It’s 2025, and the year presents a unique opportunity for asset, wealth, and investment management firms to capitalize on new industry trends and tech innovations.

- Private market valuations are measured, and tech firms are prioritizing profitability and retention over unsustainable growth strategies.

- Building and deploying technology is now easier than ever.

- Buyers are excited to adopt tech and are ambitious about the impact of AI.

For investors in this space, it’s a prime entry point. And if you’re a user looking to expand your tech stack, there are plenty of exciting options. Essentially, the stars are aligning. But when they do, there’s always the question: “What if things go wrong?”

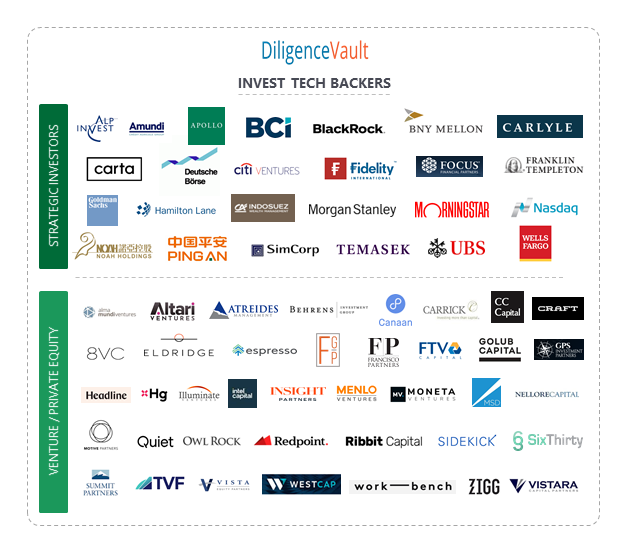

Let’s explore these transformative and skeptical trends further in DiligenceVault‘s 2025 refresh of the InvestTech map – our 9th iteration.

1. The InvestTech Transformation

The industry has witnessed new private markets, regtech and AI-first tech launches, horizontal AI firms developing expertise in financial services, and several AI solutions that enhance the analysis of VDR data and legal documents.

Mergers and acquisitions (M&A) continue to shape the landscape, with BlackRock acquiring Preqin, Morningstar acquiring Lumonic and DealX, and numerous firms announcing new partnerships and integrations.

Check Out the Latest Map Below That Captures Some of These Transformations:

If your firm name is missing, please email marketing@diligencevault.com for inclusion.

2. Vertical AI: Tailored Intelligence for Smarter Investment Decisions

One of the most exciting developments in 2025 is the rise of Vertical AI – artificial intelligence systems designed specifically for niche investment verticals. This technology brings new levels of intelligence and automation, seamlessly integrating into users’ existing workflows, automating repetitive tasks, and uncovering insights more rapidly. This drives substantial improvements in front, middle, and back-office decision-making.

For example, a Vertical AI agent for private equity LPs may track complex deal flows, analyze track record, and identify key portfolio trends, helping them make faster, more informed decisions. Meanwhile, a regulatory-focused AI agent might analyze thousands of data points, offering regulation-specific recommendations in seconds.

With such transformative potential, user expectations are high. The “AI Magic Button” is the dream for users tired of tedious tasks, searching for information, and navigating complex processes. Some of these AI Magic Button outcomes include:

- Analyzing all diligence information across VDRs, shared drives, call notes, and emails to create an investment committee recommendation.

- Reviewing new launches and existing managers in the private credit segment, predicting which managers will outperform in the 2025-2027 market cycle.

- Completing a bespoke, multi-functional DDQ with 100% accuracy.

While these expectations may be challenging to deliver at scale today, they illustrate the user imagination necessary to drive future transformation. In the near term, expect more tech platforms to introduce agent-like or copilot functionalities, assisting in decision-making by guiding users through data streams and suggesting actionable strategies.

3. Private Markets: Changing the Landscape for Investors

Private markets have long been an institutional allocation, but today they are accessible to wealth management channels. New investment vehicles, such as tokenized assets and decentralized finance (DeFi) solutions, are providing broader access to private equity, venture capital, and real estate investments.

This trend opens up three new opportunities for InvestTech firms.

- The InvestTech firms can now create solutions to support product creation, ensure compliance with investor protection regulations, and navigate the complexities of distributing assets to new mass channels.

- InvestTech can also help financial advisors and RIAs enable better risk assessments, more accurate valuations, improved investor education for this new asset class, and accelerate client onboarding and reporting.

- Last but not least, private markets GPs still rely heavily on Excel, with over 70% of processes remaining file based. There is rapid innovation in tools designed to streamline operations for private market GPs and unlock data potential.

Allocators are also participating in this innovation by investing in these InvestTech firms as direct or co-investments or via funds.

