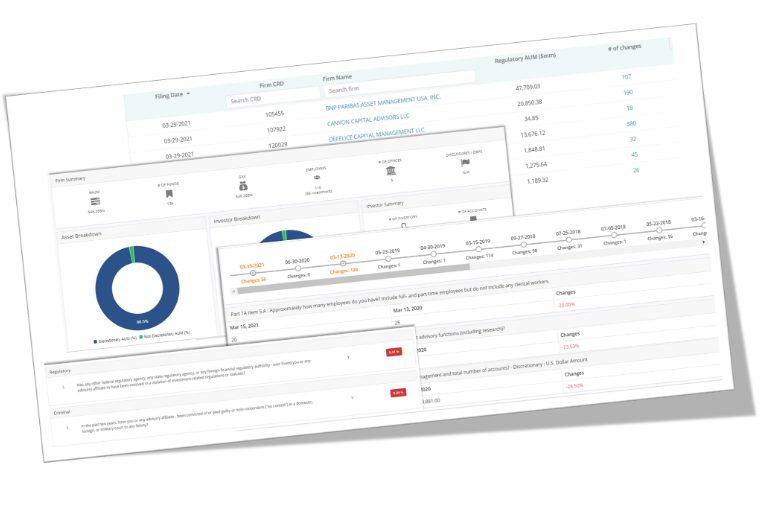

DiligenceVault’s ADV module tells you when asset managers submit their Form ADVs, provides a live profile at a firm and private fund level, identifies flags and ownership data, and even produces a table which shows the difference between submissions, right down to the smallest detail. Coupled with our due diligence functionality, DiligenceVault further assists you in requesting the right kind of data directly from your asset managers and validating changes that are happening. The information collected can then be used in our integrated data analytics tool, producing meaningful insights without the need for other software.

“Without a service like DiligenceVault’s ADV Module, we would be relying on a more manual process (to monitor and scrape data).” – Jim McKee (Director, Hedge Fund Research at Callan)

Impact of ADV Data

Data has shown that 65.5% of firms file more than twice a year, with one of the firms filing 80 times a year! Based on our analysis, we see a positive correlation between the number of employees at a firm, and filing frequency. The complexity of a firm could be a reason for more changes and/or mistakes resulting in re-filings. This creates a strong argument for the need to monitor for changes for any fiduciary.

Form ADVs are complex, but equally rich in data. Manually accessing these would mean scrolling through 10s or 100s of pages. And doing any large-scale analysis oftentimes seems impossible. Examples of decision analytics that can be powered using ADV data alone by DiligenceVault include answers to questions such as:

- PE funds with last fund launched more than 2 years ago

- All firms with PE funds above a certain AUM size

- Firms that use certain 3rd party marketers, and certain PBs and Administrators

- Service providers that are used by private credit funds

- Firms that have a high % of foreign capital

- All fund of funds above a certain AUM

- All funds that have a certain subadvisor

- Firms with no conflicts and affiliate business transactions

- Firms with material skin in the game

- Firms with higher SMA vs. pooled capital

- Firms without any Item 11 disclosures

- Firms with volatile AUM and headcount

- Firms with only discretionary assets under management

At DiligenceVault, our industry-leading technology pulls data daily into the platform, allowing clients access to information to answer a lot of the above questions and more, thus harnessing the complete information suite within Form ADV filings and updates.

Jim McKee at Callan noted, “when a client asks about a specific manager, I can quickly get a profile from the DiligenceVault snapshot, history, and immediately find any notable issues.”

Regulatory Filings’s Data Promise

Forward thinking LPs are constantly thinking about how to convert the overload of a tremendous amount of unstructured information into analyzable data sets, and incorporating results in the investment process. DiligenceVault is here to make this process fuss-free.

“If you are reviewing ADV filings or would like to add it to your process, the ADV Module is a great product.” – Jeff Barnes, Senior Associate – ODD at UVIMCO.

From monitoring your asset managers to tracking the most minute changes made in their Form ADVs, DiligenceVault makes it very simple for you. Click on this link for a demo and join the conversation: DiligenceVault Demo

Co-authors: Joseph Banda, Rahul Bhutani.