From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreRead the takeaways and insights from our team who recently attended the GAIM Ops West 2024 in Carlsbad, CA.

Read the takeaways and insights from our team members who recently attended the AIMA Global Investor Forum 2024 in Toronto.

October is Cybersecurity Awareness Month—a great time to strengthen cybersecurity practices. At DiligenceVault, we prioritize proactive protection of your access and information.

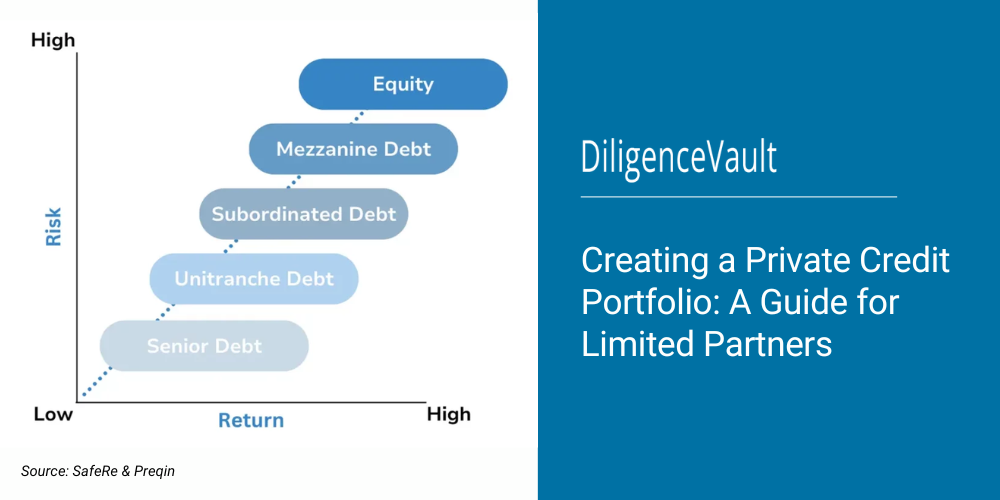

Here's a guide for creating a private credit portfolio, highlighting the key steps and considerations for limited partners.

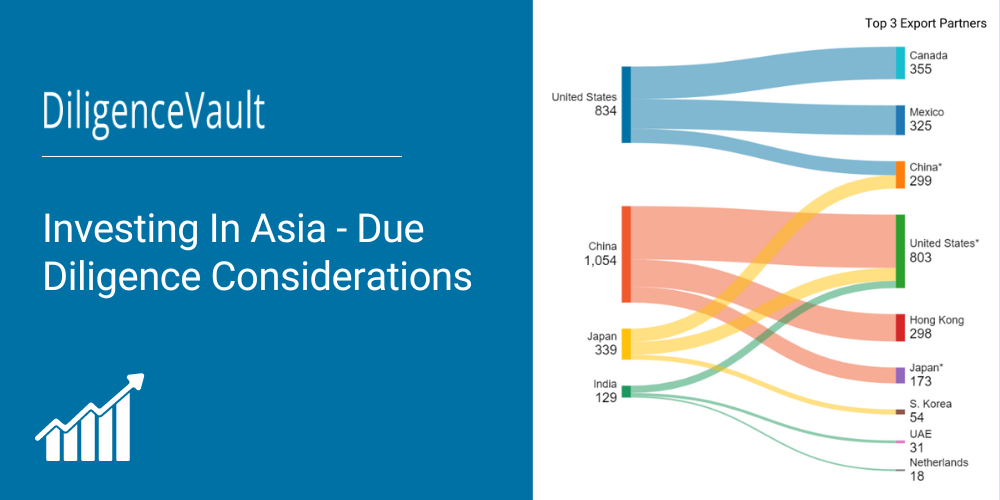

Explore the key points around Investing in Asia - from global investor sentiments to portfolio construction and due diligence considerations when investing in Asia

We share the journey of a leading asset management firm as they adopted DiligenceVault to streamline their Consultant Relations and RFP/DDQ team processes. An Asset Manager’s Journey to Transform Investor Relations

Which are the top industry DDQs? Which ad hoc and market driven events need rapid data collection and surveys? Refer our most recent blog as you build out your due diligence and monitoring program.

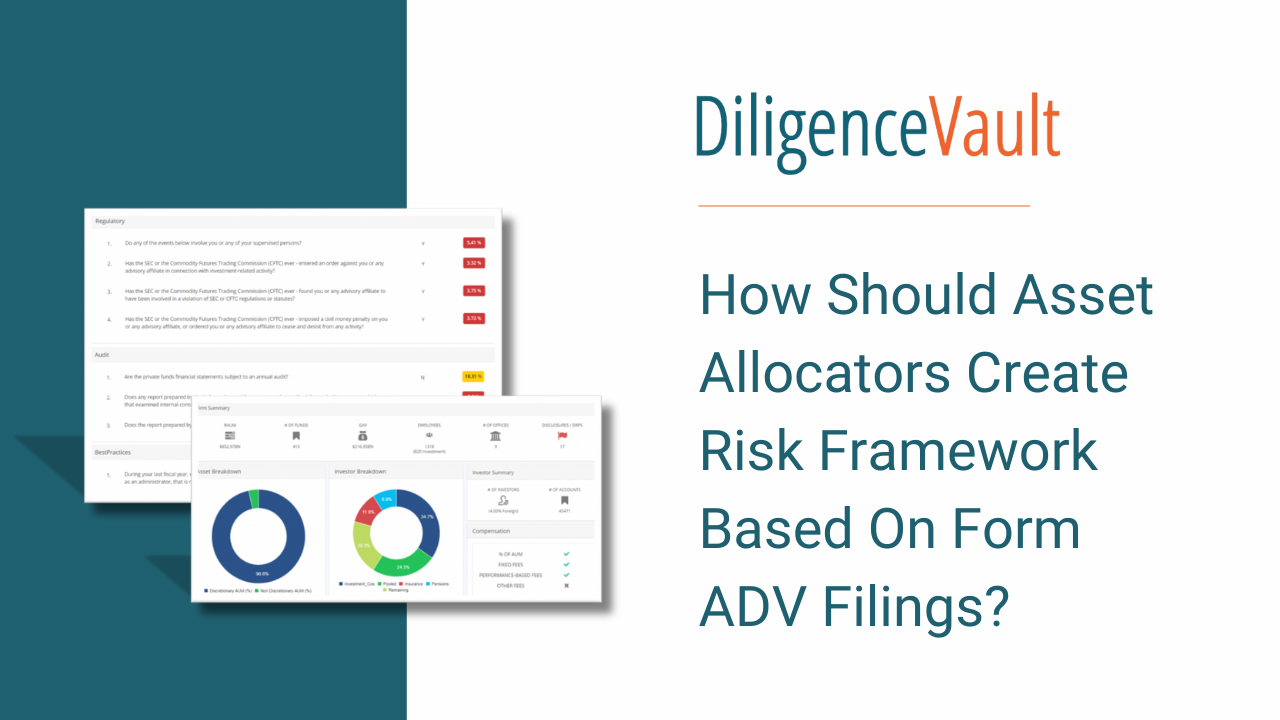

We bring you comprehensive data and insights from Form ADV Filings, helping asset allocators enhance due diligence, improve risk management, and make informed investment decisions. Grasping the nuances of these filings is essential for navigating...

We bring you 5 key takeaways from the Beyond the DDQ Roundtable. The discussion highlighted the importance of advanced tools like DiligenceVault for overcoming challenges, boosting operational efficiency, and strengthening relationships between parties during the...