From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreAt DiligenceVault, we celebrate the work of the diligence professionals that we have had the pleasure of building relationships with over the years.

Explore our latest guide that breaks down how DDQs, RFIs, RFPs, 15(c), and event-driven diligence differ in purpose, risk, and governance and why treating them interchangeably creates operational and regulatory exposure.

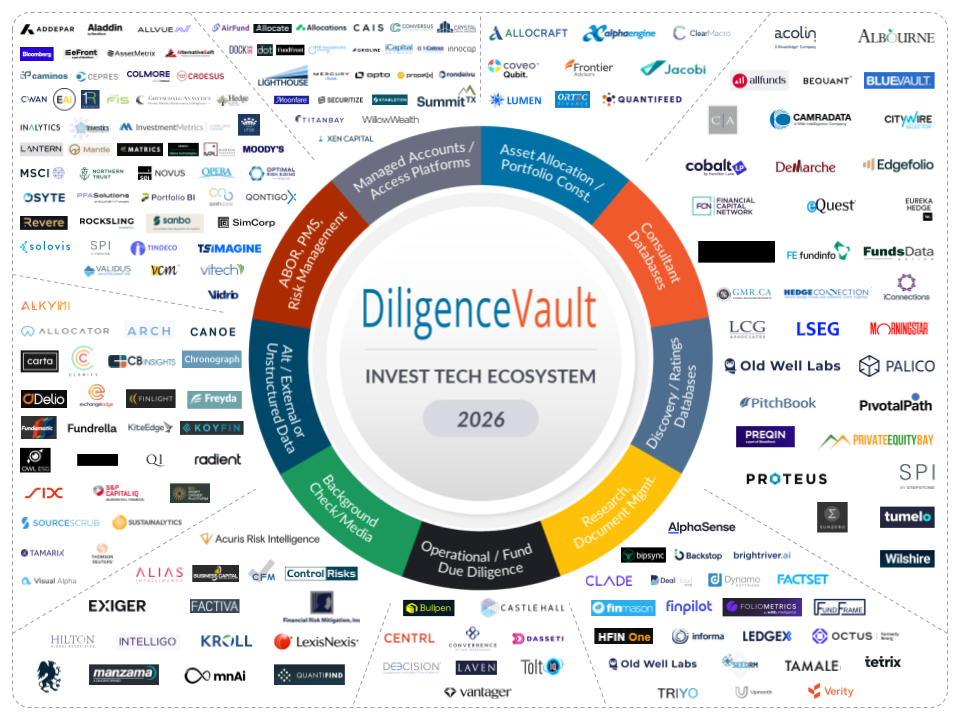

Read our blog InvestTech 2026 to discover how AI has revealed the intelligence debt embedded in investment workflows, highlighting why durable systems determine how intelligence compounds over time.

DiligenceVault’s AI journey started with a simple question: what if everyone could use AI like a pro? This is how we embedded AI into daily work and turned real workflows into scalable solutions.

Explore a 2026 reality check for allocators and asset managers. From ghosting and soft no’s to AI overload and relationship blind spots, this guide outlines what both sides should commit to and what to leave...

Explore how Australian wrap platforms are evolving through technology, ratings, evergreen funds, and alternative investments to support adviser-led growth in the $800B+ wealth management market.

