Explore top insights from the 2025 ICI Investment Management Conference, focusing on SEC priorities, fund governance, AI, DEI, Governance and more.

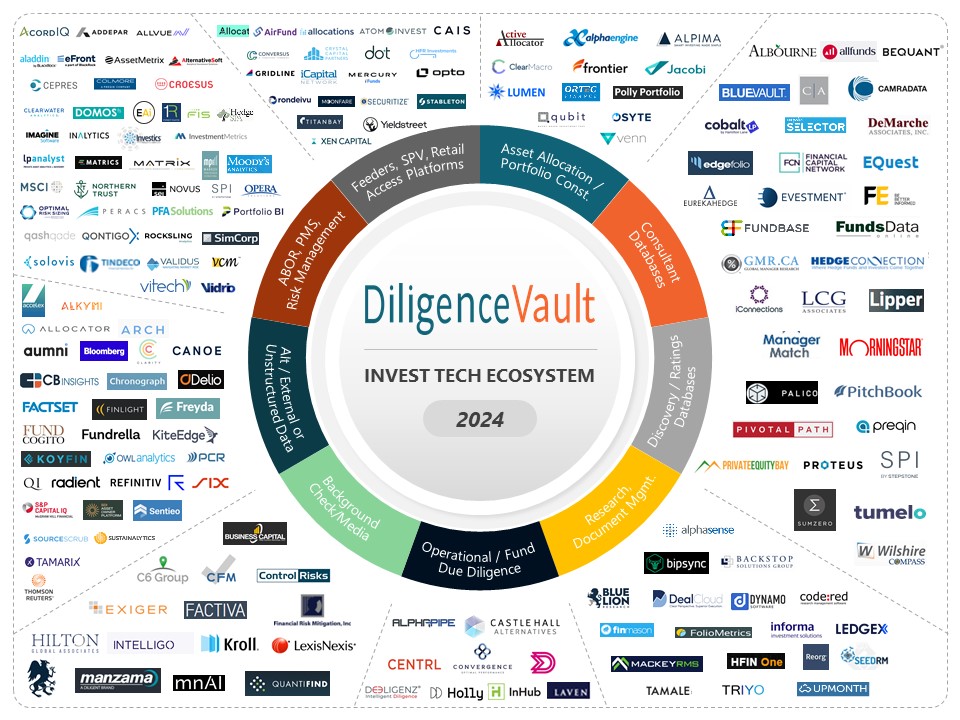

Read our blog to discover how InvestTech 2025 brings innovation, opportunities, and transformation to technology and investment management.

Read the key takeaways from our webinar on Investing In All Things Venture, featuring panelists from Industry Ventures and NEPC.

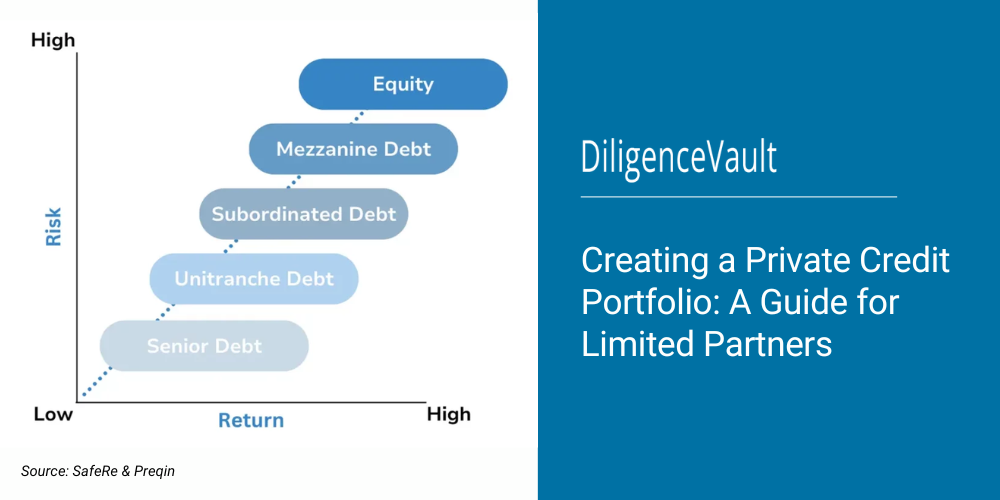

Here's a guide for creating a private credit portfolio, highlighting the key steps and considerations for limited partners.

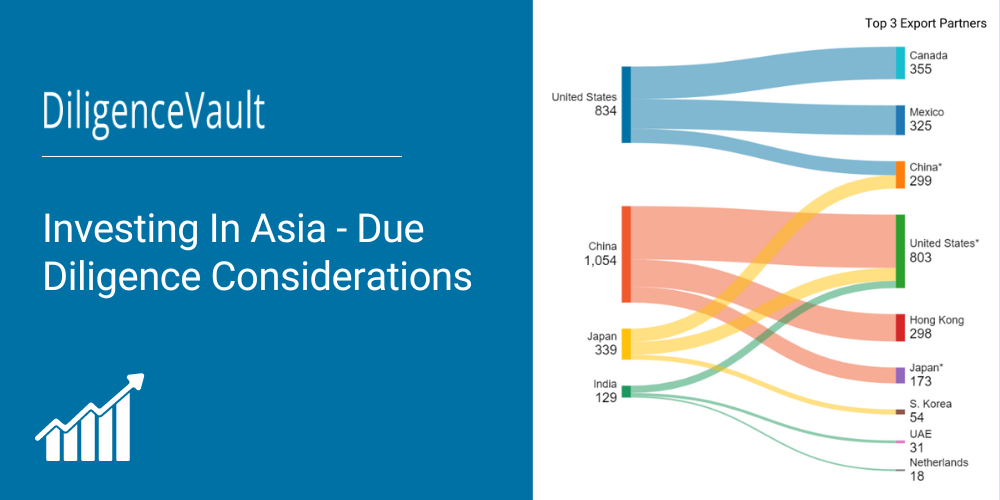

Join us for our upcoming webinar on Investing in China, Japan and India: Due Diligence Best Practices, for an insightful discussion.

Explore the key points around Investing in Asia - from global investor sentiments to portfolio construction and due diligence considerations when investing in Asia

Explore the blog outlining Part I & II of key insights and takeaways for LPs and GPs on Bain & Company Takeaways from Global Private Equity Report 2024.

InvestTech 2024 promises excitement, innovation, and opportunities for those navigating the changing tides of technology and investment management.

Key considerations for private credit diligence include investment strategy, track record evaluation, covenant monitoring and 3 more.

Read about the 10 Generative AI applications for investment, due diligence, and reporting processes at asset and investment management firms. Gain insights into industry sentiment on Gen AI.