ESG has transitioned in asset allocator’s view as a value driver and not just a risk management exercise. Sustainable investments totaled $35.3 trillion, which is equivalent to around a third of assets under management in major economies, at the start of 2020, according to a report published by the Global Sustainable Investment Alliance. This reflects a 15% increase between 2018 and 2020. EY predicts ESG-friendly flows to grow to $53 trillion by 2025.

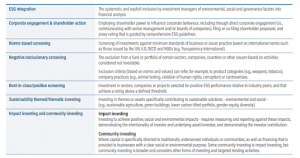

As this trend deepens, both asset managers and asset allocators are adopting one or more of seven core approaches to Sustainable Investing. These can be corporate engagement and shareholder action via proxy voting, norms-based screening, negative or exclusionary screening, best-in-class or positive screening, a sustainability theme or impact, and community investing as sustainable.

Source: GSI Alliance

The asset allocator leaders in the sustainable investing space need to document their processes, access the right information from their asset managers in a consistent format to align with their approach to sustainable investing, but also to minimize the risk of green-washing which is becoming an increasing concern. Oftentimes, these diligence data points and information are not readily available in a structured and consistent format which makes taking an analytical approach to identifying asset manager leaders and followers a resource-intensive exercise.

Viewed from the asset manager’s perspective, the increasing interest and demand from asset allocators present the following challenges and opportunities:

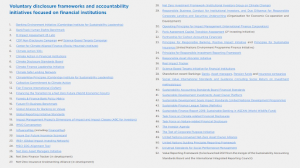

Lack of widely accepted measurement frameworks and metrics. Per World Benchmarking Alliance, over 50 voluntary disclosure frameworks, regulatory guidance, and regulatory requirements have emerged. This remains a significant struggle for asset managers, especially the ones who are embracing ESG for the first time. Identifying a set of disclosure frameworks, and a set of metrics that aligns with their investment mandate is a significant initiative and continues to be a challenge given the variability in the frameworks.

Source: World Benchmark Alliance

Demand for seasoned ESG talent. The continued focus on ESG integration and net-zero pledges across the industry has certainly caused an escalation in demand for seasoned ESG talent. From corporates to traditional fund managers and private equity firms, the hiring for ESG talent is not only to drive value creation in their portfolios but also to create a differentiated experience for investors and to prepare for imminent ESG regulations. However, the supply of talent remains constrained.

The difference in expectations from asset allocators. Per Capstone’s recent survey of 140 LPs, European asset allocators focus on environmental concerns, North American asset allocators focus on social concerns including DEI, and APAC asset allocators view governance as a key area of focus.

Bespoke information requests from asset allocators. The same type of information is being requested by multiple stakeholders in a slightly different way from asset managers. What’s more, the volume of these requests has also been rapidly increasing. Both of these factors create a significant burden for asset managers in sustainable investing reporting for the ESG talent, and risk distraction from actually applying sustainable investing principles in their own investment and diligence activities. On the other hand, there are industry standards that are evolving which would help bring standardization in the industry and alleviate some of these pain points:

- AIMA – Albourne Diversity and Inclusion questionnaire is based on the section of the ILPA DDQ published in September 2018 and has been supplemented by input from Albourne and AIMA as well as institutional investors and fund managers.

- Diversity Project is an initiative by UK-based asset owners and investment consultants to drive standardization in the collection of D&I data from asset managers.

- InvestEurope DDQ is a framework and questionnaires for private markets GPs to engage with portfolio companies.

- ILPA DDQ has a section and questions on the topic, and the ILPA Diversity in Action initiative brings together limited partners and general partners who share a commitment to advancing diversity, equity, and inclusion in the private equity industry.

- PRI’s LP Responsible Investment DDQ aims to understand and evaluate a General Partner’s (GP) processes for integrating material environmental, social, and governance (ESG) factors into their investment practices and to understand where responsibility for doing so lies.

