Discover how the $700B evergreen fund boom is reshaping private markets and why investors need sharper due diligence to evaluate these structures.

Discover how our AI Readiness Scorecard helps allocators, family offices, and RIAs future-proof due diligence.

Your step-by-step strategy for building LP trust, standing out, and raising smarter with AI

Streamlining Due Diligence with AI for Smarter Investment Decisions

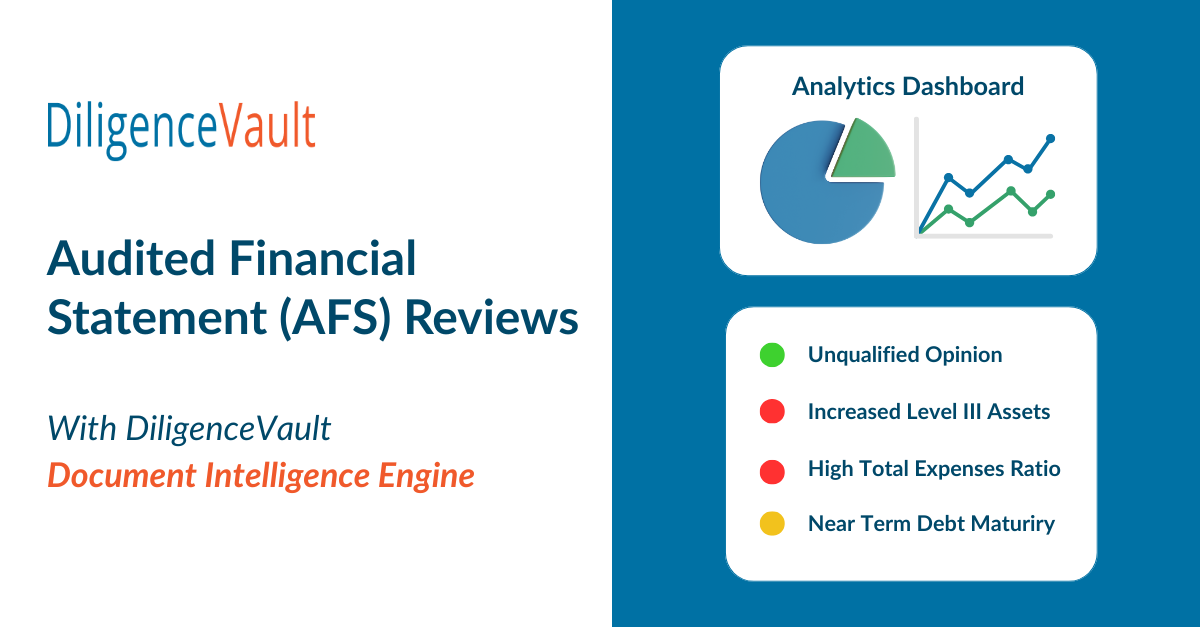

DiligenceVault’s AFS Analysis Module redefines how investment teams approach the Audited Financial Statements Review.

Essential GenAI and LLM terms for due diligence, investor relations, and asset management teams. Download the free guide from DiligenceVault.

A sustainable investing team's strategic intent is made successful by ESG data that is accurate, usable, and is embedded across the investment process. This whitepaper shows asset allocators how to...

Explore the insights from the 2025 GAIM Ops Cayman Conference, focused on ODD, AI adoption, compliance risks, and vendor oversight in the alternative investment space.

Explore top insights from the 2025 ICI Investment Management Conference, focusing on SEC priorities, fund governance, AI, DEI, Governance and more.

The asset management industry faces massive inefficiencies due to a lack of standardization across reporting, due diligence, and data management. In this blog, we break down the billion dollar problem...