Join us for our upcoming webinar happening on May 16 at 10am ET, to discuss the GP and LP perspectives on due diligence in private credit investing. Register today!

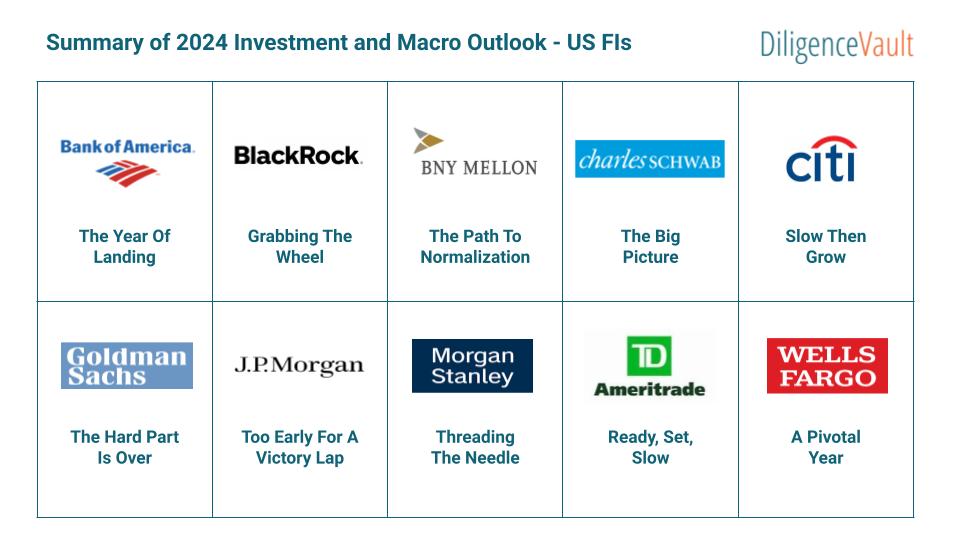

Analyzing investment and macroeconomic views is vital for fund investors' due diligence. Each year, financial institutions release reports on global markets, investment cycles, and risk factors. As 2024 begins, we've...

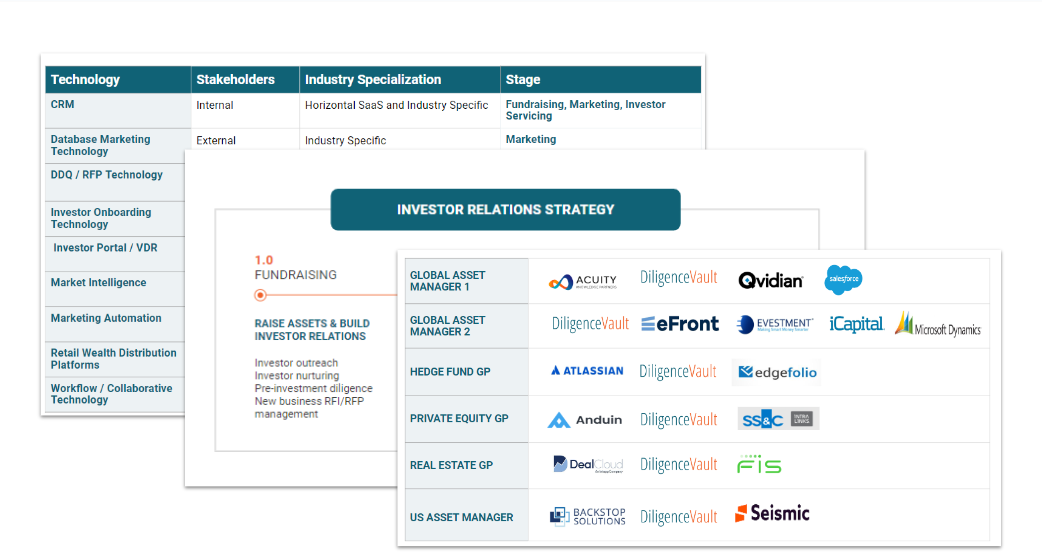

Explore the essential tech tools for investor relations in asset management. From sales strategies to post-investment reporting, a robust tech stack is crucial for efficiency and success in this multifaceted...

Due diligence tech serves asset managers and investors differently—portfolio assessment for the former, varied tools for the latter. Complexity arises based on parties involved and diligence stages.

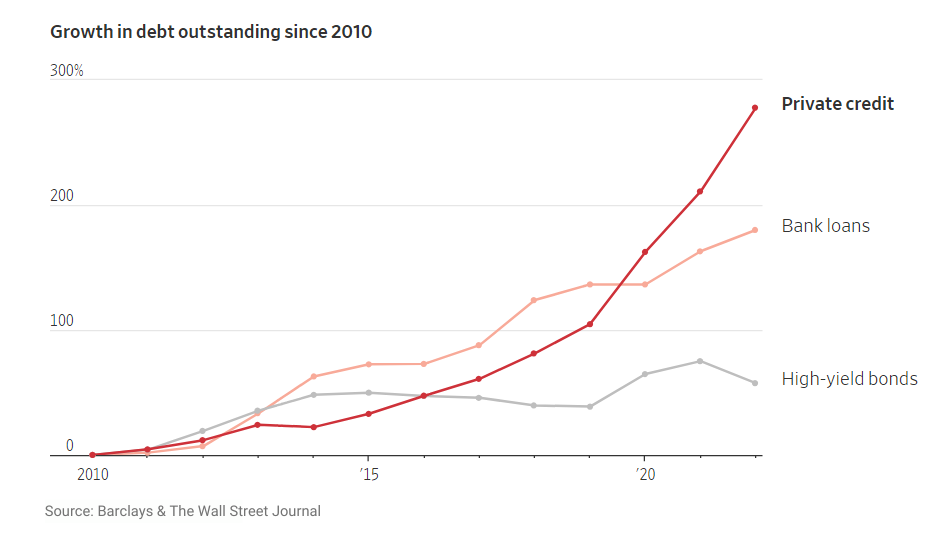

Key considerations for private credit diligence include investment strategy, track record evaluation, covenant monitoring and 3 more.

Key insights from PEI Investor Relations, Marketing and Communications conference in London, highlighting top of mind topics for investor relations, client solutions and capital formation professionals.

Read about the 10 Generative AI applications for investment, due diligence, and reporting processes at asset and investment management firms. Gain insights into industry sentiment on Gen AI.

Create a dependable, centralized RFP/DDQ knowledge hub for asset managers to seamlessly repurpose content across diverse reporting needs, spanning both Word and Excel platforms.

Are you ready to manage the new risk dimensions and complexity, and scale your diligence framework? Learn more about how DiligenceVault Navigating Asset Management M&A: Due Diligence Considerations and Trends

How are the US, UK, Australian, and Dutch pension allocators making private equity investments in response to markets, industry structural changes, and reforms?