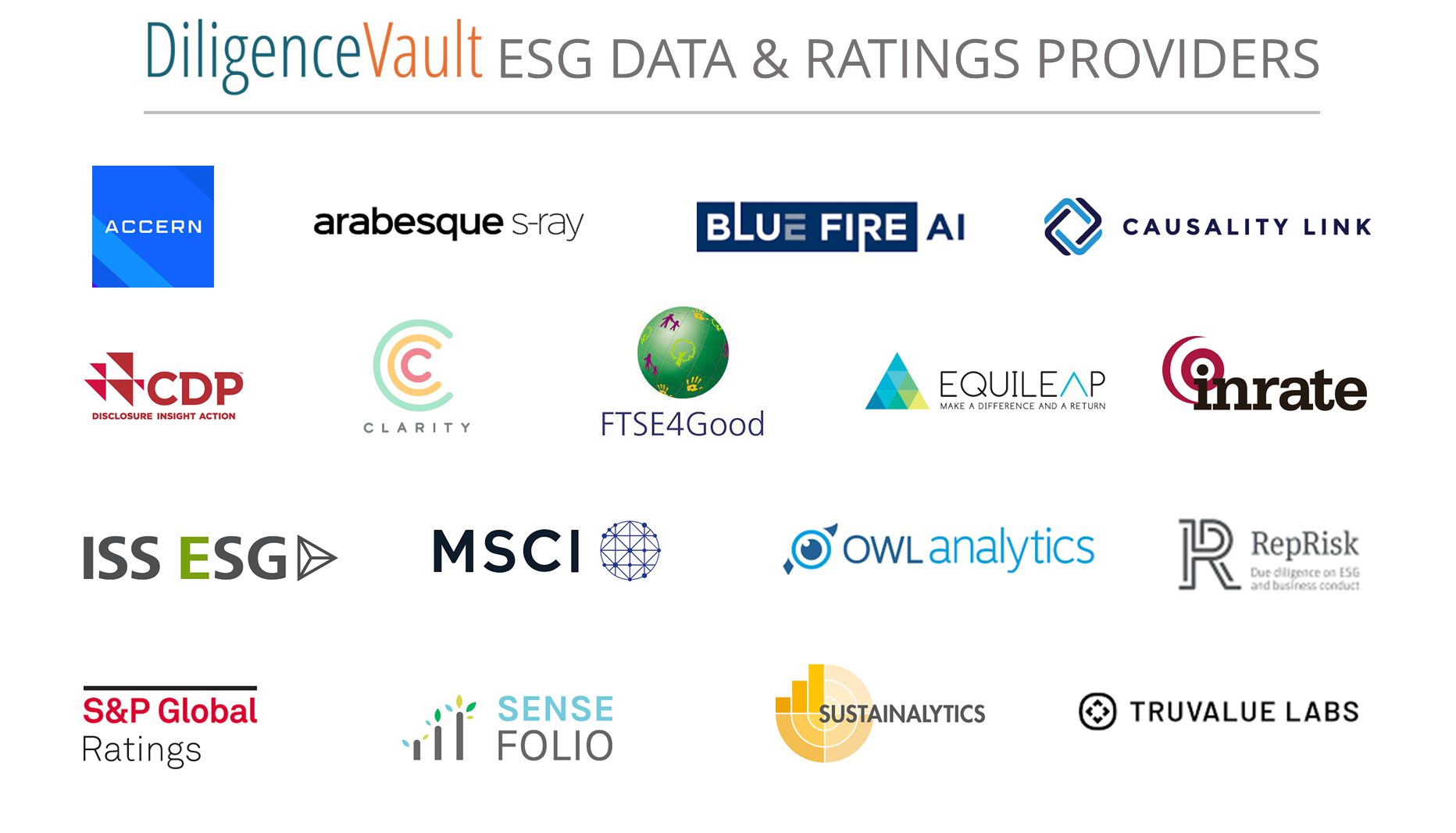

Accessing the right ESG data and ratings.With the explosion in interest in data around ESG, asset managers are now faced with multiple options around data, technology, and rating providers and it has become clear that finding the right fit takes considerable diligence and time.

Further, given this is a new and evolving landscape, we have seen asset allocators spend time on the use of external data and ratings as an additional area of diligence. Common diligence questions include – How do these data sources help with the identification of investment opportunities, the diligence of investments, or monitoring and measurement of sustainable investing framework? How do these impact the research cost burden?

The role of regulations. There have been calls to bring maturity to ESG disclosures, similar to what has been done for financial reporting not only to demonstrate the measurable impact of various ESG investments but also to minimize the increased risk around green-washing. The regulatory response across the world has seen a differing approach. Although a number of ESG disclosure standards have been developed and some have been incorporated into mandatory reporting regimes by non-U.S. regulators, any implementation by a U.S. company of an ESG disclosure framework remains voluntary at this time.

In its ‘Business Plan 2021/22’, the FCA outlined a strategy to “promote integrity” in the sustainable investing market by extending regulatory oversight to ESG service providers, including data and rating providers.

Increasing use of LP opt-out provisions.While opt-outs allow investors to be excused from a select investment if it falls within a restricted category, it certainly adds operational and legal complexity in product structuring as well as may introduce conflicts with different investors having different restrictions.

The ESG data story for asset allocators

The above developments and what paths asset managers take in response to the increased interest necessitates that asset allocators develop a defensible diligence framework. Over the past 18 months, at DiligenceVault, we have seen a significant shift in priorities in driving structure, consistency, and powering access to the right information around three sets of data and key criteria for determining asset manager’s sustainable investing credentials:

- Integration assessment: How asset allocators can diligence the extent to which sustainable investing practice is integrated into the asset managers’ investment process? What questions to ask to evaluate what sustainable investing elements are being deployed, what are the team’s ESG credentials, what disclosure and reporting frameworks are being leveraged, are they ready for the current and imminent regulatory reporting requirements?

- DEI commitment: The diversity and inclusion profile of the asset managers themselves and how their thinking is evolving in line with their commitment to various social and governance goals. Common questions here include both quantitative and qualitative elements around the alignments, demographics splits of the team based on function, compensation, and future growth plans. The industry has started to converge on standards as seen in the various DDQs which are being published.

- The sustainable investing impact: Increasingly asset allocators are requesting impact metrics and KPIs around portfolio of investments for both the public and private markets. How is the impact measures? What goals does it align with? What are the known gaps and what efforts can be put in place to develop portfolio-wide assessments?

Each of the above three diligence areas requires sophisticated data sets which are not readily available from databases or public filings and have to be directly sourced from asset managers and their portfolio companies. As a result, technology that provides connectivity to asset managers plays a critical role. While there is much more work to be done to drive meaningful efficiencies in creating a sustainable diligence process for all parties involved, the tremendous opportunity presented by the emergence of disclosure frameworks that become guideposts, the regulatory and industry coalition to drive standardization, and the role of data and technology that deliver transparency and decision analytics is significant.

Please share your thoughts, your priorities, and resources by commenting, or reaching out to us at ask@diligencevault.com.