Sustainable investing, ESG integration, and impact investing all have their own distinct meanings but one thing rings true – it is a pre-requisite knowledge for the investors of the future as it is capturing the focus of the entire ecosystem including investors, asset managers, and stakeholders.

1. No Longer Niche: There are over 3,000 Principles for Responsible Investing (PRI) signatories globally, and new members in the past four years alone account for 56% of total signatories. The Institutional Investors Group on Climate Change (IIGCC) has over 230 members with a combined AUM of USD ~$33tn. 75% of global institutional and retail investors invest at least a quarter of their portfolios in accordance to ESG principles.

2. On the Rise: The Global Impact Investing Network (GIIN) 2020 survey had 294 respondents with USD $404bn of impact assets, and nearly 90% believe that the impact investing market will be growing steadily or is about to take off.

3. Opportunities Across Asset Classes: While impact investing opportunities are available across almost all asset classes, but private debt, public equity, and private equity are the investor’s favored allocations in this sector. Behind public equity, real assets are the second fastest growing impact investing asset class.

4. Performance vs. Expectation Stays True: As a result of the Covid-19 pandemic, investors expect impact investing to weather this downturn as investors are more confident in their impact performance than their financial performance.

5. ESG Going Mainstream: Per the Callan Institute, ESG is being incorporated into Defined Contribution (DC) plans, with an estimated 36% of DC plans featuring an ESG integrated option in the plan lineup. ESG thematic investing in DC plans is also gaining traction with nearly 20% incorporating an ESG thematic option.

6. Demand from Multiple Investor Types: In Hedge Fund investing, institutional investor demand for ESG investing is leading the way. 44% of institutional investors go a step further and base their investments in ESG hedge funds with the view that they offer opportunities to generate alpha, while also offering a more defensive portfolio by looking beyond the blind spots as markets are slow to price in ESG risks. In response, hedge fund managers are deploying ESG factors to target three goals: alpha returns, beta returns, and risk management.

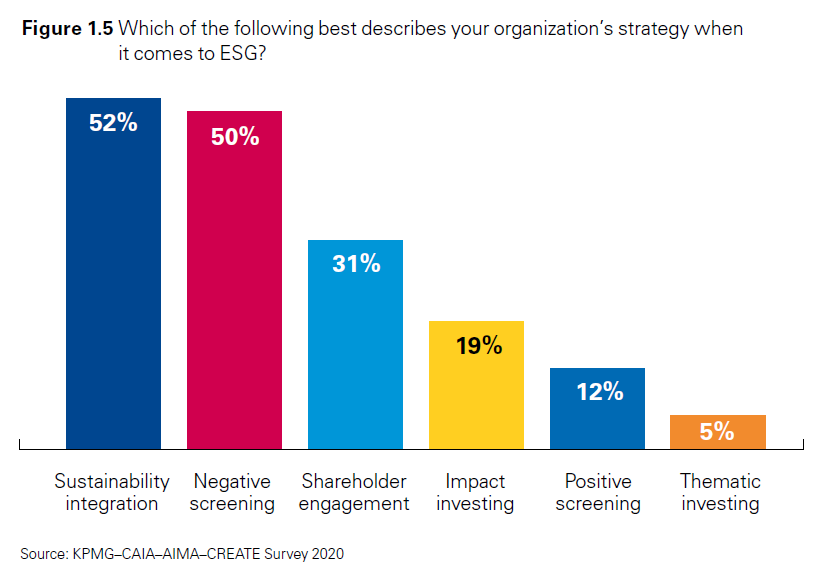

7. Hedge Fund Managers Take Action: Sustainability integration, negative screening and shareholder engagement are the three most common approaches taken in hedge fund strategies.

8. Nordics and Netherlands Lead the Way: Per E&Y, ESG adoption is comparatively common in the Netherlands and Nordic countries. One recent study showed that 90% of Dutch pension funds have adopted some elements of ESG investing. Many of these investors are also craving more ESG data, especially Norway’s SWF.

9. Demand for Action Continues: With all the momentum, investors still believe that the PE industry fails to take climate change seriously. More than three-quarters of LPs based in Asia-Pacific, 65% of investors in Europe and 47% of North American LPs hold this view.

10. ESG to ESGD: Progress, although not enough, has been made to incorporate Environment, Social and Governance into investment decision making – but what about expanding it to include Diversity? The research already exists on how it makes good business sense to include underrepresented people.

DiligenceVault’s next webinar brings together two leading responsible investors from the US and Western Europe as they share their journey as responsible investors in a discussion moderated by a leading investment consultant. Join us for this webinar!

Dewi Sylander, PKA

As PKA’s Deputy Executive Director, Ms. Dylander is a Head of Sustainable Investments (ESG) and the Investment Secretariat where she works with integrating ESG in investments, exercising active ownership and optimizing the business through sustainable investments. Ms. Dylander is responsible for climate related issues and implementing the UN SDG’s. In addition, Ms. Dylander ensures long-term value creation through an increased focus on implementing ESG factors as core elements in the investment strategy, policies and guidelines. Prior to working in PKA Ms. Dylander was the Executive Legal Director of ATP, worked as Head of Department at the Danish Financial Authority and was the Danish Climate Change Negociator.

PKA is a Danish pension plan which is one of the most distinctive voices on sustainability with focus on green investments. The fund targets 10% of its $40 billion assets under management in alternative ESG investments and an increasing portion of that is now invested in emerging markets via allocations to green bonds, infrastructure, microfinance, water sanitation, and a specific SDG fund.

Jake Barnett, Wespath Investment Institute

Jake joined Wespath in January 2020. As a manager of Sustainable Investment Services for Wespath and its subsidiaries’ investment programs, Jake is responsible for the strategic development and implementation of plans to integrate environmental, social and governance (ESG) factors into capital markets investing to promote a more sustainable investment future. He identifies engagement opportunities that seek to promote more sustainable business practices that align with the values of the United Methodist Church’s. Previously Jake was an institutional consultant at Morgan Stanley’s GraystoneConsulting where he focused on engagement with faith-based and impact-oriented institutional investors. He also co-chairs the Catholic Impact Investing Collaborative, an organization that helps faith-based investors invest their portfolios in impactful ways.

Wespath Institutional Investment manages the largest reporting faith-based pension fund in the world and uses a framework for sustainable investing that’s focused on performance with the benefit of impact.

- Ethical exclusions

- Active ownership with focus on public policy and corporate engagement, proxy voting, effective management of sustainability risk

- Strategic partnerships

- Positive impact investments

- Manager ESG integration due diligence

Source: https://www.wespath.com/assets/1/7/5298.pdf

Michelle Perry, Aksia

Michelle is a Director on the Operational Due Diligence Team at Aksia and performs and manages the operational reviews of alternative investments. Michelle is also Aksia’s ESG and Sustainability Officer and is responsible for enhancing and developing Aksia’s ESG integration initiative as well as internal sustainability efforts. Prior to joining Aksia, Michelle was the Head of Operational Due Diligence on the Alternative Investments team at Santander. Before joining Santander, Michelle held various roles within Deloitte’s global offices, including as Audit Manager with the financial services (Cape Town, South Africa and Sydney, Australia) and Executive with the transaction services division (London, UK). Michelle graduated from the University of Cape Town with a BS in Finance with honors and has a Postgraduate Diploma in Accounting. Michelle is a Chartered Accountant.

Aksia provides specialist alternative investment research and portfolio advisory solutions to institutional investors. Aksia advises on over $150 billion of client alternative allocations and represents experienced pension plans, insurance companies, government-related institutions, endowments, foundations and superannuation funds.