Private Markets Due Diligence for Wealth Management

In this blog, we share insights into how wealth management firms are building private markets capabilities and what role technology plays in their strategy.

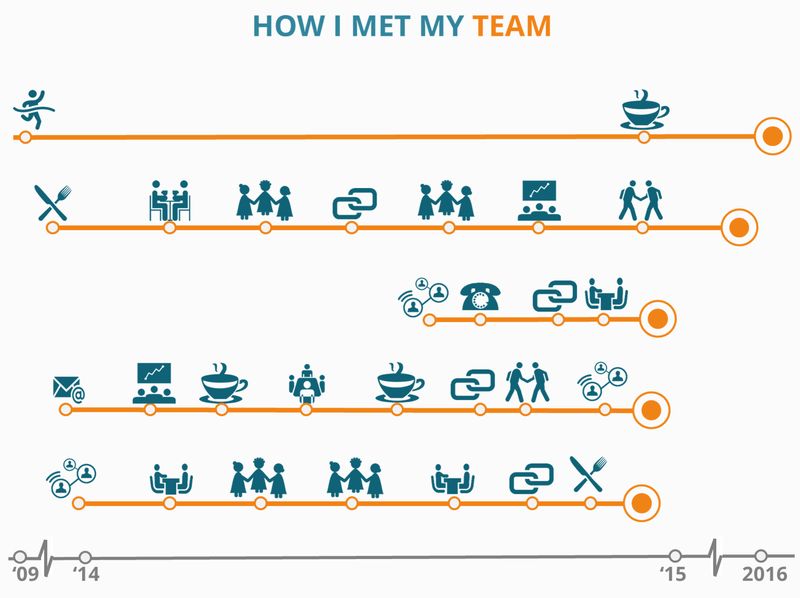

Read MoreMuch like Ted Mosby's trials and tribulations in How I Met Your Mother, it's both fun and inspiring to sit down and draw up an info graphic in a single dimension that lays out the...

The book review on 'The Due Diligence in the Second Machine Age' is contrasted with the adoption of due diligence technology in the asset management sector.

A summertime reflection on active and hedge fund investing, especially on the back of recent headlines covering large institutional investors exiting the hedge fund space, in addition to the investor narrative regarding fees and performance....

We Didn’t Do Anything Wrong, But Somehow, We Lost…. Nokia’s smartphone division was recently acquired by Microsoft..

Investor Town What does a day at an end investor or an investment consultant who hires external managers look like? **Susan Lee (CIO):** Any ideas on what managers we should be looking at to add...

Why do we rate funds? Rating investment managers is a mechanism that attempts to normalize an otherwise complex research process using a combination of quantitative and qualitative techniques. In our day-to-day life we are constantly...

In a world of negative yields, oil price roller coasters, European bank weakness, and intra-day volatility resulting from global interconnectedness, it is natural to want to add a loss floor, minimize return volatility, or both....

Why is cybersecurity important? Here are a few not so fun, but revealing facts about cybersecurity (credited to Verizon 2015 Data Breach Investigation Report: Did you know that it takes approximately 205 days between intrusion...

This post extends Hansi Mehrotra's original post in CFA Enterprising Investor Blog focused on Mutual Fund Research The time taken by institutional investors to research an investment manager may very well exceed the actual investment...