From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreView takeaways from the asset management industry conference on ESG, Diligence, Technology, and Fundraising topics from DiligenceVault

In this blog, learn about the importance of investment sourcing process - what channels to use, what technology to use?

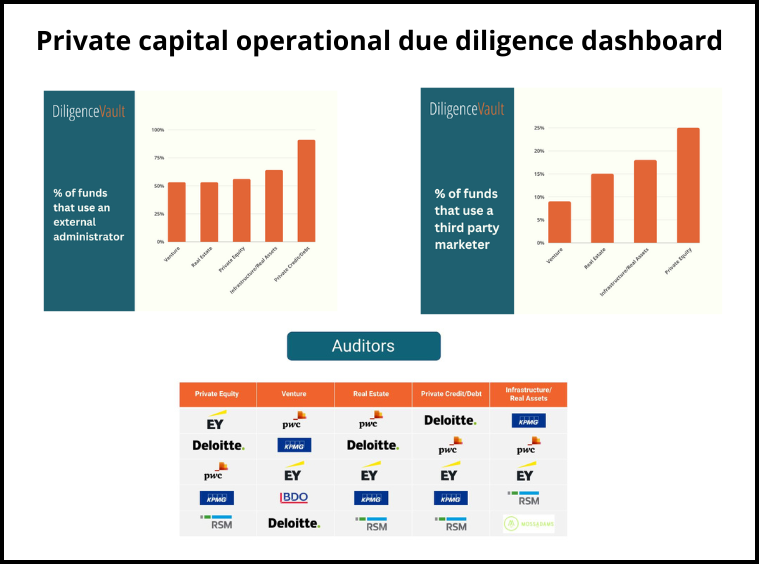

In our blog, read about the operational risk and due diligence process in private markets today, and access data-rich private capital ADV one pagers.

Learn about the benefits of using a content management system to organize and automate your RFP and DDQ processes in one place.

In this blog we highlight the five key takeaways from our recent discussion with over 40 clients and industry experts, on all that you need to know about background check.

With this year's volatile markets, fundraising in the private capital markets is becoming harder. What technology can you use to strengthen relationships with investors?

As DiligenceVault continues to support industry standards in digital format for our users, we are thrilled to add the eFront ESG Outreach framework onto the DiligenceVault platform.

The Impact and ESG investing space is growing and changing rapidly. These are a few of the emerging trends that we are paying close attention to at Veris Wealth Partners.

ESG due diligence is key to understanding the risks and rewards of impact investing, especially with a lack of industry standards for measuring ESG investment risk.