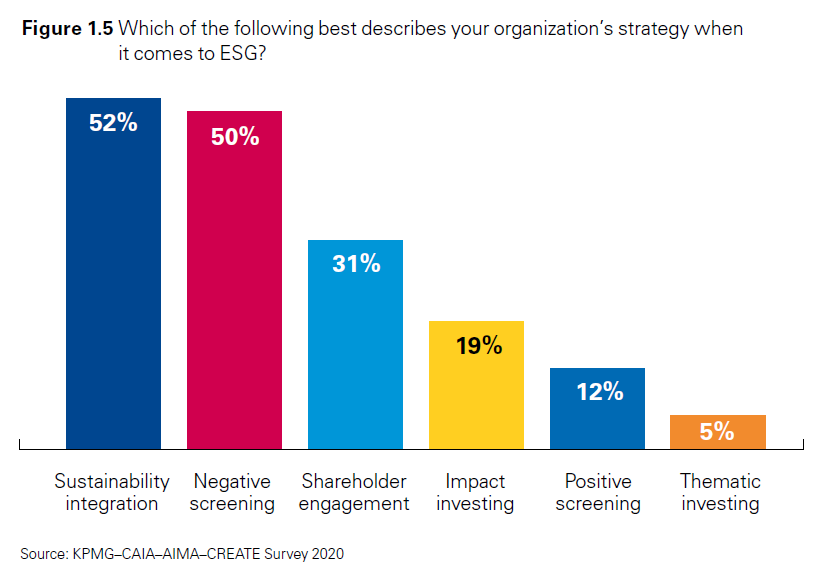

By now, it’s pretty well established that ESG investing by asset owners and allocators is no passing fad. All signs point to an only increasing importance to include ESG criteria...

Bringing you an insightful view about alternatives manager research through the lens of industry standard DDQs,

Our recent article in AsianInvestor, Leveraging Technology to Power Alternatives Manager Research, discusses the importance of manager due diligence when...

The digital diligence platform (DDP) is a foundational tool for an asset allocator or investor. At DiligenceVault, we think it's an exciting category in the industry! It's more than one...

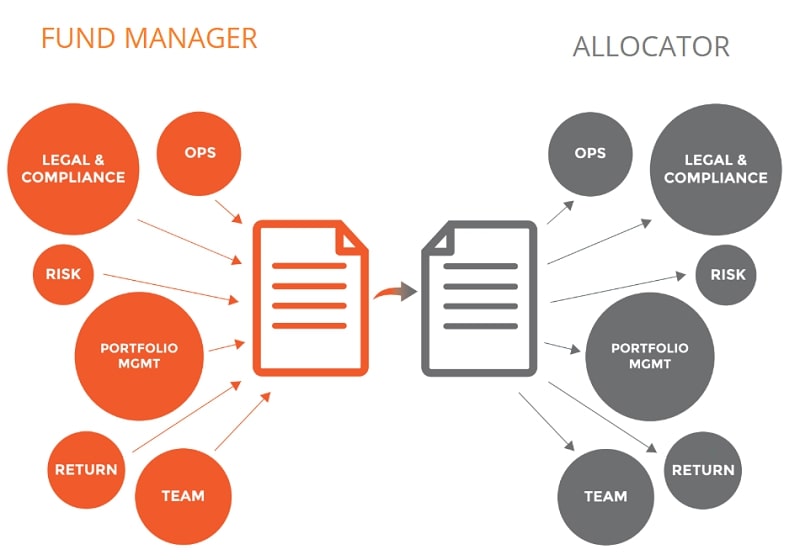

Is diligence similar to dating? Think about it: Two parties meet, exchange information, and make a decision to commit or not. Similarly, a type of diligence occurs when a person...

Sustainable investing, ESG integration, and impact investing all have their own distinct meanings but one thing rings true – it is a pre-requisite knowledge for the investors of the future...

AI's potential: Speedier decisions, deeper analytics, and a transformed future through successful AI-driven digitization.

The investment management industry runs on data. Organizations build their businesses around carefully constructed, disciplined processes of collecting and analyzing information that are designed..

This post extends Hansi Mehrotra's original post in CFA Enterprising Investor Blog focused on Mutual Fund Research The time taken by institutional investors to research an investment manager may very...