From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreRead about leveraging Gen AI for asset management, investor relations, and capital formation teams. This insightful read explores how these advanced technologies can optimize operations, enhance decision-making, and drive strategic growth in the financial sector.

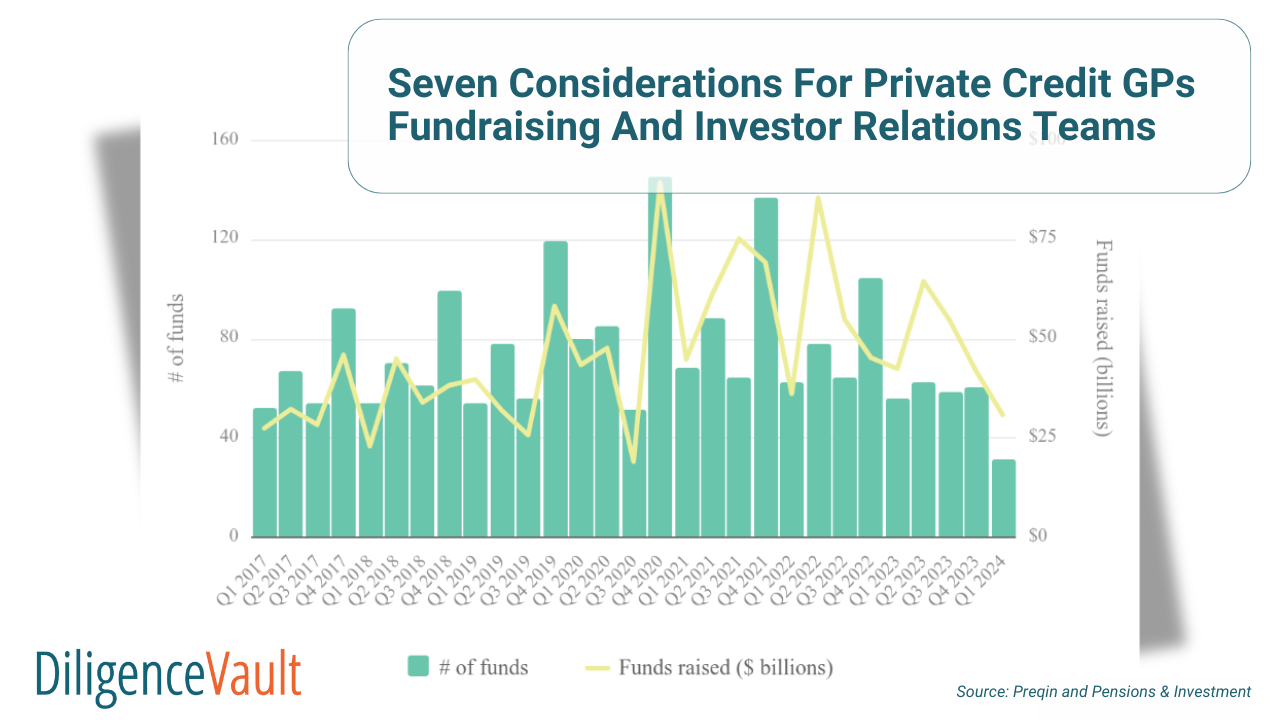

Read strategic insights for private credit General Partners (GPs) on fundraising and managing investor relations, focusing on seven key areas essential for building successful relationships with Limited Partners (LPs) and securing investments.

Review the implications of the Digital Operational Resilience Act (DORA), an EU regulation aimed at strengthening IT security within financial institutions.

We bring you the key takeaways from meeting with our asset allocator and asset manager clients at the GaimOps Cayman Conference 2024.

Read about the key insights from PEI IR, Marketing and Communications Forum NYC 2024, which focuses on the best practices and trends impacting the Investor Relations landscape in 2024.

Read about the top 9 trends in Operational Due Diligence (ODD) from Q2 2024, as discussed with industry peers at our latest NYC Roundtable.

Discover insights on fundraising strategies tailored for Private Equity in the blog. Delve into it for invaluable information!

Explore the blog outlining Part I & II of key insights and takeaways for LPs and GPs on Bain & Company Takeaways from Global Private Equity Report 2024.

