Due diligence technology isn’t just one thing; it can mean different things depending on who you ask. If you were to ask investors and asset allocators, they often refer to a many different tools and platforms. In the context of this blog, we will refer to due diligence technologies that cater to investment programs that invest in external asset managers or have a sub-advised or managed account relationships.

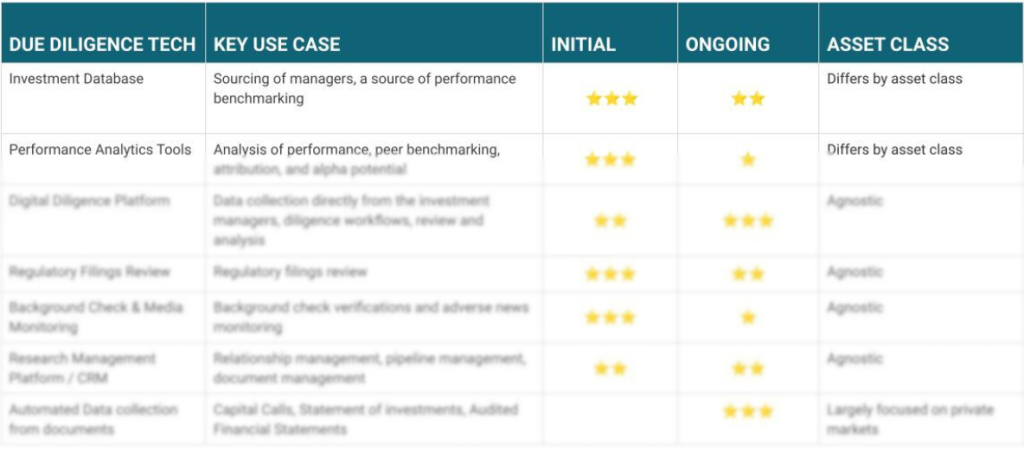

Different Types of Due Diligence Technologies

- Investment Databases: A repository of information on various investment opportunities, usually specific to investor type (wealth vs institutional), or specific to an asset class (traditional, hedge fund, private markets) helping investors assess different options.

- Performance Analytics Tools: Platforms that analyze and visualize investment performance, help with peer benchmarking, provide performance attribution, all in the spirit of aiding in decision-making and strategy development.

- Digital Diligence Platforms: Technologies that streamline and digitize the due diligence data collection and review process, making it a centralized, data-driven experience across all asset classes.

- Regulatory Diligence Technologies: Tools that assist in reviewing regulatory compliance and risk profiles of underlying investments and also ensuring compliance with applicable regulatory requirements.

- Background Check and Media Monitoring Technology Services: Services or tools that help verify backgrounds, monitor news, and track public sentiment regarding potential investments and related stakeholders.

- Research and Document Management Technologies (RMS): Platforms for managing and organizing research materials and documents related to investments.

- Portfolio Management Systems (PMS): Systems that facilitate the management of investment portfolios, tracking performance and making adjustments as necessary.

- Data Extraction Technologies: Services or tools that help extract relevant investment and operational data from fund documents such as capital calls, distribution notices, tax documents, statement of investments, and more.

This showcases how expansive diligence can be depending on stage of the investment, functional stakeholder, thee complexity and data dependencies. For instance, pre-investment due diligence might involve comprehensive research and analysis, while ongoing monitoring would focus on tracking performance and managing risks.

Developing a mental map for investment offices considering incorporating technology into your diligence framework can help you navigate this expansive landscape more effectively. It involves understanding the diverse technology components that are relevant for your investment program and aligning them with the specific needs and stages of the diligence and your investment process.

The Due Diligence Tech Stack

The stars depict the intensity of diligence needs and are not a representation of the importance of diligence technology.

Signup below to download the full Due Diligence Tech Stack 2024.

Getting Started with Tech Adoption

Investors often begin with basic tools like emails, spreadsheets, and platforms like SharePoint, Teams, OneNote, and Shared Drives for handling parts of their diligence work.

When considering purpose-built technology, their focus shifts to:

- Prioritizing Tech Elements: Figuring out what parts of their investment process needs technology first and what would be nice to have but not essential.

- Tech Needs for Different Assets: Recognizing that various asset classes demand different technology capabilities. Some asset classes have easily accessible data, while others require specific data collection tools based on their unique scope and availability of data.

- Data Sources and Data Strategy: The realm of investment research and diligence draws data from multiple sources: databases, data collection from asset managers, asset manager’s service providers, and public domains. The critical quest for investment offices is build technology support for seamless collection and centralization of this information.

- Performance Analytics, and Everything Else: This capability is central to all investors as they decide to build internal models or rely on external capabilities. It’s a crucial facet across all asset classes, necessitating distinct modeling requirements pre-investment and post-investment. Furthermore, the nuances of each asset class demand specialized analytics, emphasizing the need for adaptable models catering to diverse asset-specific analytics.

- Optimizing Data Flows and Workflows: Investment committee members, external auditors, consultants, and internal functional teams spanning investment research, risk assessment, portfolio construction, operational due diligence, sustainable investing, operations, finance, tax, legal, and compliance. Each team operates with distinct processes. However, seamless collaboration is essential as these internal and external units frequently intersect, requiring access to the same information for joint decision-making. Optimizing data flows and workflows, therefore, hinges on technology that not only accommodates diverse processes but also facilitates shared access to critical information, fostering cohesive decision-making across these varied functional domains

- Reporting Capabilities: While the collection, access, and analysis of information is key, ease of creating a seamless reporting framework is equally important for a successful adoption of due diligence technology. Creation of Investment Committee memos, board reporting, internal reporting all takes a significant time commitment from the investment teams, which technology can help make a significant impact.

By understanding these considerations, teams can better tailor their tech choices to the specific needs of different asset classes and stages of the investment process.

What Does Best in Tech Stack Look Like?

Most investors excel at high-value investment activities but grapple with manual processes and data complexities. Their core role is not to build technology, but are astute at assessing ROI and excellence. As a result, many prefer integrated solutions, like those seen in select DiligenceVault client tech stacks (in the image below). This approach frees them to focus on their investment strengths, leveraging seamless, best-in-class tools for informed decisions without tech headaches.

What this infographic also demonstrates is that the demand for a mosaic of cutting-edge technologies in investors’ diligence tech stacks is evident. By adopting an best-in-class tech stack, investment offices can streamline workflows, centralize data, empowering their teams to harness comprehensive, consolidated data, thereby amplifying the efficacy of their decision-making processes.

At DiligenceVault, we’re not just excited; we’re driven by the prospect of contributing to a unified and integrated ecosystem. Our collaboration with peer due diligence technologies underscores our commitment to delivering an unparalleled, cohesive solution for our shared clientele. As we stride into 2024, this connected approach stands as the cornerstone for navigating the ever-evolving landscape of diligence technology.

Interested in learning more about DiligenceVault’s offering and our integration partners? Sign up for a demo here.

For additional resource on the InvestTech tech ecosystem, do checkout our annual infographic.