4. Outcome-Based User Experience: Bridging the Gap Between Complexity and Simplicity

As InvestTech platforms become increasingly complex, delivering a seamless and intuitive user experience focused on outcomes will be critical. Engagement with over 70,000 DiligenceVault users in more than 100 countries has shown that users demand not only powerful tools but ones that are easy to navigate, integrate with their workflows, and deliver tangible results.

Whether it’s a private markets LP managing a complex portfolio of co-investments, a wealth manager evaluating various asset classes, or an asset manager RFP team responding to hundreds of investor requests, the focus must be on delivering an outcome-based user experience.

InvestTech buyers are moving away from a “toolbox” mindset – where each piece of tech addresses a specific function – and toward a results-driven mindset, where technology is expected to solve specific business challenges at scale. Hurray! A shift which will be welcomed by scale players of the InvestTech ecosystem!!

5. Regulation in the Era of Disruption: Keeping Up with Changing Rules

Regulators are increasingly focused on creating frameworks that support new innovations. For private markets, regulatory compliance is a new area as their offerings reach the mainstream. Regulatory bodies are working to address transparency, investor protection, and market integrity concerns. Firms are also keeping a close watch on AI regulations and the responsible use of AI.

ESG remains a significant area of focus, with regulatory changes shaping long-term decision-making. Notable recent developments include:

- The EU’s first Omnibus proposal, which consolidates several sustainability directives across Corporate Sustainability Due Diligence Directive (CSDDD), Corporate Sustainability Reporting Directive (CSRD), and the Delegated Acts of the EU Taxonomy.

- Australia’s new Sustainability Reporting Standards, which require climate-related disclosures.

Regulatory clarity will provide stability, helping to build trust. InvestTech tools can deliver solutions to simplify data access, reporting, and reduce the risk of errors, while maintaining good governance and audit trails for the clients who need to comply with these.

6. A Fragmented Industry Calls for a Universal Solution

The InvestTech ecosystem is still fragmented, with diverse firm types, firm sizes, use cases, and jurisdictions. There’s no single solution that covers all aspects of the front-to-back workflow for every firm type. For a bold transformation, InvestTech will likely need to integrate two or more of the following approaches:

- Connected Tech: Creating interconnected platforms that share data seamlessly is vital for a unified experience. Firms will be able to choose the best tools while ensuring compatibility with the broader ecosystem.

- Centralized Ecosystem: A centralized and global platform where asset managers, allocators, and their service providers could connect, and exchange information and access key insights could radically streamline operations and foster collaboration across the industry.

- Data Standards and Portability: Converging on data standards and enabling portability will address information silos. For instance, imagine if all fund audited financial statements (AFS) were available in structured formats rather than PDFs, or if legal documents followed standardized templates, or if allocators agreed on what’s inside a DDQ 80% of the time. This would significantly reduce friction in the industry.

A universal solution would be a game-changing moment for the industry, creating tremendous value for users, tech firms, and investors alike, and at DiligenceVault we are excited to be playing a part in all the three areas.

7. The D and E Focus: Technology Alone Isn’t Enough

Modern tech has made it easier than ever to build and deploy technology products, resulting in a constant stream of new tech products entering the market. In 2025, the key to standing out is focusing on distribution (D) and excellence (E).

InvestTech firms that prioritize building tools that genuinely meet user needs and solve specific problems will rise to the top. Technology is only effective when it is both functional and user-friendly. Users are looking for platforms that offer not just features, but tangible, actionable outcomes and that integrate seamlessly into their workflows.

Another key driver of success will also be distribution. The fragmented nature of the industry means that the cost of client acquisition will be very high. In addition, InvestTech tools are often sold, not bought. Therefore, firms must develop scalable distribution strategies and partnerships to create success at scale.

Are You InvestTech Ready?

InvestTech in 2025 is an exciting and rapidly evolving space. Vertical AI, accelerating integration trends, new opportunities in private markets, outcome-based user experience, and evolving regulations are necessary ingredients that drive tech adoption. While the industry remains fragmented, solutions are emerging to bridge these gaps.

For firms in the ecosystem – whether you’re backing innovation or advising on tech transformation – the future is bright.

In 2025, the question is no longer whether InvestTech will transform asset and wealth management -it’s how quickly you can adapt to these changes and make them work for you. The road ahead is full of promise, and with the right tools and strategies, allocators and InvestTechs can capitalize on this transformation.

Thank you Team DiligenceVault, our clients, industry influencers, and friends for your review in refreshing the 2025 InvestTech map. If you’d like to add your firm to any of the InvestTech, Investor & Backer, or Database & Consultants maps, please email marketing@diligencevault.com.

Do read about our InvestTech musings since 2017 :).

2024: InvestTech in 2024 – Setting the Stage for A Thriller

2023: 2023 a Year of Thinking Big and Bold

2022: InvestTech Moments in 2022

2021: The Age of InvestTech

2020: Top 10 Creators of InvestTech Unicorn

2019: And The Next InvestTech Unicorn Is…

2018: The Rise of Integrated InvestTech

2017: Who Defines the Future of InvestTech