From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

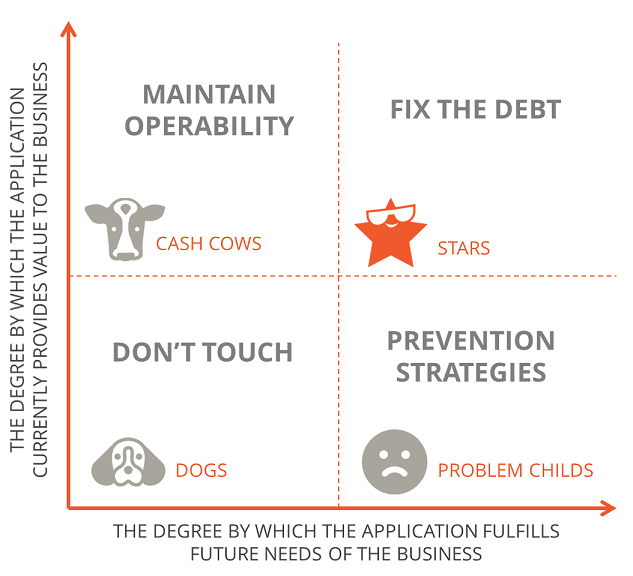

Read MoreTechnical debt is a term coined by Ward Cunningham to describe the...

Digitization and digitalization are accelerating in the asset management industry in response to new growth strategies, differentiation strategies and margin compression.

The skill and experience you amass in an area of professional competency is one thing. Taking that expertise and turning into a strong and successful business is another. In this blog, we review advice from...

Technology and human ingenuity have made wonderful things possible in our personal lives. Whether it is connecting with friends and associates, or finding products and services, there is much more at our fingertips than ever...

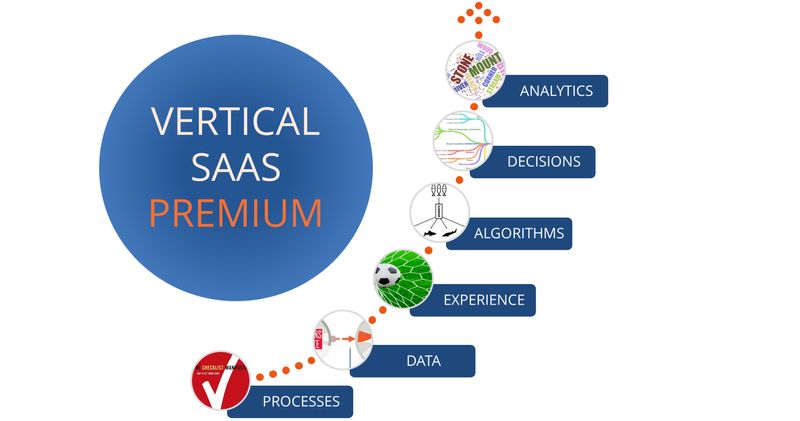

A recent discussion with a tech-savvy prospect has inspired this blog on the economic value of building a vertically integrated SaaS platform. The question asked and answered is "How does DiligenceVault deliver greater value than...

If you are a young professional or the parent of college or college-bound students, you probably know what the Common App is. If you are somewhere outside those cohorts, you may not know, because you...

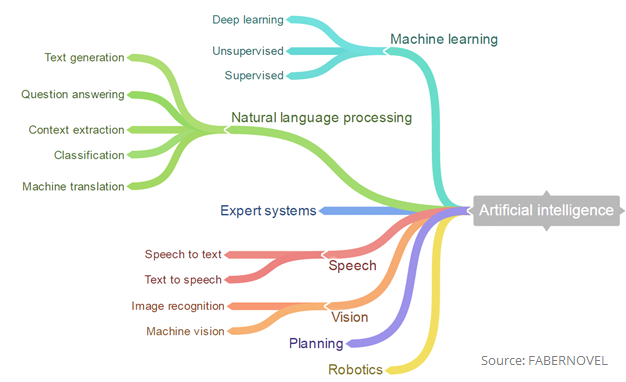

Classification is one of the most instinctive behaviors that humans exhibit. It is also a foundation for all cultural and scientific advancements, be it the taxonomy trees of evolution, Freudian classifications of anxieties and disorders...

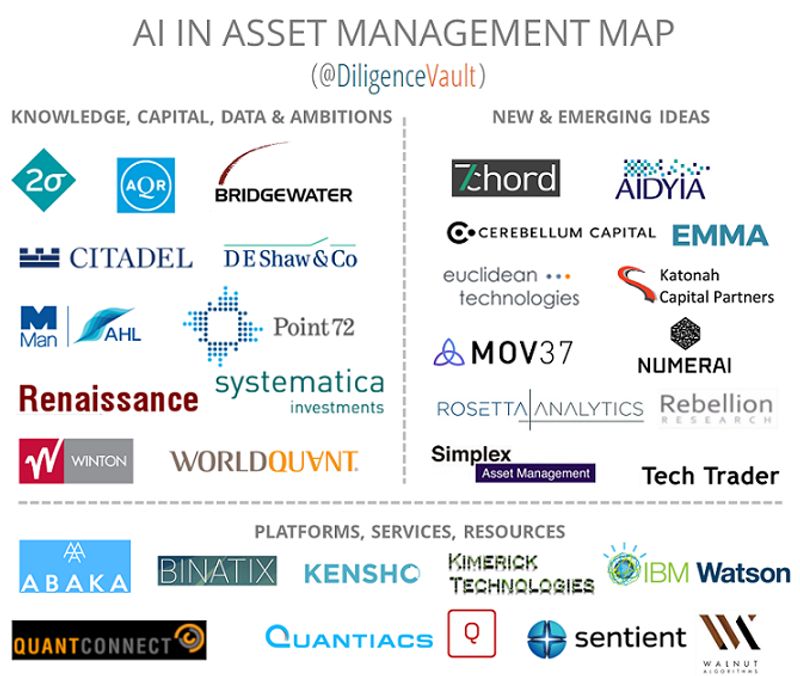

Artificial Intelligence as a locus of investment is very tempting for asset owners. Expectations for AI are lofty,

Atul Gawande’s 2009 book “The Checklist Manifesto: How to Get Things Right” details the author’s search across disciplines for ways to improve process outcomes, looking for techniques that could be applied in his own field...