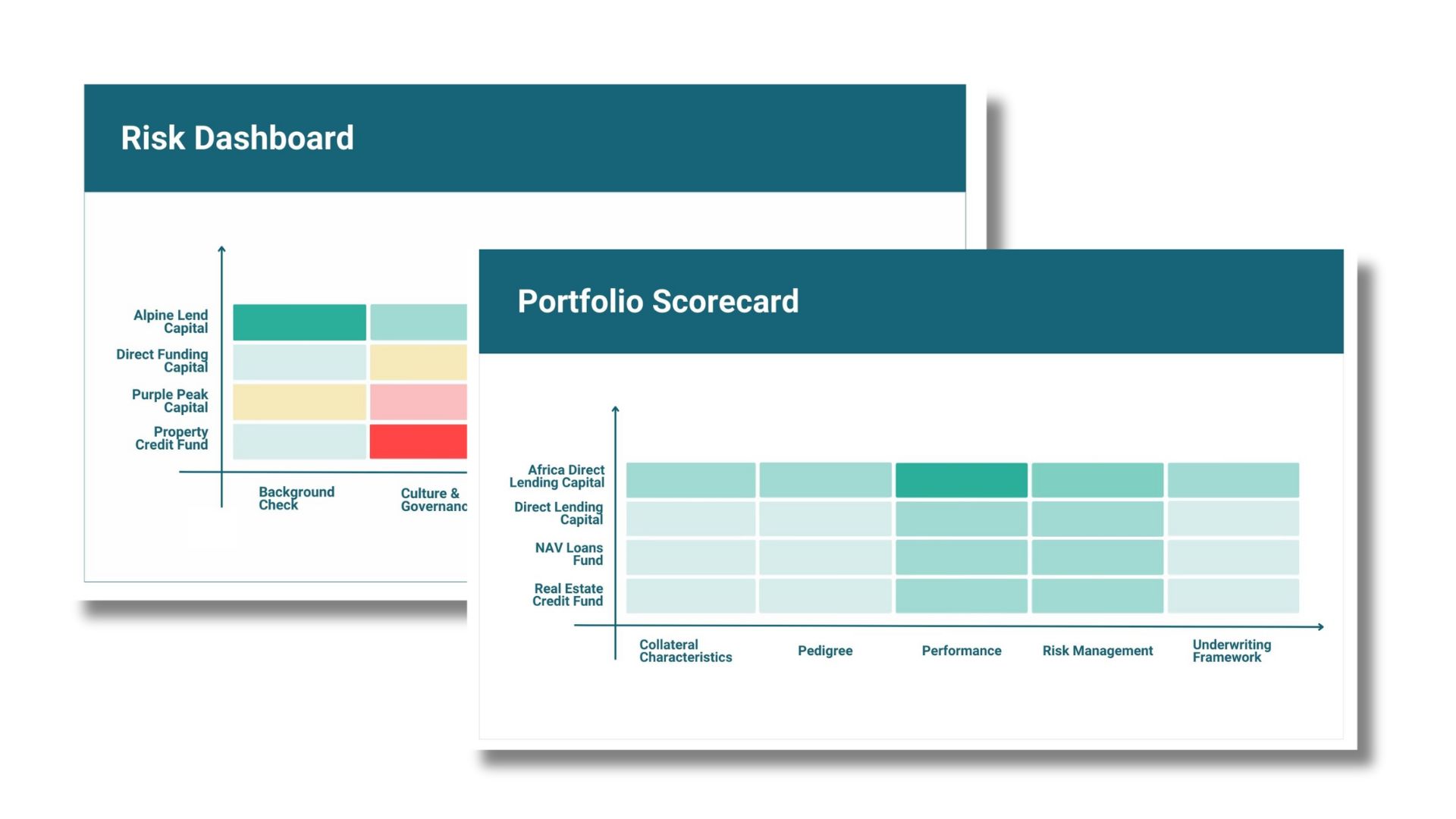

The five key use cases and best practices for building a tailored assessment framework, driving informed investment strategies, and fostering resilience over time.