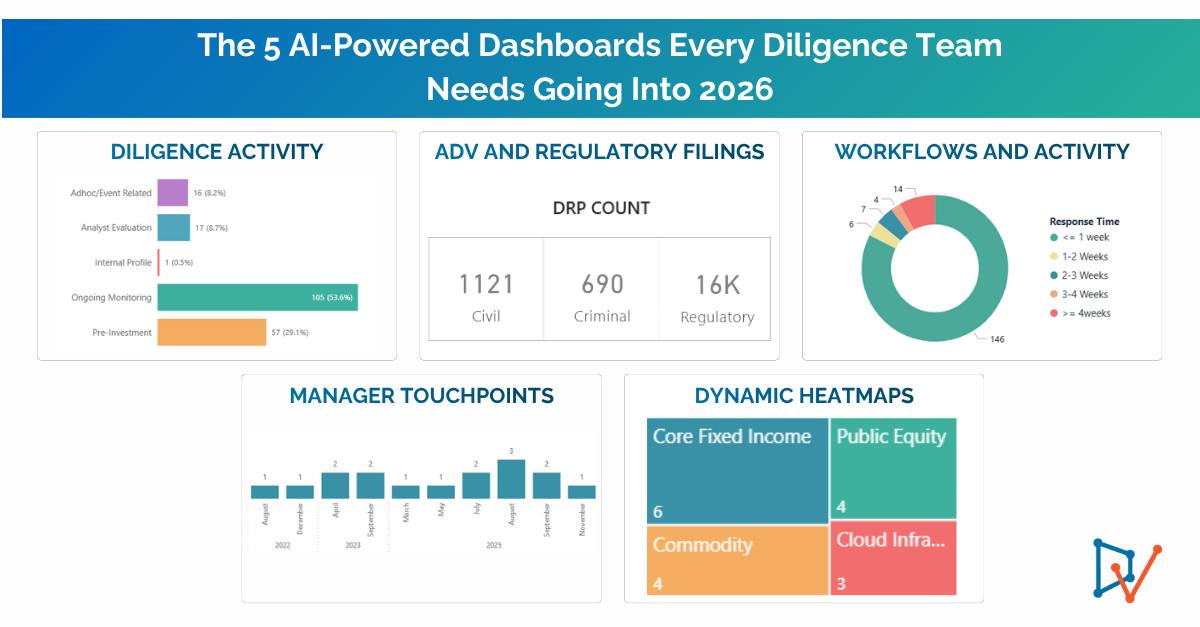

In our latest blog, we explore the five dashboards every IR team needs to operate with more clarity, speed, and confidence in 2026.

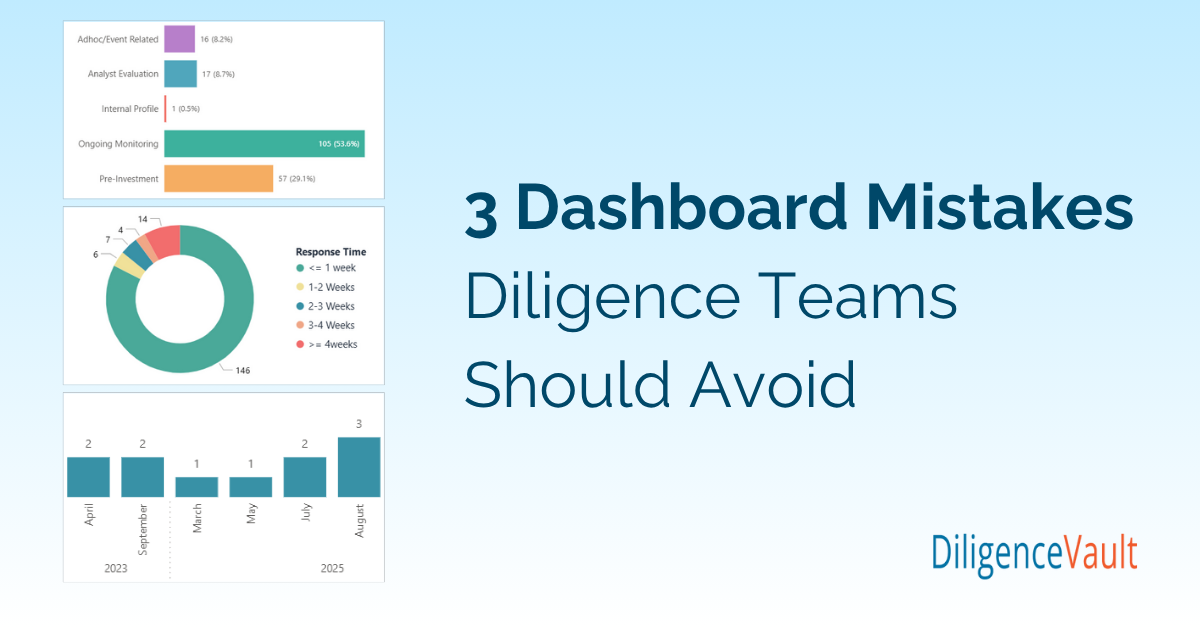

In our latest blog, we break down the most common dashboard mistakes made by diligence teams and how both small and large organizations can avoid them to drive better adoption and insights in 2026.

If 2025 felt reactive, 2026 demands clarity. This is Part One of our series detailing the 5 AI-Powered Dashboards that serve as the operating system for modern diligence. Discover how to move from information overload...