In our latest webinar on #SVBResponse - 'Due Diligence During A Stress Event', we discussed views on the Silicon Valley Bank crisis event, potential impact on future diligence approaches and much more.

Access the takeaways from a webinar hosted by DiligenceVault and CIO Magazine, where our expert panelists discuss the various trends, insights and best practices of operational due diligence in 2022 and beyond.

A webinar where our expert panelists discuss the various trends, insights and best practices of manager research and operational due diligence in 2021 and beyond.

A webinar hosted by AIMA and DiligenceVault's discuss how a demand for data, new technology and the increasingly important role of due diligence are driving the modernization of investor/manager communications.

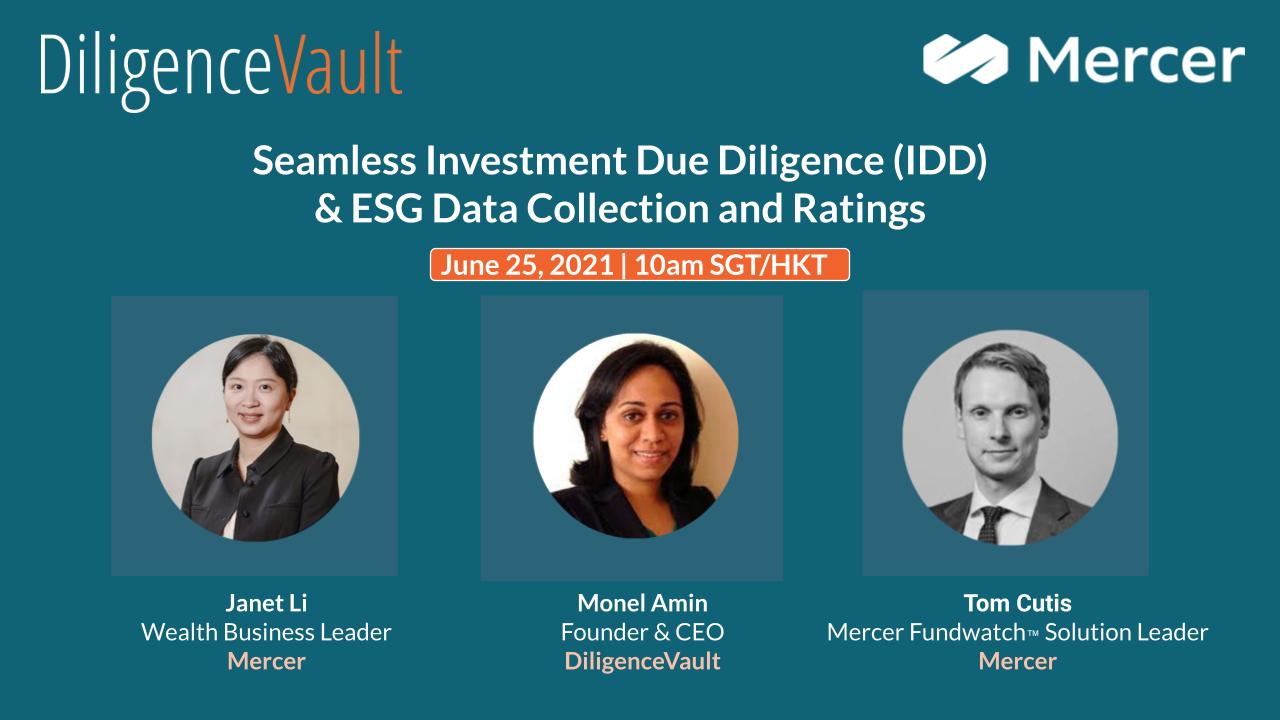

Join us to hear how you can modernise IDD and ESG data collection and forward-looking research via DiligenceVault and Mercer FundWatch

