“One of the most consistent patterns in business is the failure of leading companies to stay at the top of their industries when technologies or markets change.” Quote from a 1995 HBR Article The famous quote from Nokia’s CEO: We Didn’t Do Anything Wrong, But Somehow, We Lost… is a recent reminder.

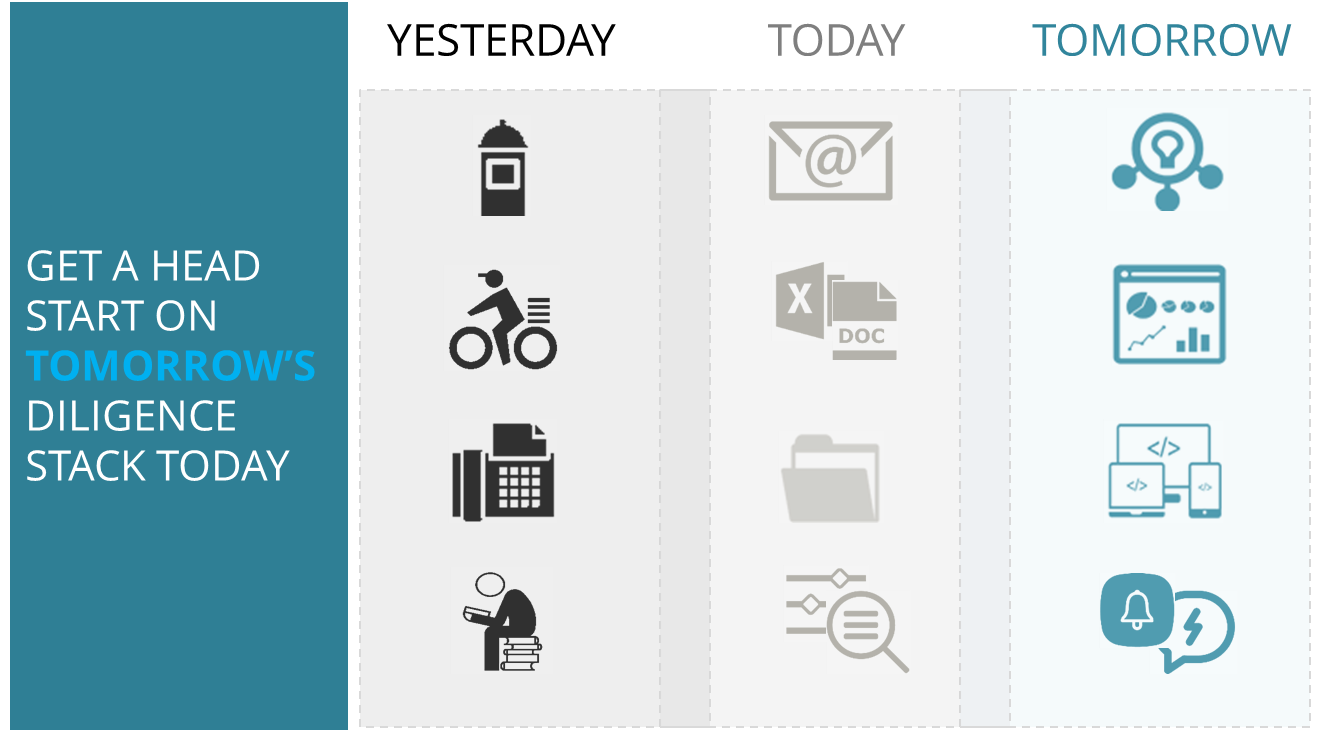

Technologists have long used the terminology of a stack; and these stacks have evolved rapidly, offering exponential possibilities for new functionality, reliability, speed and new behaviors. As a result, technologists constantly make choices between succumbing to the familiar and comfortable, or investing for the future.

Extending the concept of a stack to the fund investing / allocation world, we ask the very same question. What is the diligence stack? Without oversimplifying a complex process, we break it down in to 4 components. And to think about where ones center of gravity lies when evaluating the diligence stack.

Direction of Information Flow:

Is the information pushed by the manager, or is it pulled by the investor?

1.Do you have a bottleneck with respect to managing the information exchange and processing the information?

Types of Information Exchanged

What supports your investment decision making? Track record / manager profiles, questionnaires, documents and policies, or portfolio details?

2.What gives you competitive advantage as an investor? Most comprehensive or right-sized information?

Sources of Information

Who and what are the sources of this information? Almost all investors would leverage most common sources. For the most part, scarcity of resources, time constraints, and competitive boundaries between peer investment firms are the roadblocks which preclude comprehensive adoption of all information sources.

3.Do you have the bandwidth to expand in to non-traditional information sources which offer differentiation?

Uses of Information

How is the information leveraged? And how does it all come together to support a decision is another key component of the stack.

- Initial and pre-investment review to evaluate merit, conflicts, contradictions

- Ongoing monitoring reviews to monitor sentiment shift, risk factor changes and new risks

- Management reports to evaluate investment rigor, and portfolio perspective

- Client reports to demonstrate expertise and diligence

The life span of traditional information is short. The value is diminishing and the outcomes are not memorable, because they often tend to be mundane. The transition from traditional to the blending of information approach which asks more from the data. Is blending a casual collision of information based on chance, or is it driven by deliberate preparation?

4.Are you able to reap the exponential benefit of mixing it all up?

Transforming to the Smart, Connected and Digital Stack

The investment offices of the future, both big and small, must prepare for the new thinking or be left behind. The next generation of investors who are completely comfortable with current generation tech, will start asking the question: what is your diligence stack? And when they start expecting vs. demanding change, then the industry will really begin to change! And the change will not be incremental, but monumental, which will not be a race to the finish line, but a thoughtful, gradual and strategic process.

Automate: Firms will use tech to do check-the-box work, to enable better governance, to eliminate work that is redundant, creating a rich environment were the investment team’s mental faculties take the center stage.

Collaborate/crowd source: Investors will participate in various forums and platforms to have better and faster access to information. An excellent read on this topic: InvestTech and Crowdsourcing Best Ideas co-authored by Arun Muralidhar and Samuel Kunz

Integrate: Technologies will integrate with each other and external information flows within the industry, helping the entire investment process in becoming more agile

Experience: Equipped with the new tools, diligence will cease being a myopic process to uncover issues and weaknesses, and will start to become a new investment experience, which is source of vital information to drive decision making?

Emails and online documents have replaced messengers, faxes and postal mail to exchange diligence information. And texts have replaced phone calls. These trends will continue.

Areas which will matter include the amount of time one has to invest in intellectual curiosity, to deepen relationships where the conversation is not centered around check-the-box discussions, to identify commonalities between the two entities, to understand expectations, and to facilitate a substantive dialogue that creates “win- win” outcomes.

So what is your diligence stack today? And what investments will you be making to enhance the diligence experience of your team, investment partners, clients?