7 years of learning, growing and adapting

The vision for DiligenceVault started with a problem set that I had faced as an investment risk professional – solving a diligence problem for investors and asset managers that make an interconnected network, when diligence is manual, analog, and cumbersome for all parties. The vision for a solution was not just a new technology, but also for a network, an ecosystem, a brand new category that we have had the privilege to create – a DDP – a Digital Diligence Platform.

As we mark our seventh anniversary, we’d like to share some of our experiences in creating a DDP:

Start with a network vision where all parties benefit.

The greatest enemy of a weak network is the illusion of it. Whether it’s social networks, or interconnected internet, the history of networks is fascinating. A successful network creates value for all participants and unlocks a behavior that would have been impossible to do unilaterally.

Success is iterative and requires focus

It’s incredibly difficult to create a network. To make it work successfully, it’s important to:

- Build out a strong client success team to manage this transition and making change management a human experience,

- Continuously enhance the technology experience based on user feedback,

- Say no to new client opportunities where the main motivation is not to take advantage of the network

- Focus, focus, focus…but also learn, learn, learn

Successful companies, much like successful people, never stop learning. DV, too, has learned immensely over the years. In our own journey, we sometimes started down a road that, ultimately, we came to realize didn’t fit in with our core network-first vision. Call it “product-drift”.

For instance, in 2016, we were presented with the opportunity of building a whitelisted version of DV. As we were developing it, we realized it would create friction in the network as now managers had to access and maintain their diligence data in two places. Since then, we have turned down two white label and on-prem deployment client engagements.

In another instance, based on user demand, we forayed into the Research Management System / CRM space and realized very quickly that it was a distraction from the core 2-sided digital diligence platform. Instead, now we integrate with CRM and RMS. Sometimes, the lesson learned is not necessarily obvious. When we first started out, the industry viewed us as a startup, unproven, and we faced a lot of rejections for being too small. As we created a category lead, now smaller allocators view us as too big, even though our client focus and our DNA have only gotten stronger as we have become more responsive with experience and resources. Sometimes perception and reality are two different things as we’ve worked very hard to ensure we address the needs of all our users – both big and small.

What we have learned from these experiences is to not overpromise, but maintain focus, and communicate openly with the industry. With focus comes clarity and a steadfast belief in the vision.

Paraphrasing Steve Jobs – if you don’t believe in something, you are not going the extra mile, working the extra weekend, challenging the status quo.

If someone shares your vision, join hands

We are grateful for starting a relationship with our first institutional backer in 2019 – Goldman Sachs – because they bought into our network vision. They were excited about the value of a common diligence platform – a concept of technology and network coming together to challenge the status quo.

Early adopters are visionary, struggling with frictions in the network alongside you. One of our users is a wealth arm of one of the largest global asset managers. They bought into not just the technology to simplify their diligence process, but also our network vision. They were patient as we built the network. Two years into the relationship, now they are receiving digital requests from some of their smallest clients as well as their largest relationships, facilitating their own growth story :).

An equitable network needs architecture and planning

Our vision is to make diligence possible for all, whether you are managing a portfolio of 10 managers or researching 5,000 funds, whether you are an emerging asset manager or managing trillions in AUM.

Every day we make progress in making this a reality. It’s become part of our DNA thanks to our amazing client success team that collects so much feedback from our user community and our responsive product engineering team that delivers value on a weekly basis with a focus on the following:

- Remove dependency from Word and Excel and unlocks digital data exchange

- Humanize collaborative authoring experience between team members

- Create an integrated experience, eliminating copy and paste nightmares

- Deliver on diligence workflow automation efficiency and reduces costly errors

- Establish institutional memory on the platform which is critical for diligence continuity

- Provide intelligence and insights in the diligence process to uncover risk areas and growth opportunities

Further, we fundamentally believe that a weak network creates inequality in the outcome for one side. In a strong network, the advantages for both sides converge and create a win/win. So, we invest in the network as a multiplier that builds on the technology advantages and fundamentally shifts industry’s behavior – for the good:

