A fund advisor’s fiduciary duty requires significant oversight.

DiligenceVault provides a comprehensive platform for sub-advisor due diligence and oversight.

DIGITAL DILIGENCEDigitize your subadvisor oversight

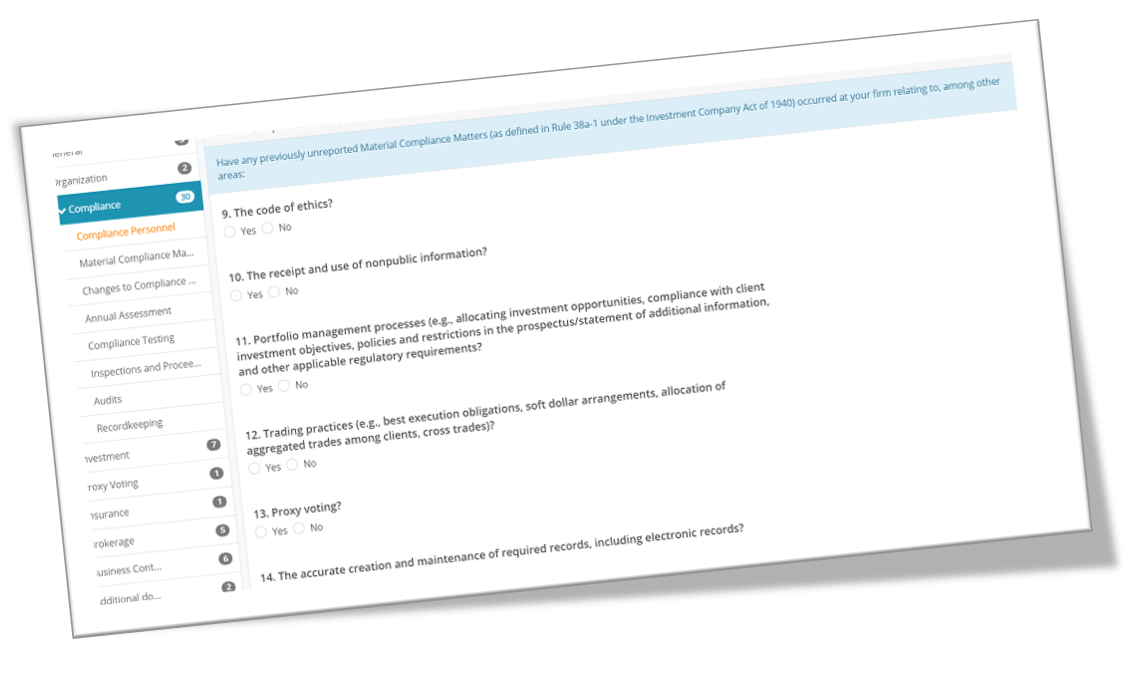

DigitalDiligence is a core module that enables you to transform your diligence framework across initial and ongoing monitoring of sub-advisors.

- Collect data and documents from subadvisors for initial due diligence, ongoing monitoring, and annual contract renewal process.

- Avoid avoidable and costly errors when conducting advisor diligence, and eliminate errors that come from manual processes

- Automatically flag risk areas, outliers, and even compliance issues

- Enable transparency for the entire team on a centralized platform

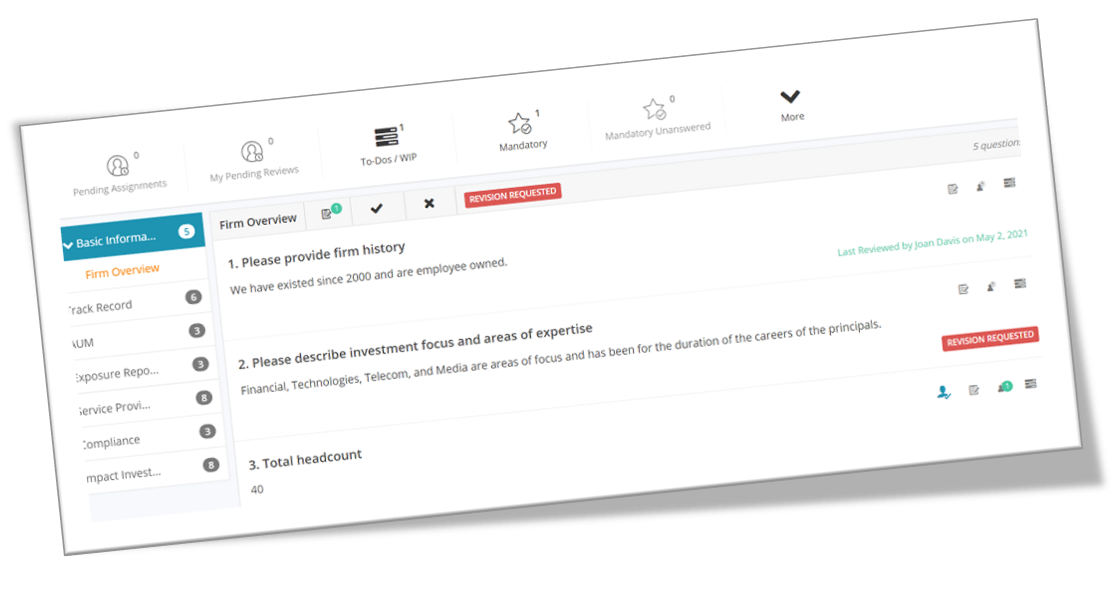

COLLABORATIONCollaborative review and authoring

Collaborate with sub-advisors, internal compliance and manager research teams, as well as external counsel.

- Eliminate the need for copy and paste from multiple data sources

- Overlay collaborative review process in generating opinions and recommendations

- Create presentations from all your research data in a few clicks in your brand

- Enable transparency for the entire team on a centralized platform

ANALYTICSIntegrated risk-based analytics

Leverage powerful analytics to demonstrate an institutional framework for oversight and governance.

- Automatically flag outliers and unusual advisor resposnes

- Quickly identify material changes across advisor responses and regulatory filings

- Integrate risk-based scoring to deliver advisor risk dashboard for the fund board and senior management