DiligenceVault hosted two Operational Due Diligence (ODD) Roundtables in New York last week. Attended by industry leaders, both clients and industry friends, the event served as a shared platform to delve into key issues shaping the industry. Here is summary of the pivotal topics that dominated the conversation:

Gen AI – And The Many Ramifications

It was no surprise that a key risk factor identified by the roundtable participants was the use of AI:

- Participants view data security and data confidentiality breach as a material risk factor as asset managers have not blocked the use of ChatGPT or other public Large Language Models (LLM) without adequate monitoring capabilities being put in place.

- Firms would need to put data leak prevention measures in place before enabling use of public LLM. Our CTO brought up the recent move by OpenAI to eliminate login requirements for the free version of ChatGPT, which has the potential to further complicate the data security challenges as the users may not have access to modify their security and privacy settings under this new mode of engagement.

- The risk of exposing internal, client and investment partner intellectual property is significant in the current environment with limited compliance oversight.

- Other risks factors discussed included explainability, false positives as well as model compliance with current and new AI regulations.

- Participants also mentioned the risk of “AI washing” and expected SEC enforcement action related to IP breaches related to use of public LLMs.

Some ODD practitioners are now including new questions on use of Gen AI. At DiligenceVault, we have created a GenAI DDQ for asset managers and service providers as a guidance for our clients.

While the risks were discussed, participants do expect greatest use of Gen AI in the following use cases:

- Chaperoning research calls with expert networks

- Review of financial statements and legal documents

- Summarization of due diligence findings

- Bringing efficiency to vendor assessments

Vendor / Third Party Diligence – Business And Data Security Risks

As the outsourcing trend continues in the asset management industry, the importance of monitoring external vendor relationships is a critical business process for asset managers. A lot of service providers are new and unknown.

Beyond reviewing the operational risks of service providers, ODD teams are partnering with CISOs and security experts to assess the security posture of external service providers. Upcoming regulatory requirements on oversight of external service providers is a key area of focus across the world – SEC in the US, DORA in Europe and APRA in Australia.

Fees – Pass Through Fees – Management Fee

Large private markets GPs continue to get greater allocations from LPs. The bulk of the fee revenue generated by these GPs come from co-investments and secondaries. Most large GPs are publicly listed, so it gives greater transparency into their fee revenue.

The new custody rule will require SMAs to be audited which will result in additional fees charged to SMA investors.

ODD experts indicated their preference for total expense ratio (TER) ratio, and breakdown of operating and non-operating expenses. Firms should consider creating TER benchmarks, but across lifecycle stages especially for private markets funds.

Even with more expenses being passed through to the investors, the transparency and expense breakdown is critical. Some participants were concerned with uncapped pass throughs, and management fee being a profit center. They would like to negotiate annual caps on pass through fees, especially on back office and fees being paid to affiliates.

Participants also noted recent SEC enforcement on misappropriation of management fees as the fee documentation in the LPA is often vague – leading to ruling in favor of the GP.

Conflicts Of Interests

It’s important for firms to have a good compliance culture, and is viewed as a de-risking factor by the ODD teams. The participants discussed existing and emerging conflicts of interests where improved compliance culture can help mitigate risk factors.

- Increasingly seeing CCO / COO and COO/CFO double hatting of roles. Some of these trends could be driven by firms managing expenses, and others could be that the role of the CXO has morphed into oversight as more firms outsource key operational and finance functions.

- More firms are employing family members in key control functions which may jeopardize independence if not structured properly.

- Participants also noted that preferential treatment on co-investments is a potential area of conflict that has been increasing.

- Dual signatories is still a foreign concept at a few firms.