- Be international about building an architecture that empowers many to many interactions

- Enable institutional memory for responders to reuse responses between disparate requests for a delightful diligence experience

- Provide requestor transparency on a centralized platform across their entire portfolio

- Make firms data-driven and help build the foundation for leveraging AI / ML technology

- Free up bandwidth – helping people develop skills that won’t be replaced by technology

- Energize users who have been used to a certain way of doing things since they joined the workforce – to adopt digital – with the network promise

- Creates partnership opportunities with other tech providers to extend the value proposition for all users

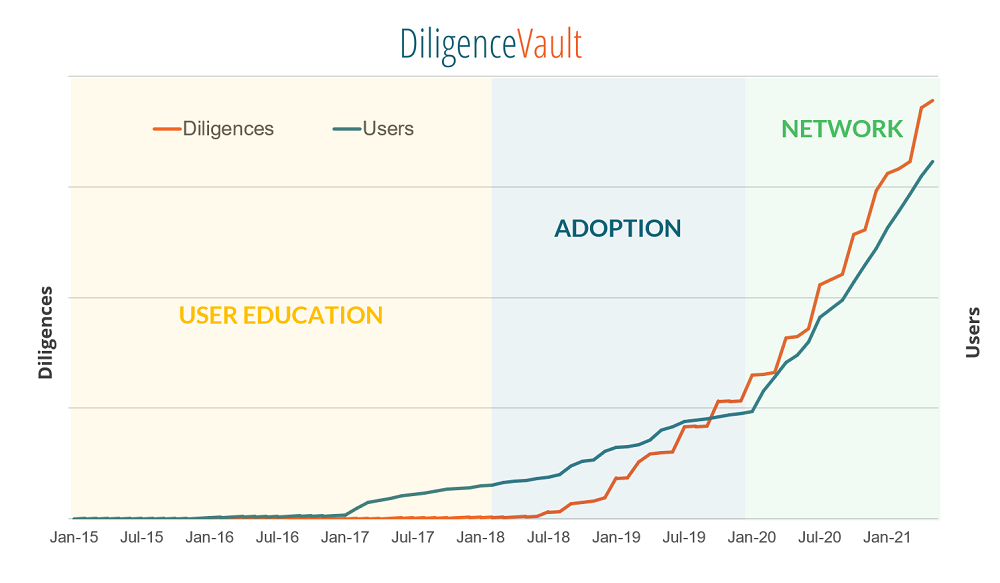

The nature of progress: gradual, then sudden

Today we celebrate a rapid increase in adoption of the platform, not only by active users, but also by user activity. All the hard work of user education, and supporting adoption is now creating a network.

Two very different asset allocator implementations last week saw 91% and 97% manager coverage for a portfolio that had over 150 boutique asset managers and household names. This is the network vision becoming reality. Every new user who joins with the aspiration of making their diligence process easier finds that hope becomes a reality, and we are excited to deliver beyond their expectations!

Also last week, we co-hosted a panel with AIMA – and invited a client, a user, and a non-user to the panel as speakers. Coincidentally, the non-user, a UK-based boutique contrarian manager, received their first DV request on the day of the panel. This is the power of the network we are excited about :).

Because of YOU

Dearest users, if you are part of our diligence ecosystem, you are seeing firsthand the benefits of a network-first mindset, so let’s celebrate the power of the industry’s first and leading ecosystem collectively – all 21,000 of you – as we make diligence possible for all and humanize the diligence process.

No matter how big this network gets from here on, please know that we are here to listen to your feedback, and more importantly, we are here to address your concerns.

Had you not leaned in, we would not be solving the diligence problem collectively! So we are grateful for your adoption, for your feedback, and for your championship of DiligenceVault. Let’s collectively unlock more value for each other and win together as we continue on this journey. Thank you for your role in making the impossible possible!