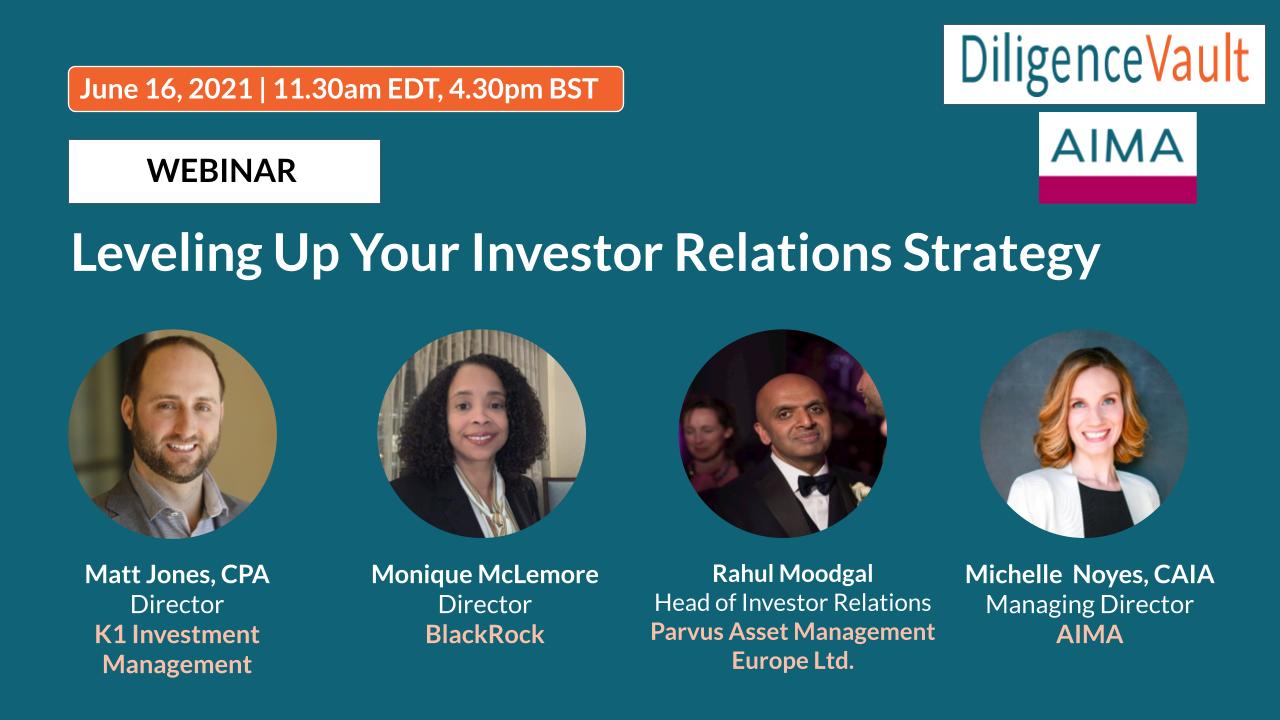

Join AIMA and DiligenceVault for a webinar on how a demand for data, new technology and increasingly sophisticated allocators are driving a modernization of asset management investor relations.

Access webinar replay to see how integration between FactSet RMS and DIligenceVault streamlines diligence of external managers for asset allocators

Our expert panelist from AZ PSPRS Trust, ILPA, and Bostwick Capital discusses the anatomy of a DDQ, the structure and the process of DDQ management, industry vs. custom DDQs and much more.

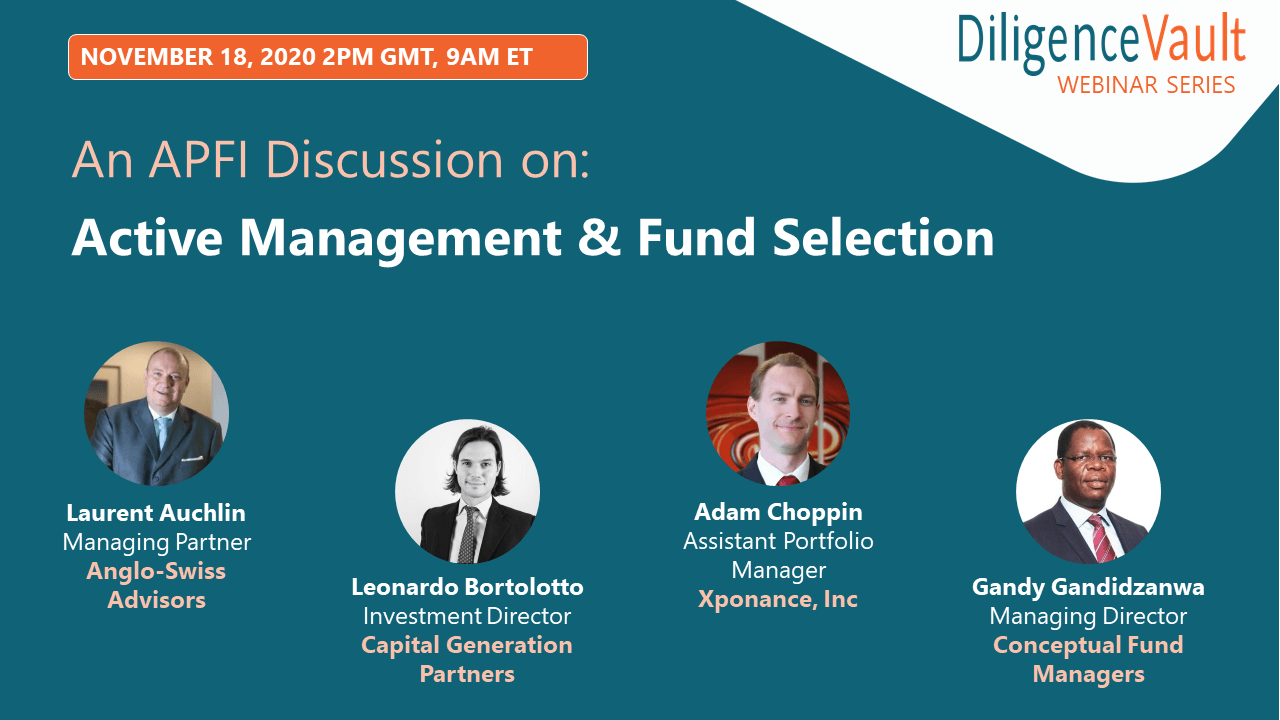

Our expert panelists from Anglo-Swiss Advisors, Capital Generation Partners, Xponance Inc and Conceptual Fund Managers, discusses Active Management & Fund Selection, and more.