Private Equity Valuation And Continuation Funds

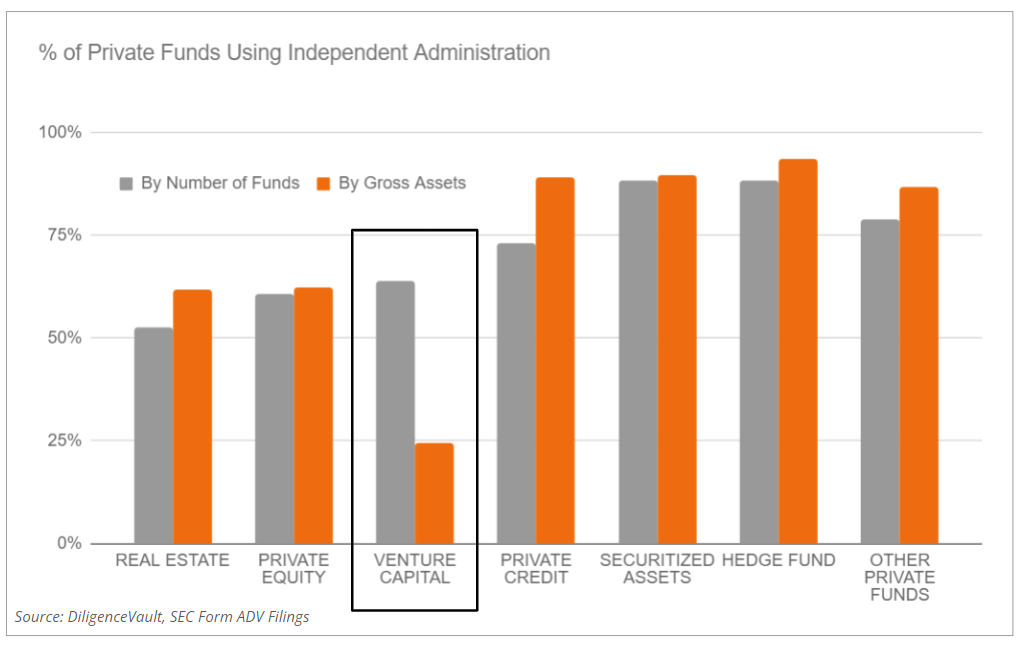

Given the lack of exits, muted deal activity, changing value creation drivers, investors are worried about valuations in the private markets. The roundtable participants expect greater convergence around best practices in the next 24-36 months. Over 60% of private markets firms now use independent administration which is a significant improvement from the prior 24 months. We analyzed ADV filings data to shine light on the use of administrators by fund types to serve as an industry benchmark and highlight potential risks.

Private markets GPs would be expected to institute another best practice around independent third party valuation, especially if the current environment were to extend.

LPs are also observing that GPs are only applying a small haircut when transferring the PortCo assets to a continuation vehicle. Many GPs are maintaining valuation of a PortCo at a last round which may be older than 18 months, which is also another concern for LPs as market dynamics have materially altered.

Onsites Vs. Virtual Diligence

More ODD teams are opting for in-person meetings over virtual ones, particularly when evaluating new manager relationships. It is important to note that roundtable participants were largely from the metro New York area, potentially biasing the results due the ease of meeting more managers in a close proximity. However, there was a unanimous consensus on the overall importance of onsite meetings.

A notable aspect highlighted by participants are the challenges posed by new launches that are entirely remote. However, roundtable participants pointed out that they often rely on the pedigree of the management team and their previous experiences as a mitigating factor for such teams.

New Best Practices Trends

Participants also noted that new best practices are developing, and two discussed include:

- Greater use of veto over governance committee as most institutional investors want to see this control

- Credit check being requested for everyone who has access to cash movement, has trading control, or is in a control position

Diligence Data Intelligence

As more structured data is being captured by allocators, it creates an important intelligence source in benchmarking best practices:

- Offer as a resource to asset managers on market practice

- To negotiate a remediation

- To enhance internal risk assessments and scoring methodology

For instance, the analysis of independent administration using the Form ADV dataset we presented above is an example of such data intelligence, which could help ODD professionals encourage more managers to work with independent administrators.

The All Important People Factor

The ODD is a combination of art and science and ODD experts bring invaluable qualitative aspects to the investment decision process. An onsite is important in offering a gut check and a good avenue to check for the asset managers team’s competency, personality , and how they treat you. Investments are usually multi-year commitments.

Common people and culture related red flags include:

- Control functions having limited authority

- The CIO or portfolio manager joining the ODD onsite meeting

- Observing balance of power in the room with concentration of power with one individual

- Being defensive when weaknesses are brought up

- Citing other institutional clients to defend not having a control

- Limited transparency, as an example around SEC correspondence

- Familial relationships without proper mitigation as brought up earlier

- No evidence of adaptability. Has the firm changed technology stack in a decade?

- Management with limited focus on innovation. Static operating models. Is everything in house and internally built or do they leverage outsourced services or technology?

The Next Roundtable

Stay tuned!

In the meantime, check out the top 9 ODD trends of Q1 2024 from our London Roundtable.