Private Markets Due Diligence for Wealth Management

In this blog, we share insights into how wealth management firms are building private markets capabilities and what role technology plays in their strategy.

Read MoreIn this blog, discover how to elevate your experience using DiligenceVault's data integration strategy.

Key insights from PEI Investor Relations, Marketing and Communications conference in London, highlighting top of mind topics for investor relations, client solutions and capital formation professionals.

Create a dependable, centralized RFP/DDQ knowledge hub for asset managers to seamlessly repurpose content across diverse reporting needs, spanning both Word and Excel platforms.

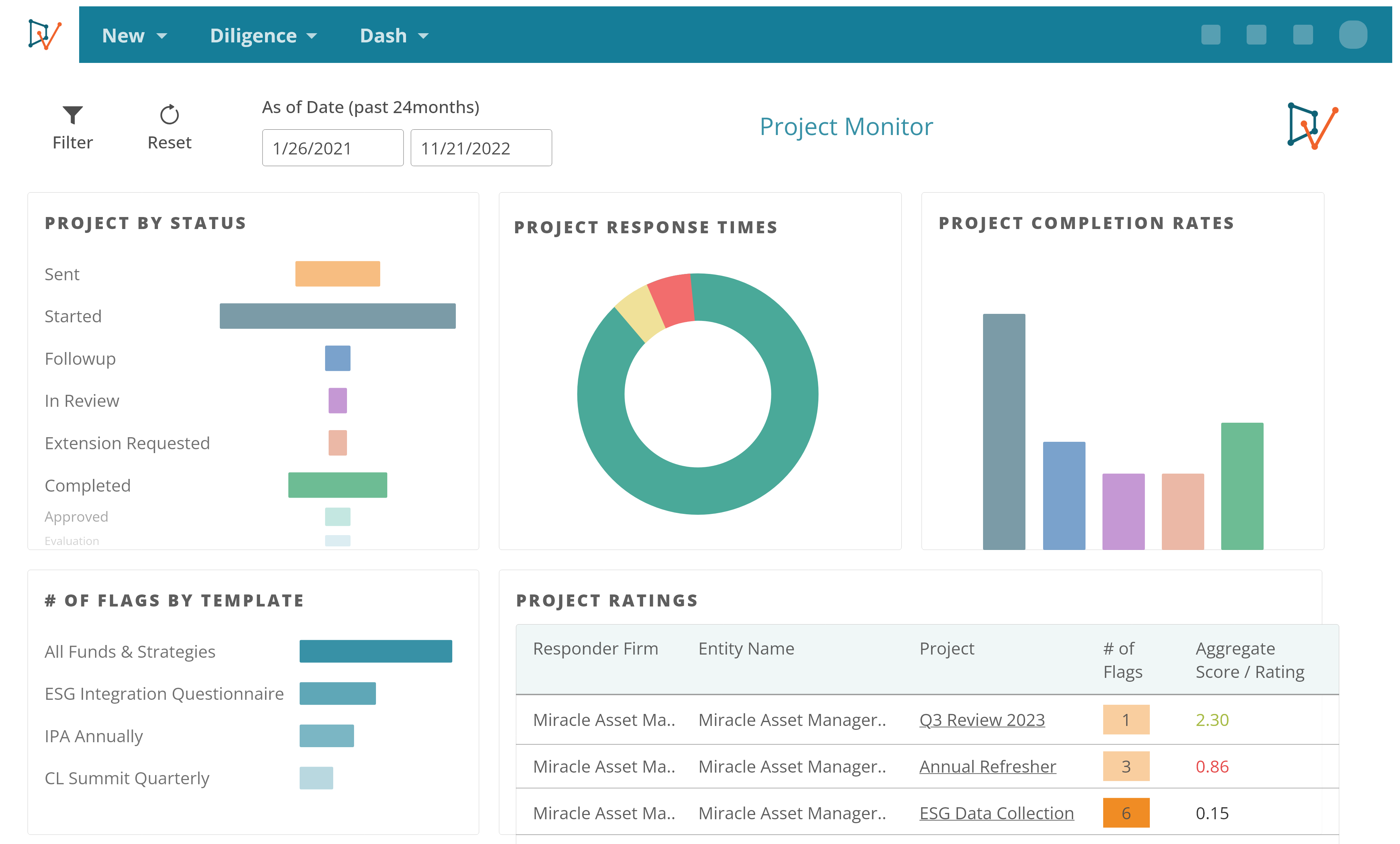

Unleash the hidden potential of data with DiligenceVault's Power BI dashboards, enabling data-driven decisions with customized insights and seamless exportability for enhanced analytics.

Are you ready to manage the new risk dimensions and complexity, and scale your diligence framework? Learn more about how DiligenceVault Navigating Asset Management M&A: Due Diligence Considerations and Trends

How are the US, UK, Australian, and Dutch pension allocators making private equity investments in response to markets, industry structural changes, and reforms?

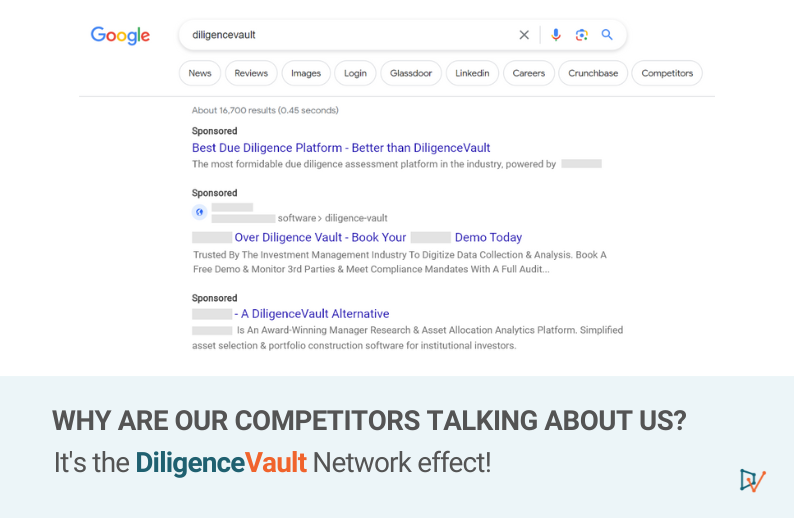

Wondering who DiligenceVault’s competitors are? Learn about how they're validating DV's market position and value through their marketing strategy.

The first part of our Generative AI series covers the opportunities and risk, the second part discusses Gen AI applications for asset allocators and asset managers, and the last part would be Gen AI applications...

In our latest article, we share insights into how wealth management firms are building private markets capabilities and what role technology plays in their strategy