Inside the $700 Billion Evergreen Fund Boom: What Investors Really Need to Know

Private markets are evolving, and so are the vehicles investors use to access them. Among the most significant shifts is the rising adoption of evergreen fund structures. These vehicles offer perpetual access to private assets with built-in flexibility for subscriptions and redemptions.

As interest grows from wealth channels, RIAs, and institutional allocators, the need for a specialized due diligence framework to evaluate evergreen funds has never been more critical.

Why Evergreen Funds Are Gaining Traction

Several macro and structural trends are fueling increased demand for evergreen vehicles:

- Access to the illiquidity premium: Wealth investors seek returns traditionally reserved for institutional allocators.

- Reduced volatility: Evergreen funds provide smoother performance profiles relative to public market exposure.

- Portfolio diversification: Evergreen structures may offer diversified exposure without the commitment of a closed-end fund’s lockup.

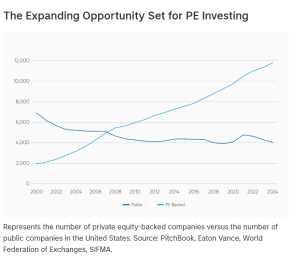

- Longer private company lifecycles: Companies are staying private longer, particularly in high-growth areas like AI and infrastructure, limiting access via public equity.

- The magnificent 7 impact: Meanwhile, public market performance has been increasingly concentrated in the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla), further motivating investors to seek differentiated return sources.

Evergreen vs. Closed-End Fund Structures: Key Differences

| Feature | Evergreen Fund | Closed-End Fund |

| Minimum Investment | $10K – $50K | $250K – $1M, and often higher |

| Fund Term | Perpetual | 8–15 years (with extensions) |

| Structure | Mutual or interval or tender offer fund | Limited partnership, may be unregulated |

| Portfolio Concentration / Capital Deployment | Usually diversified and fully deployed | Usually concentrated and deployed over multiple years |

| Subscriptions | Monthly or quarterly | During new fundraise |

| Redemptions | Periodic redemption windows | At GP discretion or upon exits |

| Distributions | Often reinvested | Upon exits or fund wind-down |

| Performance Metrics | NAV-based compound returns | IRR, TVPI, DPI |

| J-Curve Exposure | May be minimized | Yes |

| Valuation Frequency | Monthly | Quarterly |

| Tax Reporting | 1099 | K-1 |

Innovation in Evergreen Fund Design

Asset managers are adapting the evergreen structure to meet new investor needs:

- Target-date evergreen funds: Designed to align with investor liquidity or retirement horizons

- Multi-manager platforms: Offering curated evergreen access to top-tier managers

- ESG or impact-aligned evergreen strategies: Offering thematic investment strategies for the next generation wealth investors

- Retail-distributed evergreen funds: via feeder and platform access

They are structured as semi-liquid interval funds, tender offer funds, or internal evergreen funds, and may offer an accessible, scalable way to participate in private markets. But with convenience comes complexity, and raises diligence demands for fund selection.

Why Credit and Secondaries Are Viewed as Building Blocks for Evergreen Funds

Certain asset classes fit naturally within evergreen fund structures because they address common liquidity and performance challenges. Credit assets generate immediate yield through regular interest payments, which helps eliminate the typical J-curve seen in private equity and supports ongoing liquidity needs. Their diversified loan portfolios also reduce concentration risk, while active secondary markets in select credit segments provide opportunities for timely exits.

Secondaries complement this by offering immediate diversification across vintage years and managers, shortening the J-curve since assets are already seasoned. The established secondary market networks enhance liquidity and help mitigate risk through broad portfolio diversification. Together, credit and secondaries create a sweet spot for evergreen funds seeking stable cash flows and flexible capital deployment.

How Should LPs and Advisors Diligence Evergreen Funds?

To responsibly evaluate evergreen fund opportunities, investors must:

- Create a thesis for what type of underlying asset exposure is important and what are the return and risk expectations with the evergreen fund allocation?

- Use wealth platforms that support ongoing diligence and portfolio monitoring (e.g., subscription/redemption tracking, performance benchmarking).

- Conduct due diligence themselves with the support of specialist ODD consultants: Review policies on gates, queuing, and redemption timelines, scrutinize valuation and reporting processes: Monthly NAVs require timely, fair, and auditable inputs.

A Purpose-Built Evergreen Fund Due Diligence Checklist

To support allocators and advisors, we’ve created a due diligence checklist tailored specifically to evergreen structures. The framework helps address structural, operational, and alignment-related considerations necessary for evergreen fund reviews.

Key areas include:

- Team experience managing perpetual capital

- Strategy focus (direct vs. secondary, income vs. growth)

- Valuation process and frequency

- Liquidity stress testing and performance impact

- Redemption governance and queue management

- Performance measurement alignment

- Tax and reporting infrastructure

What the Industry Needs Next

For evergreen funds to scale responsibly and protect investor trust, the industry must:

- Establish standardized reporting and operational best practices

- Develop benchmarks and performance comparables across evergreen strategies

- Continuous regulatory clarity

- Embrace technology for scalable and transparent fund operations

Final Word

Evergreen funds offer meaningful advantages, but they require a more nuanced and ongoing diligence approach. Investors who adopt modern evaluation frameworks and ask the right questions will be better positioned to identify high-quality opportunities while avoiding structural and liquidity pitfalls.